Ohio Business Tax: Variable

In Ohio, limited liability companies with annual gross revenues of more than $150,000 are subject to a business tax. LLCs with a gross income of less than $150,000 are exempt from this tax.

Certificate Of Incorporation Fees

The Ohio Certificate of Incorporation is? the vast majority of expenses, which can also improve depending on whether you form u. With. LLC or foreign LLC. However, a person may submit both applications to the Las Vegas Secretary of State.

Reserving A Name

In cases where your Has llc company has searched for a company name and found that the selected name is there, but the improvement documents have not yet been submitted. You can pre-order by name.

State Taxes On Business

When it comes to non-income matters, LLCs are the most reputable tax address. In other words, the responsibility for paying federal income tax lies with the LLC itself and the individual members of the LLC. By default, LLCs do not pay federal income tax themselves, only their members.

Is there an annual fee for an LLC in Ohio?

Maybe you are looking to form an LLC in Ohio together. People find it difficult and expensive to set up an LLC. However, it’s usually easy and the cost varies by account. We have all the information you need about the cost of setting up an LLC, especially the cost of an LLC in Ohio.

Here Are The Steps To Register A Home-based LLC (LLC) In Ohio.

A Producer Limited liability (abbreviated as LLC) is a way to legally structure a business. It combines the fixed responsibility of a corporation with the convenience and lack of financial responsibility.Features offered by a partnership or individual entrepreneur. Any trader attempting to limit his wife’s personal liability for business debts and subject to legal action should consider forming an LLC. A company name is not required to form an LLC in Ohio. Although not required, if you have a good business name but are not yet ready to start a business, keeping it is a good option. Submitting the Name Reservation Form and paying the full fee of $39 entitles you to sole ownership of the desired name for one hundred and eighty days. But if you’re ready to try out your LLC, go straight to the Filing of Articles section instead, as this will automatically register your name. It should be noted that the cancellation or transfer of a reserved company name costs only $25.

Choose A Name For Your LLC

The first step you must finally take When choosing a company name for registered LLC in Ohio. Ohio law requires that the names of new onlineThe companies were different from the names of other companies registered with the Secretary of State of Ohio. The purpose of this requirement is to avoid confusion in the eyes of the public. For example, you cannot choose the name “Hometown Bakeries, LLC” even though “Hometown Bakers, LLC” is already registered in Ohio.

How Much Does An LLC Cost In Ohio? ð??µ

The cost to apply to form an LLC in Ohio is $99, whether online or by mail. This is true whether you work for a private (in-state) or (out of state) mystery LLC.

Can Zenbusiness Provide You With A Legal Representative

Our registered representative The service now provides you with a legal representative who will receive relevant legal documents and notices on our behalf. This service keeps your business compliant by ensuring you always have a legal officer for your LLC.

Fix Registration Errors Quickly

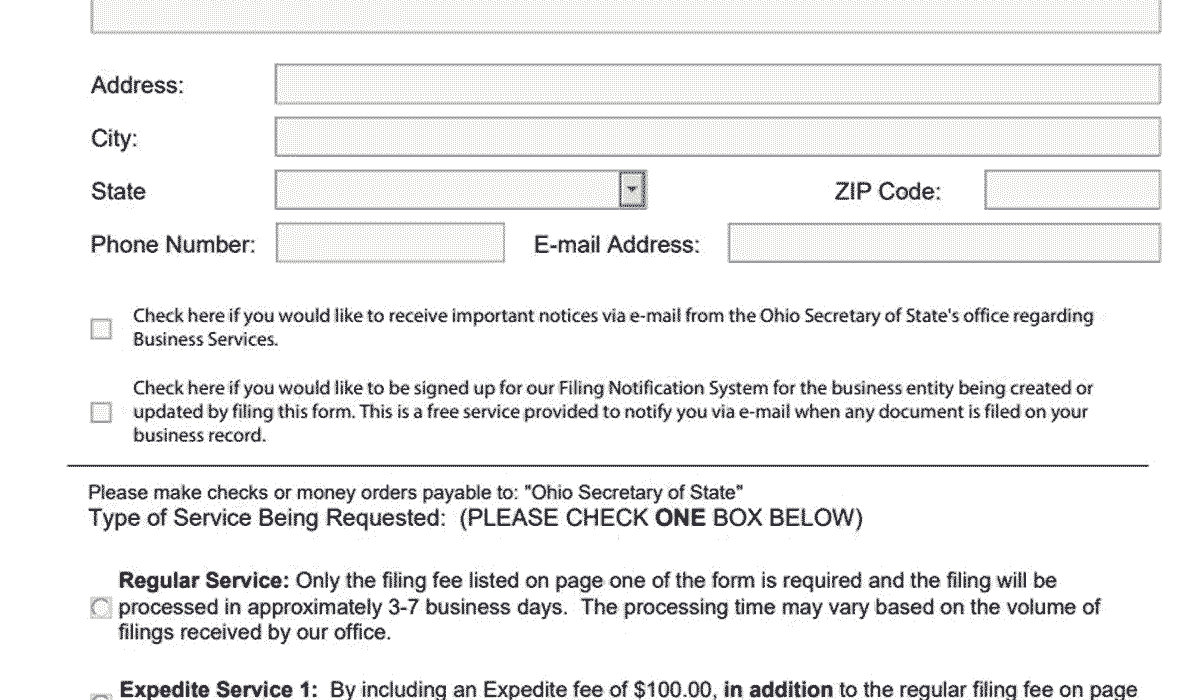

If you’re in a hurry, your LLC file is ready to use. it is possible to make one or more deviations. PossibleBut, you misspelled your full title or provided the wrong title page. Resolve any issues by filing a Correction Certificate or Form 612 as soon as possible. Commission can be $50.

How much is filing fee for LLC in Ohio?

Here are the steps to form an LLC in Ohio. For more information about starting an LLC in any state, see How to Start an LLC.

Do I have to renew my LLC Every year in Ohio?

If you want to register and operate a small limited liability company (LLC) in Ohio, you must prepare and file various documents along with your claim. This article reviews the major current tax and reporting obligations for an LLC in Ohio.