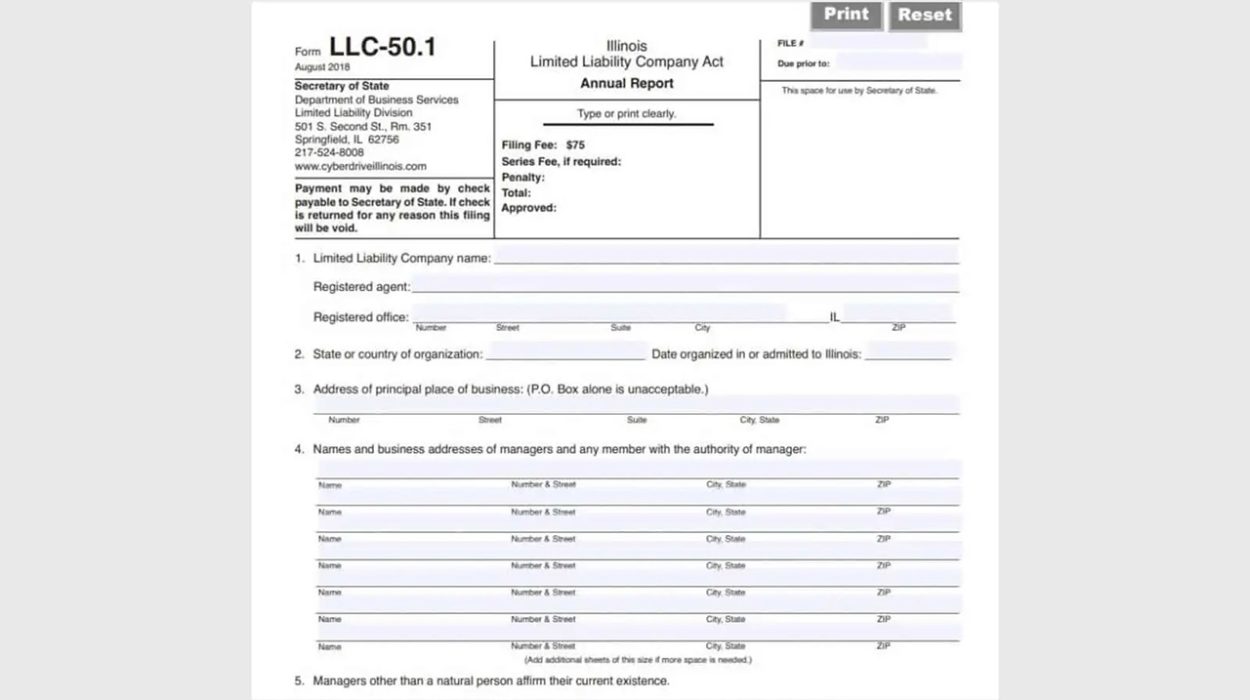

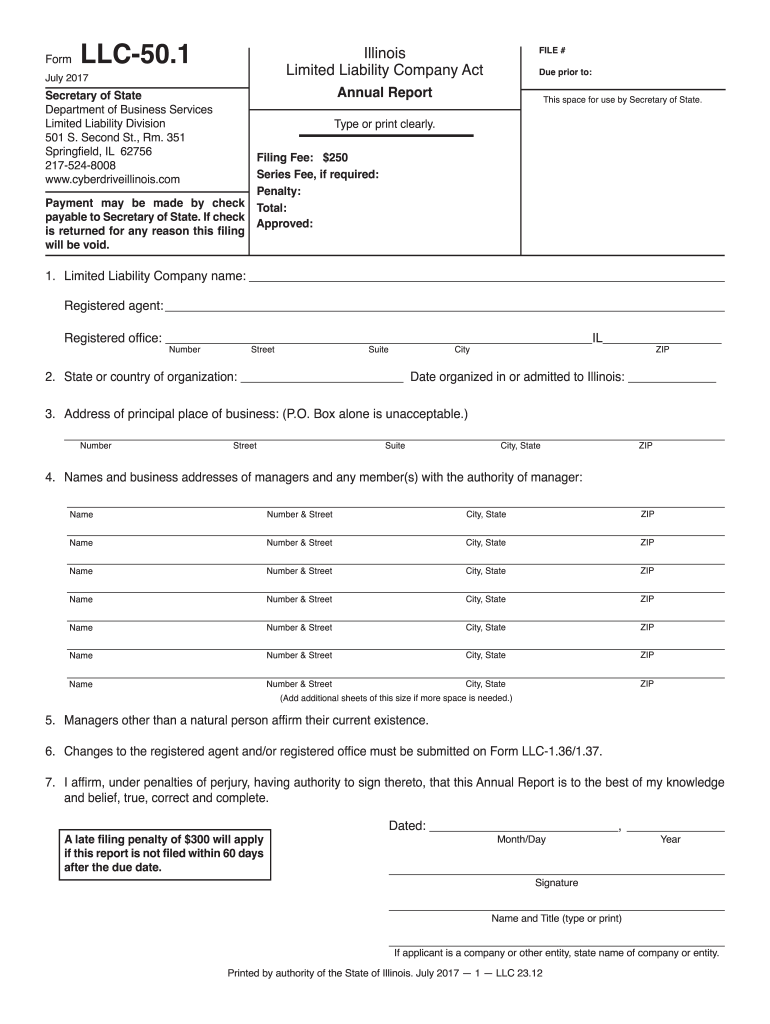

Illinois LLC Annual Return Filing. After forming an LLC in Illinois, you must file an annual return and pay a $75 fee each calendar year. You must file your annual return in order for your Illinois LLC to meet the requirements of the Illinois Secretary of State and be in good standing.

How do I file an LLC annual report in Illinois?

Follow the methods below to successfully submit your Illinois Annual Return:

LLC Annual Report Services

For more information about corporate strategy, call 217-524-8008, Monday through Friday, 8:00 am to 4:30 pm. (central time). PDF files with all documents related to the filing requirementsIllinois LLC documents are available from the Publications section.

What Will I Get From The State?

H2 > If You Mail Your Annual Report, The Illinois Secretary Of State Will Not Send You No Evidence Or Confirmation. However, If You Submit Version 2 Of Your Annual Return In A Self-addressed And Stamped Envelope, You Will Receive Confirmation In The Mail In Due Course.

Foreign LLC Form Fees In Illinois

H2> If You Previously Had An LLC Registered In Another State And Want To Expand Your Business In Illinois, You Must Register Your LLC As A Foreign LLC In Illinois.

Illinois Name Llc Requirement

The name of an LLC must end with “Limited Liability Company”, “LLC”, or “LLC”. The use of hyphens in an absolute name is often not sanctioned by a fair state. The name must be distinguishable by using the name of a local or other LLC licensed to do business, or a name in which an undisputed exclusive is reserved or registered at the time.e right. Words such as “bank” or “trust” and variations thereof require the approval of the Department of Banking and Trusts.

Illinois Annual Report Information

Businesses and nonprofits must file annual returns to stay in good standing. state administrator. Annual returns are required in most states. Payment Deadlines and Charges by State and enter Entity.

What Is An Illinois Annual Return?

An Illinois Annual Return must be filed annually – Maintain a good LLC reputation if you own an Illinois limited liability company. SARLs may submit their annual return online or by mail. Online filing costs more, but it only takes 1-2 business days to process the report. It’s more economical to help you with the postage, but processing time may take 10-20 group days.

Here Are The Main Steps To Take To Register A Limited Liability Company(LLC) In Illinois.

A Limited Liability Company (LLC) is an option for a successful business organization. legally. It combines your limited liability of a corporation with some of the flexibility and freedom from formalities provided by a partnership or sole proprietorship. A good business owner who wants to limit their personal liability in addition to their personal liability for business debts should consider forming an LLC. For more information about starting another LLC in any state, see How to Start an LLC.

Annual Report Contents

Typically, the annual report is prepared by an existing LLC in Illinois (or any other business matter) contains all such information relating to his business and his clients. Without a doubt, the standard content of a Comprehensive Annual Return or Franchise Tax Annual Report is:

How Do I Calculate Illinois Franchise Tax?

The State of Illinois offers two systems for calculating total total tax for a franchise, is there a suitable ratea?? and encourages companies to take advantage of the results of the strategy, which are at least a consequence of it. Here is a quick overview of the two options:

What Is The Illinois Annual Report?

Like other reports, the State of Illinois requires companies to report to us regularly to demonstrate that they are doing so. . in accordance with the rules of the competent jurisdiction. A “Good Reputation” certificate confirms that you “follow the rules” and also indicates legitimacy and legitimacy.

Do you have to renew LLC in Illinois?

If you want to register and submit a limited liability company (LLC) in Illinois, you will definitely need to prepare various credentials and submit them to the state. This article reviews the basic filing and income tax obligations for an LLC in Illinois.

Does Illinois require annual report for LLC?

Illinois Compliance for Members/Managers Referencing an LLC: