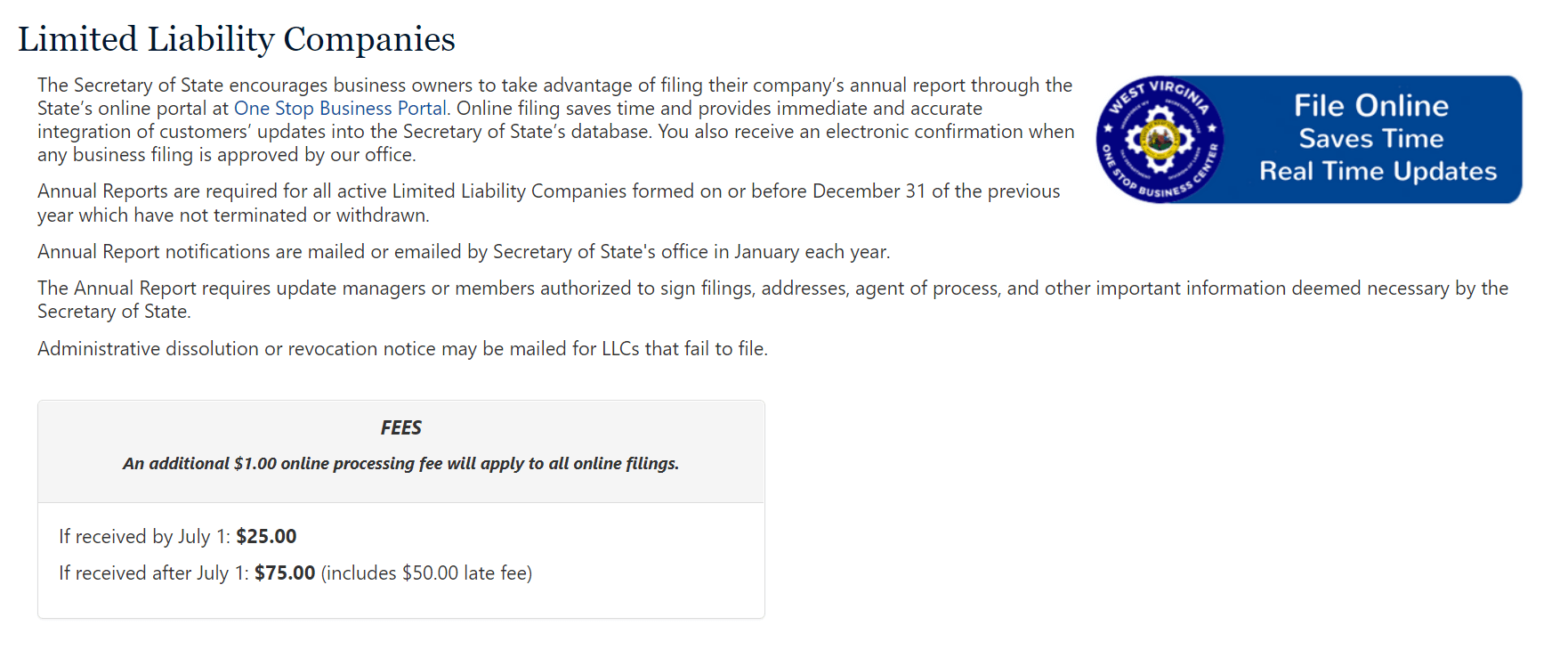

Annual report. Each branch of West Virginia LLC, domestic and foreign, must file a 12-month return with the Secretary of State and pay a $25 registration fee. The position must be filed between January 1st and July 1st of each year, which usually follows the calendar year in which the LLC began operations.

The Cost Of Registering A Foreign LLC In West Virginia

If you already have an LLC registered in another state, and therefore want to firmly expand your business in West Virginia, you are here. You must register with the LLC as a foreign LLC in West Virginia.

Certificate Of Incorporation Costs

The West Virginia Certificate of Incorporation is generally responsible for most of the registration fees, also depends on whether you are forming a domestic LLC or a foreign LLC. However, you may submit both applications to the West Virginia Secretary of State.

Annual Return

The State of West Virginia requires you to file a special annual return for your LLC.They do file the report online through the Business4WV website. The annual report must be submitted by June 30 almost every year. For LLCs incorporated on or after January 1, the initial return must initially be filed no earlier than the executive calendar year. The application fee must be $25. Late filing fees will be charged $50.

Filing Annual Returns

All LLCs doing business in West Virginia must file their annual return with the Secretary of State and pay a deposit. fee from $25. This includes foreign LLCs doing business in the state. The first annual report of the LLC must be submitted between January 3 and July 1 of the year following the year of incorporation, and each subsequent annual report must be submitted within this interval.

West Virginia LLC Costs: Where To Start? ð??

Creating an LLC in West Virginia requires several steps. We will help you with the process and asking price. But if you want us to take care of the initial paperwork, we can registerbuy West Your Virginia LLC today for $49.

Get The West Virginia Annual Reports Service Today!

GET STARTED GET STARTED

West Virginia Annual Report Information

Businesses and nonprofits must submit budget reports to stay in good standing. Foreign Secretary. Annual returns are required in most states. Deadlines and fees vary by state and entity type.

Choose Your LLC Federal Income Tax Form

One of the great benefits of limited liability is the tax flexibility it provides. When applying for an Employer Identification Number, you will most likely choose what your business will be like after taxes for federal income tax purposes. Despite some limitations, an LLC may be classified slightly higher for federal income tax purposes given that:

The Total Cost Of Forming A West Virgin LLCinii

You don’t even need the exact name of the reserve company in the LLC formation process. This is completely optional. If you’ve got a big name in mind but aren’t ready to launch your business yet, consider reserving a promotional name. It costs $15 and keeps the name of your choice for 120 days. However, if you are ready to start your business from scratch, skip this step and go directly to the Articles of Association, where your name will be automatically recorded.

How to file an annual return

How to submit an annual return

h2> Business owners are encouraged to submit their annual returns online through the Government Business Portal. You have the option to submit your annual return for the current year at the beginning of January 1st.