Choose a name for your LLC.Designate a registered agent.Submit the articles of association.Prepare an operating agreement.Get a TIN.submit annual reports.

How are LLC taxed in Kentucky?

How your LLC will be taxedIn this guide, we list the main business taxes required in Kentucky, including taxes on self-employment.employment, payroll taxes, federal taxes, and sales taxes. LLC profits are not subject to corporate level taxation like C corporations. Instead, the taxes are as follows:

Make Sure The Union Site Is Secure

www.nolo.com must first check the security of your connection Continue.

Employer Withholding

All employers are already required to withhold federal taxes from their employees. wage. You withhold 7.65% of your taxable wages, and your employees are clearly responsible for 7.65%, bringing the current federal tax rate to 15.3%.

Plan, Get Started , Manage Or Grow A Business

H2>Kentucky Business One Stop Is Is Ideal For Creating An Easy-to-use Environment For Kentucky Companies To Find The Requirements And Tools They Need To Own And Grow A Specific Business In Kentucky

It Is Easy To Create An LLC In Kentucky

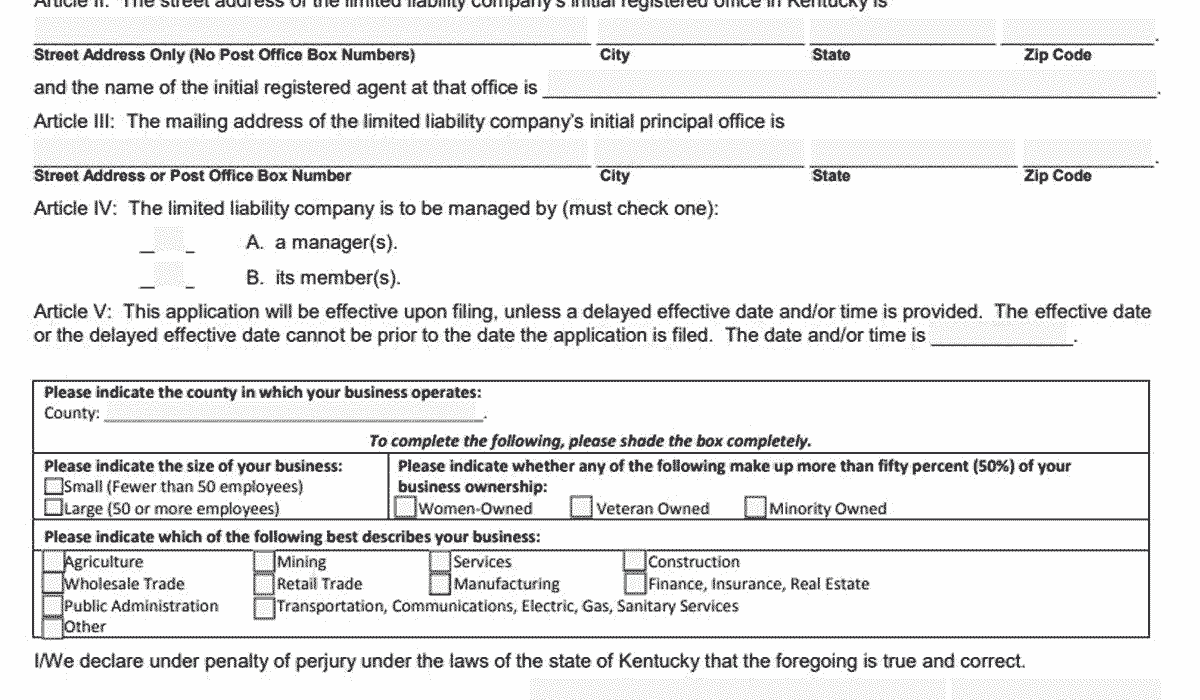

A Kentucky LLC – To form another LLC in a Kentucky LLC, you must file the Articles of Association of this corporation?? Corporate Secretary, Kentucky, which costs $40. You can apply online, by mail, or in person. You are viewing the Articles of Association, the legal document that formally establishes your Kentucky LLC.

Make Sure The Connection To The Site Is Literally Secure

casetext.com staff should first check the safety of your accessories. Continue.

In A Nutshell: Your Budget Calendar

Here’s a fantastic overview of all the paperwork, costs, and time it takes to create it LLC, which is part of Kentucky. Be sure to read the step Guide – “Current Materials” – to understand your current expenses in order to reconcile them Pleasant Kentucky LLC. From the section

Costs Of Running A Business

You would most likely assume that starting an LLC in Kentucky is actually difficult, but the process can be quite simple, especially if you have good help background. The first steps to truly establishing an LLC in Kentucky will lay the groundwork for your new business.

Kentucky 990 TSubmission Requirements

Submission Requirements begin with the Bylaws. E-commerce can be presented on the one-stop trade portal linked to the Secretary of State website. The registration fee is $8. If you choose to ship the goods, please use the mailing address of the Secretary of State, P.O.Box 718 Frankfurt, KY 40602-3490.

LLC Vs. Corporations

If it’s in the market To choose between forming an LLC and being able to register your business, regardless of the state in which clients register your business, you can simply base your decision on one of the following factors:

Optional Name Reservation Process

The name reservation process is a way for you to choose your business word before creating a company. Knowing that you can see that the company name is yours can give you peace of mind as you prepare to take the next step in starting a shared business. You can use this extra time and space to work on other details.

Who is exempt from Ky LLET?

Kentucky has a limited liability corporation tax (LLET) and corporation tax. Depending on the legal form, your specialty may be subject to one, both, or none of these taxes. In addition, if income from our business is personal to you, most of the income is taxable on your personal income tax return.

What is the Kentucky limited liability entity tax credit?

Closely related to the Kentucky income tax idea in KRS Chapter 141 is the Kentucky Limited Liability Tax, a tax commonly referred to by many as LLET. LLET has updated the Alternative Minimum Settlement (AMC). ), which came into effect in the award years of 2005 and 2006. Thus, Kentucky has had a full revenue variant of the tax nearly every decade.