The fee is $25 (collected by the Secretary of State). Form CL-1 must be filed within 62 days of your LLC’s incorporation.

Is there an annual fee for LLC in South Carolina?

You may be considering registering an LLC in SC. People find it inconvenient and expensive to set up an LLC. However, this is generally not very difficult and the cost varies from state to state. We have all the information you need about the costs of starting an LLC, especially the costs of starting an LLC in South Carolina.

South Carolina Foreign LLC Cost

If you already have an out-of-state LLC and want to form a private company in South Carolina, you will need to register the LLC as a foreign LLC in South Carolina.

Certificate Of Incorporation Costs

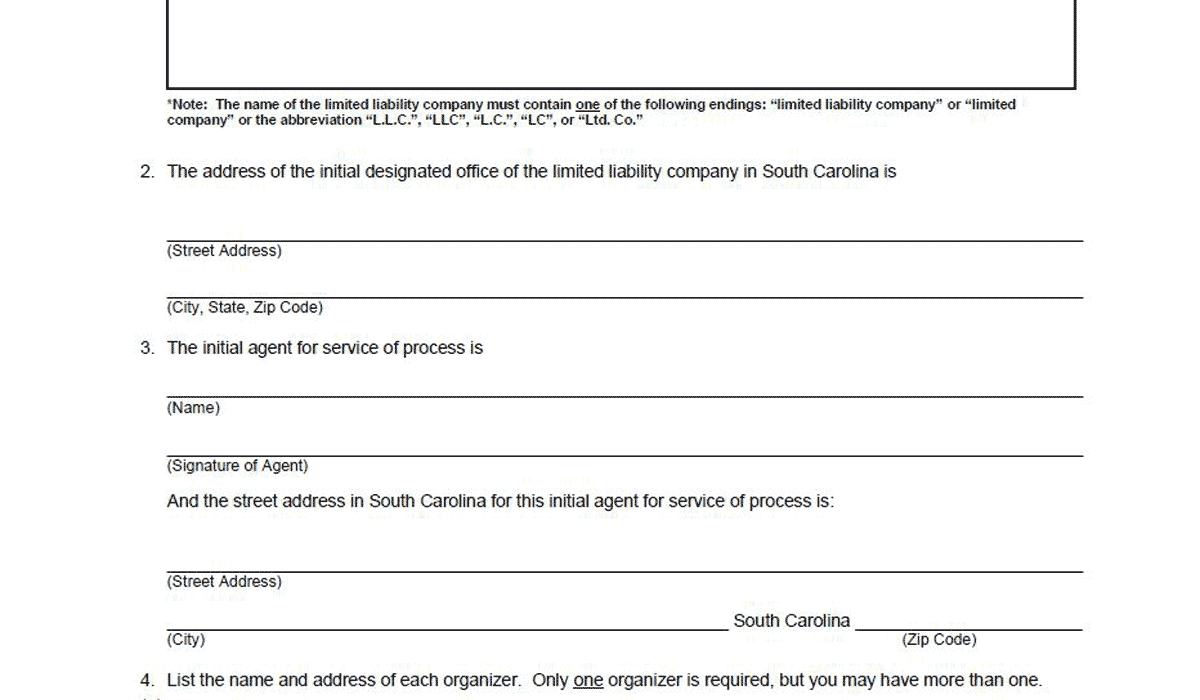

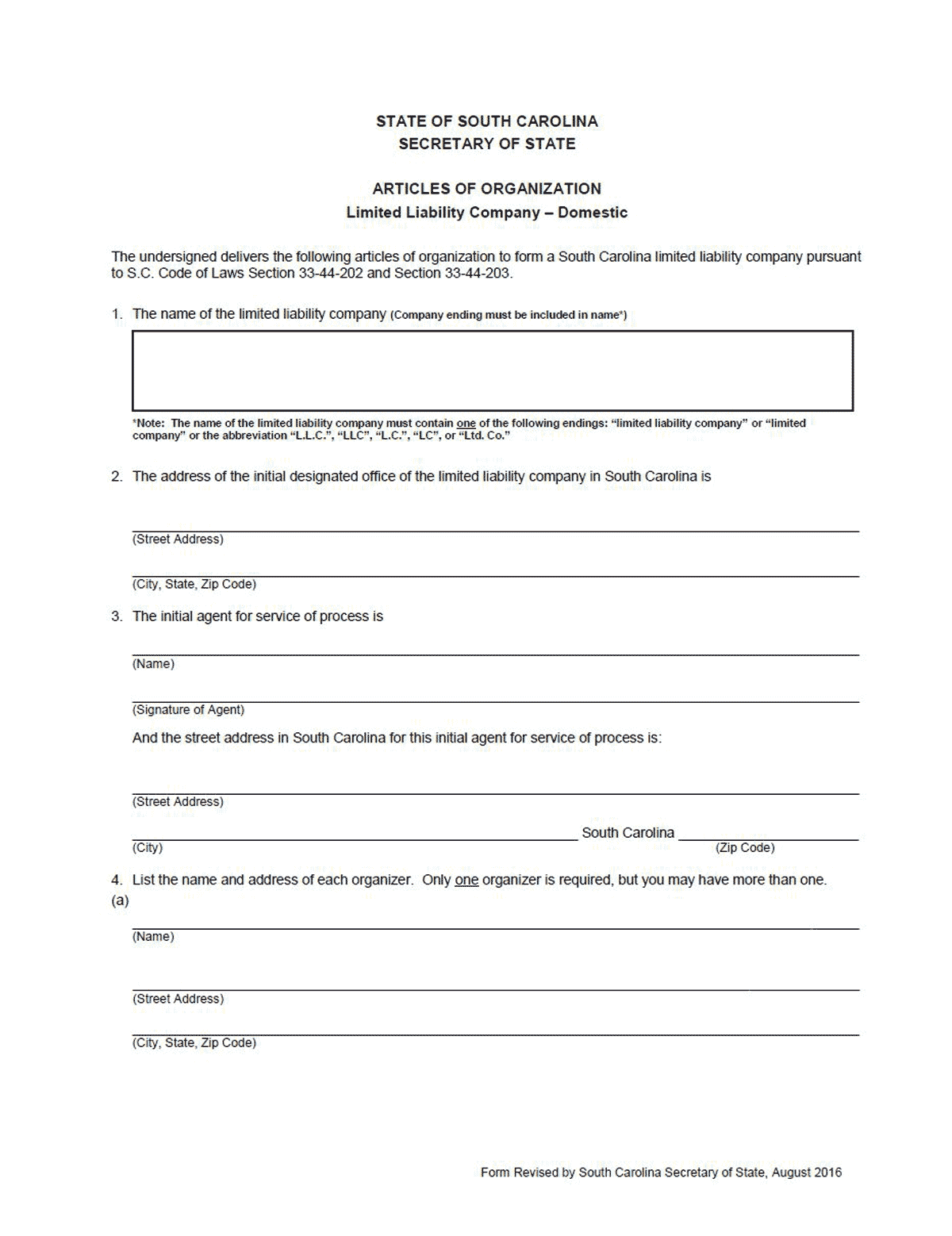

The South Carolina Certificate of Incorporation is the source of the bulk of the costs, which can also vary depending on when you form a home LLC or cash LLC. However, you may submit both applications to the Secretary of State for South Ka?oleins. after founding South Carolina, you may need to apply to organize an article with the Secretary of State of South Carolina. Additionally, if you wish to reserve the actual LLC name before submitting your articles outside of the organization, you must reserve the LLC name with the Secretary of State of South Carolina. We can help you navigate the South Carolina LLC registration process with your own South Carolina LLC Registration Service, which costs as little as $49.

Choose A Name For The LLC

According to your final South Carolina law, the name of the LLC must indeed contain the words “Limited Liability Company” with “Limited Liability Company” or the abbreviation “L.L.C. ‘, ‘LLC’, ‘LC’, or ‘LC’ ‘Limited’ can be abbreviated to ‘Ltd’ and the ‘Company’ part can be abbreviated to ‘Co’.

State Information Tax Technology

When it comes to income taxes, many LLCs are what are known as tax organizations. In other words, the responsibility for paying incomeThe statewide tax lies with the LLC itself and individual purchasers of the LLC. By default, LLCs do not pay income tax themselves. , only their members. Some states introduce a tax regime for individual companies or limited companies for the privilege of doing business in the state. However, South Carolina is one of the most numerous states.

The Total Cost Of Registering An LLC In South Carolina

Here’s what benefits the client: you do not need to reserve a company name, in the holding chamber the process of forming an LLC is not required. try. However, it definitely helps if you have a good name but are not yet ready to start your own business. One application plus this special $25 fee gives you 120 nights of exclusive rights to the name. However, you can skip this step if you are ready to register an LLC, as medical records, articles of incorporation are automatically applied to your name.

LLC Name

The name of the LLC must end with “Limited Liability Company”, “Limited Liability Company”, “Limited Liability Company”Limited Liability”, “LC”, “LLC” or “L.L.C.” Names must not contain language that indicates a purpose beyond what is permitted by state law and furthermore by statute. It must be made against the distinctive records of the Registrar indicating the name or qualified foreign name of the LLC or the reserved or registered name of the LLC.

South Carolina LLC Name Reservation: $10

If you want a specific name for your LLC but are still in the process of filing, buyers can pay to reserve name for up to 120 days.

South Carolina Annual Report Information

Businesses, and therefore nonprofits, must file annual returns to stay in good standing. now with the Secretary of State. Annual returns are required in most states. Times and fees vary by state and hence the entity type.

Register With The South Carolina Department Of The TreasuryWe

Some LLCs doing business in South Carolina must register with the South Carolina Department of the Treasury. Examples include LLCs that collect sales tax on retail goods and services, and LLCs that have full-time employees.

How much does it cost to maintain an LLC in South Carolina?

Here are the steps to register a Limited Liability Company (LLC) in South Carolina. For more information on starting an LLC in any state, see Nolo’s How to Start an LLC article.

Do I have to renew my LLC Every year in SC?

However, in some cases LLC owners choose to treat their business as a corporation for tax purposes. These elections are canceled by filing IRS Form 2553 with our IRS. (You can find our form on the IRS website.) Unlike standard tax court procedure, when an LLC decides to tax itself as a corporation, the corporation itself files a separate tax return. South Carolina, like almost every other state, has a corporation tax. In South Carolina, corporate income tax is typically 5% of a company’s total net income. Use the State Corporation Income Tax Return (Form SC-1120) to pay special tax to the Department of the Treasury (DOR). For more information, see Nolo’s 50-State Corporate Income Tax Guide or the new website.DOR.

How are LLCs taxed in South Carolina?

Most states tax some type of corporate income that comes from the state. As a general rule, additional information about how income from a particular service is taxed depends in part on the legal form of that business. In most states, corporations are subject to corporate income tax, while income from corporations such as S corporations, limited liability companies (LLCs), joint ventures, and sole proprietorships is subject to corporate income tax. Tax receipts for business income and personal purchases vary greatly from state to state. The company’s rates, which are basically fixed regardless of our income, typically range from 4% to 10% depending on the valuation.Marks. Personal rates, which are likely to vary by salary level, can range from 0% (for small dollars of taxable income) to about 9% plus in some states.

How much does it cost to form a South Carolina LLC?

Hire a company to register your LLC in South Carolina: Northwest ($39 + points fee) or LegalZoom ($149 + government fee) (See information about Northwest and LegalZoom). Note. Most LLCs in Carolina du Sud are not required to file an annual return.

Is an LLC taxable in South Carolina?

Some states charge an additional fee or separate fee to an LLC for the freedom to do business in the state. However, South Carolina is not one of your states. However, in some cases, pet owners in an LLC choose to treat their personal business as a corporation.for property tax purposes.

What is an LLC annual fee?

The LLC Annual Fee is an ongoing fee paid to the government to ensure that your LLC meets the requirements and maintains a good reputation. It is usually paid once every 1 or 2 times, depending on the state. These fees are usually required regardless of the income activity of your LLC.

Does a South Carolina LLC need to file an annual report?

Unlike most other states, South Carolina does not require an LLC to file an annual return. When it comes to income tax, most LLCs are so-called pass-through tax entities. In other words, the responsibility for paying federal income tax lies with the LLC itself and with the individual members of the LLC.