Minnesota LLCs are also required to file an annual renewal each year. Filing this renewal by mail costs $25, and filing online or in person costs $45.

Choose A Registered Agent

All LLCs in Minnesota must provide a registered office. The appointment of a registered agency is optional. The registered agent primarily acts as the primary point of contact for your LLC. Most importantly, if your business is sued, these people are responsible for taking over the operations.

LLC Name Fee

First of all, this fee payment is completely optional. You are not required to reserve a company name before registering an LLC. However, if you have a great name and want to protect it as you prepare to start your business, reserving a name can help. The form is available online and in paper form. Sending price tags by mail costs $35, while sending price tags online or in person is $55 (because they are automatically accelerated). To save time and money, when you’re ready to submit your article organization, just start here and aan account in your name.

What is the tax rate for an LLC in Minnesota?

If you want to create and also operate a Minnesota Limited Liability Company (LLC) website, you need to prepare and file several different documents with the state. This article reviews the main current tax reporting and filing requirements.Declarations for Minnesota Limited Liability Companies.

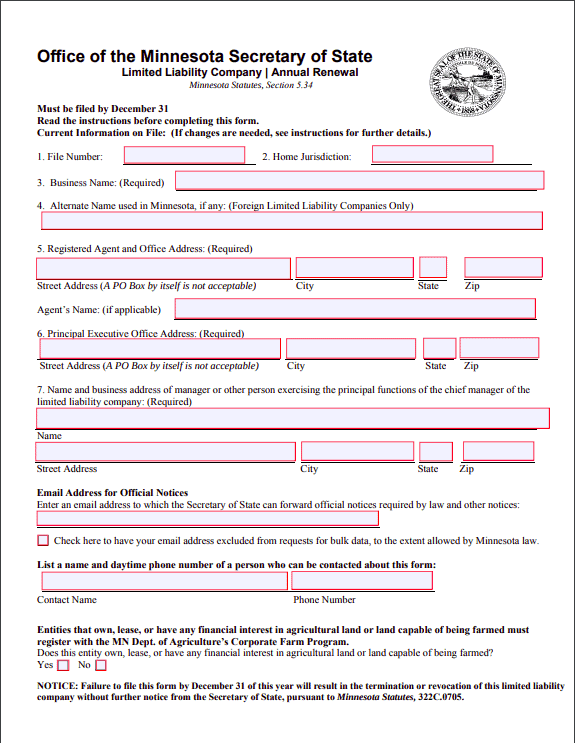

Submit Your Minnesota Annual Report

Your Minnesota Annual Report can be submitted online, in person, or by mail. To obtain a paper form or submit it online, you must visit the Minnesota Secretary of State website.

Annual Application Fee

Free: One Time. you must submit your LLC’s annual return to the Minister of State each year. Submitting a report is free, but you must allocate time and resources to prepare it. Save yourself headaches and funding by using our annual return service and help you meet your LLC annual return obligations.

What Is The Annual Return Filing Fee In Minnesota?

Financial reporting filing fees depend on the type of business you have and whether you are a corporation. Domestic or international to Minnesota. Take a look at the bed below for your unique entry fee. Condition.

ManualMinnesota Annual Return Fee

If you own a corporation, which could be an LLC, you probably won’t buy it to pay the filing fee. However, they are often required to submit a report by 31 December. Minnesota is unique in that, again, there is no charge for their home records. The only type of business that has to pay a commission is a forex firm that has to pay $135 to follow a report to the Secretary of State’s office. Partnerships are not required to file an annual return in Minnesota. There are no late filing fees in the situation, but you will have to pay $45 to reopen your business if the form dismisses you. The Office of the Assistant Secretary of State started a project to help fix unsightly documents for businesses online. This work is funded solely by a temporary know-how grant for this amazing project, which expires June 33, 2011. The add-on increases additional fees as follows??:

Name Your Minnesota LLC

Name Your Minnesota LLC

H2>To Register Minnesota As An LLC, You Will Need A Name For Your LLC, To Be Approved By The Secretary Of State Of California. The Name You Need To Acquire Must Be Different From The Name Of Any Other Minnesota LLC, Corporation, Limited Partnership, Or Limited Liability Company Already Registered With The Minister Of State Of Minnesota. It Should Also Be Distinguished From Almost All Names, Service Marks, And Sometimes Reserved Or Intended Marks Registered In Minnesota When Filing Statutes With The Minnesota Secretary Of State. Can Articles Be Submitted Online Or By Mail? Online Filing Fees Are Typically $155 And $135 For Mail-in Submissions.

Tuition Certificate Application Fee

Covers most of the cost of the Minnesota tuition-related certificate. It may also depend on whether you are setting up your own LLC or a foreign LLC. However, you have the option to submit both applications.Secretary of State of Minnesota.

Does Minnesota have an annual report?

Businesses that are also non-profits must submit annual returns to stay in good standing. Foreign Secretary. Annual returns are often required in most states. Deadlines and additional fees vary by state but also the entity type.

Does Minnesota require registered agent for LLC?

A Minnesota Certified Agent is required by law for any registered company in the state of Minnesota. The Authorized Agent receives all official documents from the State of Minnesota and also receives court services that may be provided to the business during the course of the litigation.