File your taxes with ease and learn about the potential benefits of tax treatment.Easy to create, manage, regulate, manage and respect.Protect your personal assets from professional obligations and debts.Low cost offer ($100)

Selecting A Form Of Incorporation And Your Corporation

The following is a brief description of the various forms of incorporation of a corporation under the laws of the State of Indiana. Caveat: formalOpening a businessA weight always brings great benefits and legal consequences. Caution should be exercised in deciding which form of business organization to use and when conducting business. The Corporate Department would like to help, but cannot offer legal advice. It is highly recommended to consult a lawyer for additional advice.

Is there an annual fee for LLC in Indiana?

The State of Indiana requires you to file a biennial return for your LLC. You can submit an article online on the SOS website or send the form (State Form 48725) by mail. The report must be submitted every 365 days on the anniversary of your LLC registration. For example, if your LLC was incorporated on July 15 of a strong odd year, your report will be current in July of each subsequent odd year. Current application fees are $30 for mail-in applications and $22.44 (including a $2.44 debit card fee) for online applications.

The Cost Of Successfully Setting Up A Foreign LLC In Indiana

If someone already has an LLC registered in another state and you want to expand your business there “Indiana, you should all register your LLC as an unusual LLC in the state of Indiana.

State Business Tax

For most taxes, LLCs are almost always referred to as LLCs, which are subject to pass-through taxes. In other words, all responsibility for paying federal income tax lies with the LLC itself and is filed by the individual members of the LLC. By default, LLCs themselves do not pay income tax, especially their members. Some states levy a significant separate tax or fee on LLCs that are eligible to do business in their state. However, Indiana is notState of the Union.

Indiana LLC Costs: Where To Start? ð???

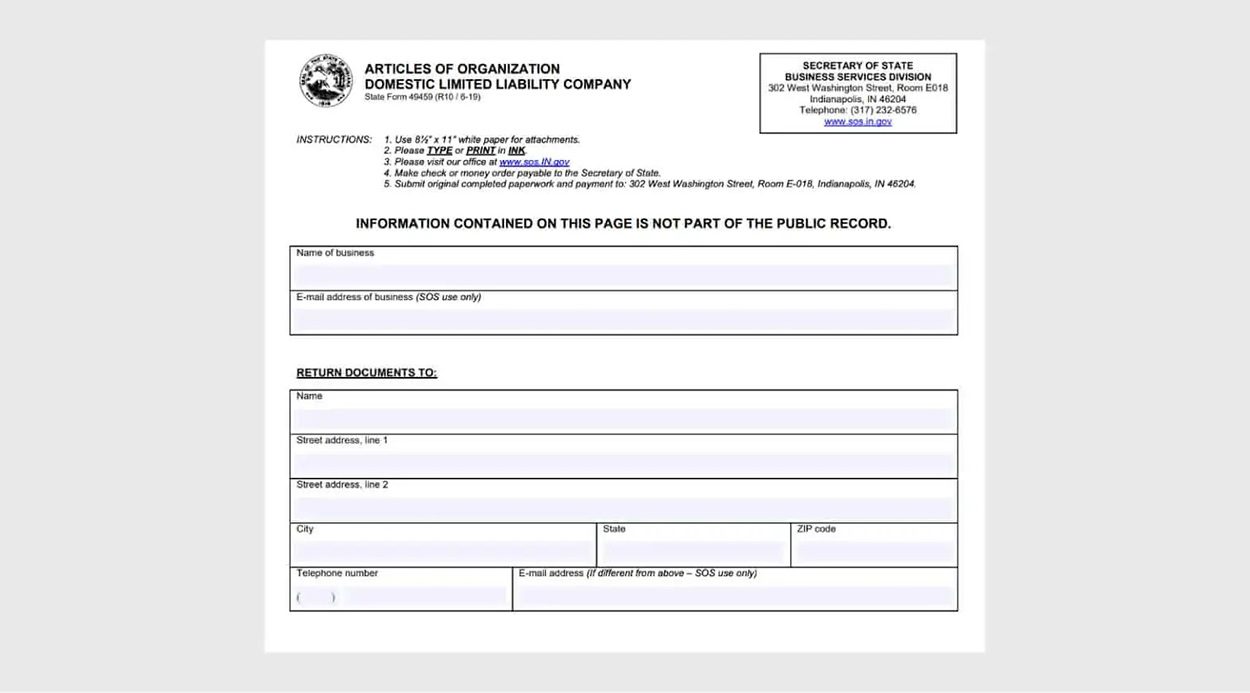

To form an LLC in Indiana, you must… I begin with this, I present the Articles of Association to the Secretary of State. How much did it cost to start a business with Indiana? Finding all fees can be tricky, but we’ll let you know what the requirements are. With Indiana, our LLC formation service, our team of certified professionals will help you create an LLC quickly and easily. usually bears most of the costs, which may also depend on whether you register a domestic or foreign GmbH. However, you can submit many applications to the Secretary of State of Indiana.

Cost Of Setting Up An LLC In Indiana: $90

To form an LLC in Indiana, you will need a folder with Items produced through an organization with the Department of Business services of the Secretary of State. The Memorandum of Association essentially creates a new business unit, and users can submit the form online, to relatives, by mail, or fax.

The Annual LLC Fee

For Your LLC remains consistent and in order to work, there is a standingThese are the fees you will need to pay to your state. You must pay a commission for these products, regardless of the cash flow your LLC earns or the overhead it incurs. Some states require an annual payment, while others require payment every two years. In over 90% of the states, the state will close all of your LLCs if you do not pay the LLC’s annual personal fee.

Total Cost Of Forming An LLC In Indiana

Reservation A name is not required to register this LLC in Indiana, so feel free to skip this step if you are not interested and ready to register your agency immediately. But if you’re not going to an LLC for a while but are worried about your name being verified, booking can help. $20 gives you exclusive rights to the name 120 times, after which you can renew ownership by paying another fee. But if or when nothing prevents you from filing articles of incorporation, do so instead, as the application will be officially registered in your name.

Initial Costsrequired To Form An LLC In Indiana

Let’s start by discussing the absolute basics. You certainly won’t form an LLC in Indiana without filing a Memorandum of Incorporation, the document that officially registers the company at the scene. This form costs $100.

Indiana Annual Report Fees And Instructions

Indiana is certainly a bit unique when it comes to biennial medical records because of their fee structure may differ significantly. if you are mailing online. If you are a corporation or LLC, filing by mail costs $30 and filing online is $22.40. If you are a good non-profit organization, filing by mail costs $10 and online is $7.14. There are no late fees when filing in Indiana. However, the state has the option to close your business if you apply more than 120 days before the deadline.

How much does it cost to maintain an LLC in Indiana?

The main cost of forming an LLC will likely be the $95 fee for filing your LLC’s Articles of Association online with the Secretary of State of Indiana.

How is an LLC taxed in Indiana?

Most cities tax at least some types of corporate income with the state. The details of taxation of the income of a particular company, in principle, depend on the legal form of the company. In most states, corporations are subject to exorbitant corporate income taxes, while income derived from corporations such as S corporations, limited liability companies (LLCs), partnerships, and corporations. Individuals are subject to state tax on certain income. Corporate payroll tax rates and personal income tax rates vary considerably from country to country. Corporate rates, which are mostly paid regardless of income level, generally range from 4% to 10%. Personal tax rates, which usually vary depending onof total income can range from 0% (for small amounts of taxable income) to about 9% or more in many states.