You will need an LLC State Identification Number to make the online form available. The annual report must be submitted no later than April 00 of each year. The annual return filing fee for a qualifying New Hampshire LLC is $100.

Online Business Services

Starting your business in Hampshire is easy with QuickStart. An online solution that not only searches you by group name, but guides you through the habitat to get your secretary of state business up and running in no time.

Different Companies Get New Hampshire Benefits< /h2>New Tax: Hampshire Levies A Whopping 8.2% Tax On An LLC With A Gross Profit Of $50,000. This Tax Is Due On The 15th Day Of The Third Month Following The End Of The Tax Year.

LLC Annual Return Reminder

The Secretary of State of New Hampshire will provide you with information shortly. reminder shortly after January 1st. Depending on what was listed on your Hampshire New LLC incorporation certificate, the state will send a noticeExpense by mail or e-mail.

New Hampshire LLC Expenses: Where To Start? D?

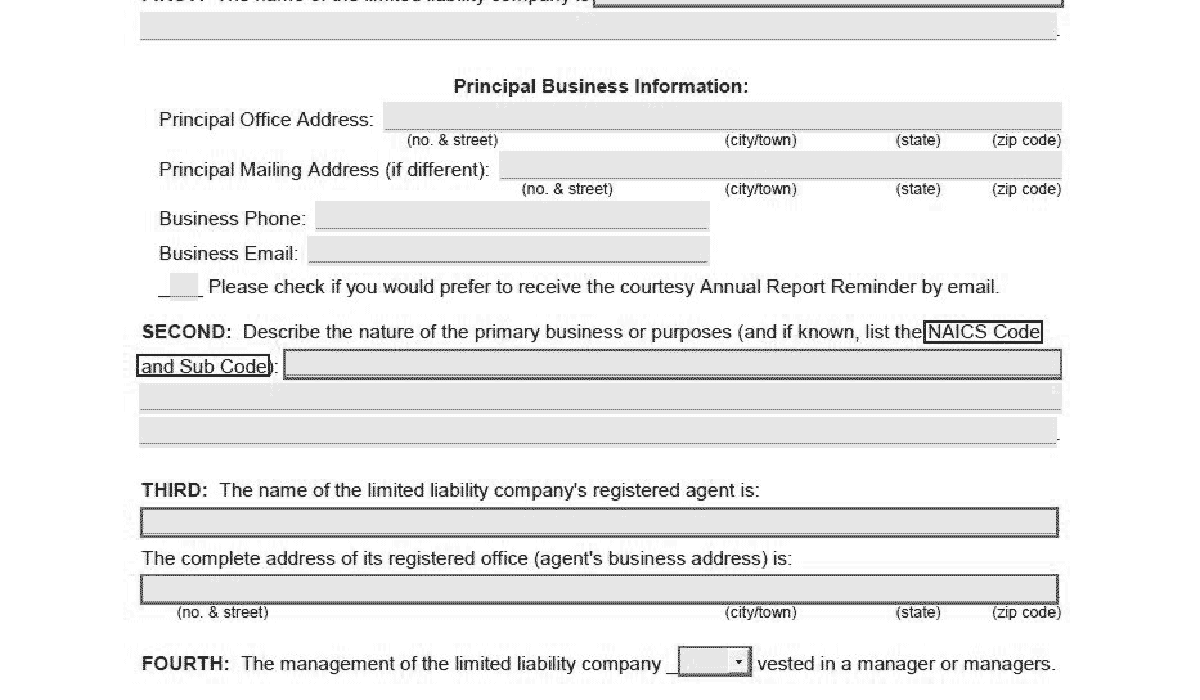

Start collecting an LLC by filling out and copying the certificate of state registration. We can make incorporating a lot easier with our free New Hampshire LLC incorporation service. Open in the blink of an eye for only $49.

Can I Reserve A New Hampshire Company Name?

Yes. If you have the perfect company name but also want to make sure it’s available when you apply for an LLC, you can reserve your company name for 130 days by filing a name reservation request with the New Hampshire Division of Corporations and paying a fee of $15 US dollars. /p>

New Hampshire Annual Report Information

Companies and non-profit organizations must prepare annual reports to cope with the stagnation say secretary. In most cases annual reports are required. Deadlines and fees vary by state and entity type.

Instructions And Fees Fromfiling Your Annual Return In New Hampshire

If you have a partnership that you don’t have, your best bet is to file your annual return in Hampshire. If you manage a corporation or LLC, you must file your $100 annual return by April 1st. Nonprofits must pay $25 to submit their reports by December 31st. Non-profit organizations only have to file a report every vacation year, unlike other corporations that are required to do so annually.

New Hampshire LLC Application Fee: $100

To Form An LLC In New York Hampshire, You Must File A Articles Of Incorporation (LLC Form-1) With The Department Of State. The New Hampshire Department Of State Charges $100 Per Level To Edit And Save This Document Online Or By Mail.NH LLC Vs. NH Corporations

Now that we have reviewed it, the main features that apply to all LLCs and corporations, and secondly, the study of more specific features that distinguish New Hampshire LLC or New Hampshire Corporation fromseveral states, which leads us to the final answer, which company is the most desirable for your business. Each state has its own tax laws and regulations that govern the market for their business, and these unique details should be known when choosing your business. The information in this section contains these specifications for New Hampshire LLC and each of our New Hampshire locations.

Ready To File Your New Hampshire Annual Return?

Social media is becoming an increasingly preferred method for companies to connect with their customers, competitors and customers. Let’s dedicate useful inventory information and tools to help buyers grow your business.