| LLC STATUS | REGISTER FEE | F ANNUAL LLC… | DUE | PAID TO WHO & F… |

|---|---|---|---|---|

| Alabama LLC | $200 | $100 minimum | AL department for … | |

| Alaska LLC | $250 | $100 | < td style ="">Biennale, January…AK Department of … | |

| Arizona LLC | $50 | $0 | N/A, N/A | |

| Arkansas LLC | $45 | $150 | < td style ="">Annually, May 1stArmenian Secretary of St… |

Annual Tributecha

The State of Michigan requires you to file annual returns with an LLC. You must submit the same reporting year by February 15th. (The exception applies to new LLCs formed after September 30 of the previous year, which must not file until February 15 immediately after they are created.)

How much does LLC cost in Michigan?

Costs Of Forming A Foreign LLC In Michigan

If you already have an LLC registered in another state, or if you want to expand your business directly in Michigan, you must register your LLC as a foreign LLC in Michigan.

Where Can I Get An LLC Form?

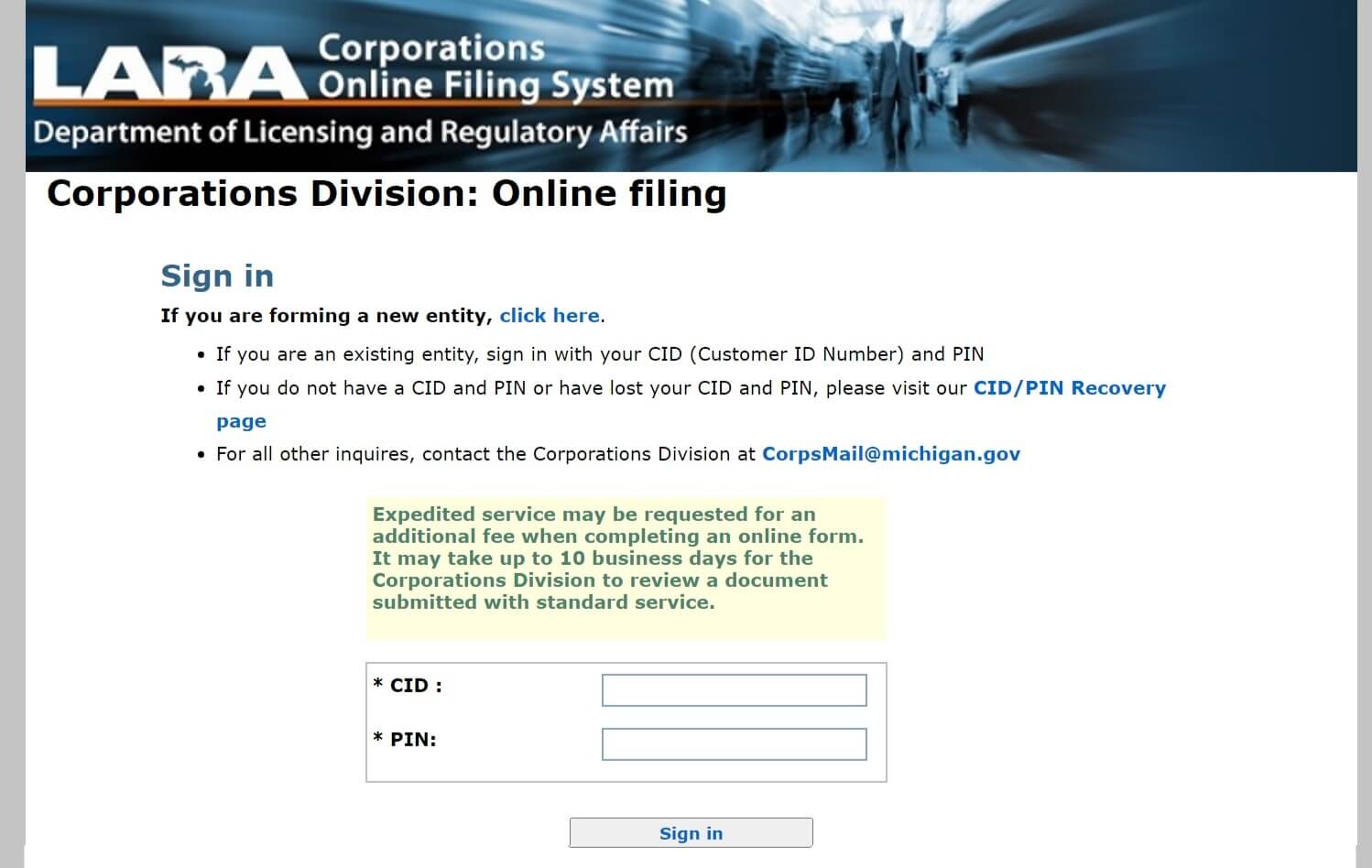

Renewal forms must be downloaded from the attached website of the Department of Licensing and Regulation, also known as LARA. However, you are not required to use uploaded forms. You may be allowed to use forms that you provide yourself. You should also be able to help create your own forms, as long as your website makes sure it has all the information it needs to process the form. After submitting documents for registered agent and family service, you willReceive your renewal certificate immediately, which can be purchased by logging into the LARA website. LLC

Michigan LLC Costs: $50

The Great Lakes State is cheaper when it comes to LLC formation costs. Most local and unknown LLCs cost as little as $50 statewide to file.

LLC Operating Agreement Fee ($0)

Michigan LLC Operating Agreement is a written agreement between LLC members. . The operating agreements provide details of the LLC’s ownership, how the LLC will be treated, and how profits will be distributed. The government will send a pre-printed annual return form to the LLC, also known as the company’s representative, approximately three months before the due date. LLCs and corporations can simply receive email notifications only to the resident agent’s registered email address. The opportunity to file a clean annual return is available approximately 90 days prior to this date.

Annual Return Filing Deadlines In Michigan, Not To Mention Failurepx

Michigan Statement Reports must be filed using LARA Corporation’s Online Application System OR by submitting a pre-filled form that California will send to your Resident Representative 90 times before your application deadline.

About The Michigan Annual Report

Businesses and nonprofits must submit full annual returns to stay in good standing. Foreign Secretary. Annual returns are required in most states. Deadlines and fees vary by state and object type.

Michigan Annual Return Instructions And Fees

The cost to file a major Michigan annual return depends on the type of business the individual owns. Businesses must submit a comment and pay $25 by May 15 if they have applied. Nonprofits must pay $20 by October 1st. Michigan foreign corporations must pay $25 by May 15, and LLCs by February 15. PartnershipsI don’t have to file an annual report, I would say the state.

What Is Michigan’s Annual Report?

With its Annual Report, the state wants to determine if you had to allow them to make major changes to your business, such as adding new officers and directors or changing your business address. In Michigan, these facts and practices are reported to the Division of Corporations, which is affiliated with the Michigan Department of Licensing and Regulation (LARA). The entire process can be performed continuously through the LARA State Field Portal.

What are the advantages of a LLC in Michigan?

How to start a LLC in Michigan?

How do you get a LLC license in Michigan?