To have an LLC in Wisconsin, you must spend the money for a $25 annual fee, plus 3.54% to 7.65% income tax, 5% sales and use tax, and applicable federal taxes. How much does it cost to entertain an LLC in Wisconsin? The answer to this question is quite common: it depends on the number of musicians in the company.

How much does it cost to start an LLC?

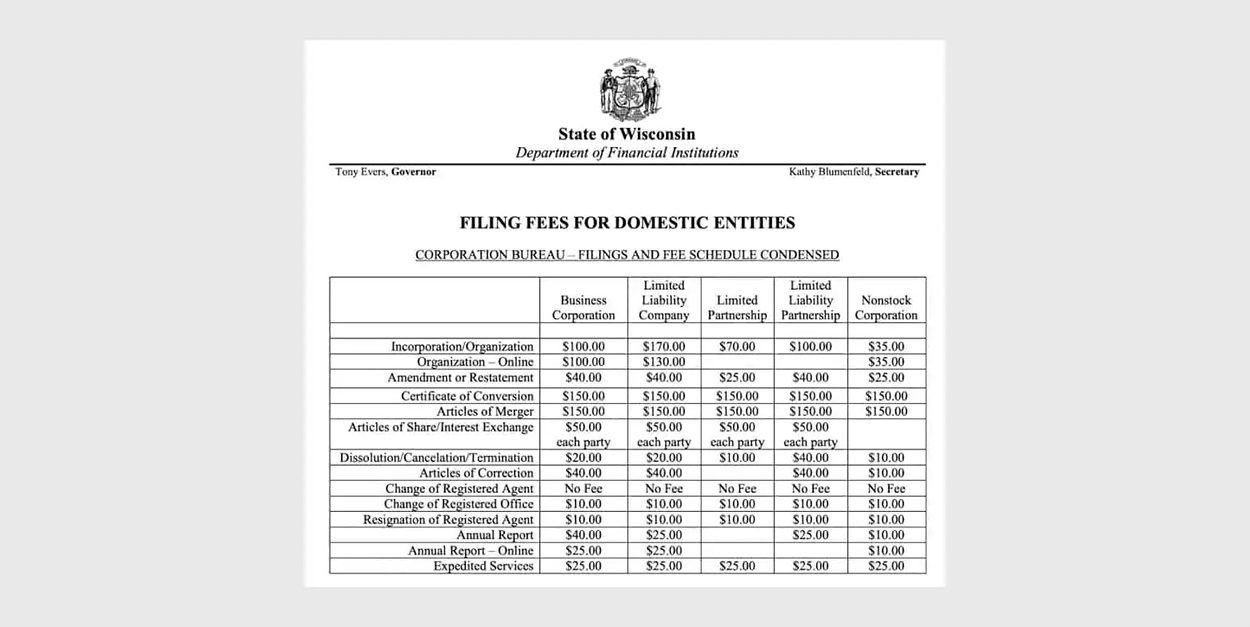

Be sure to refer to the table below, which has been designed for the most accurate information. The table below shows LLC annual fees by state. As of 2021, the average annual price for an LLC in the US is $91. In most states of the union this is called an annual report, but it has many other names: an annual certificate. Annual list of participants. Annual registration fees.

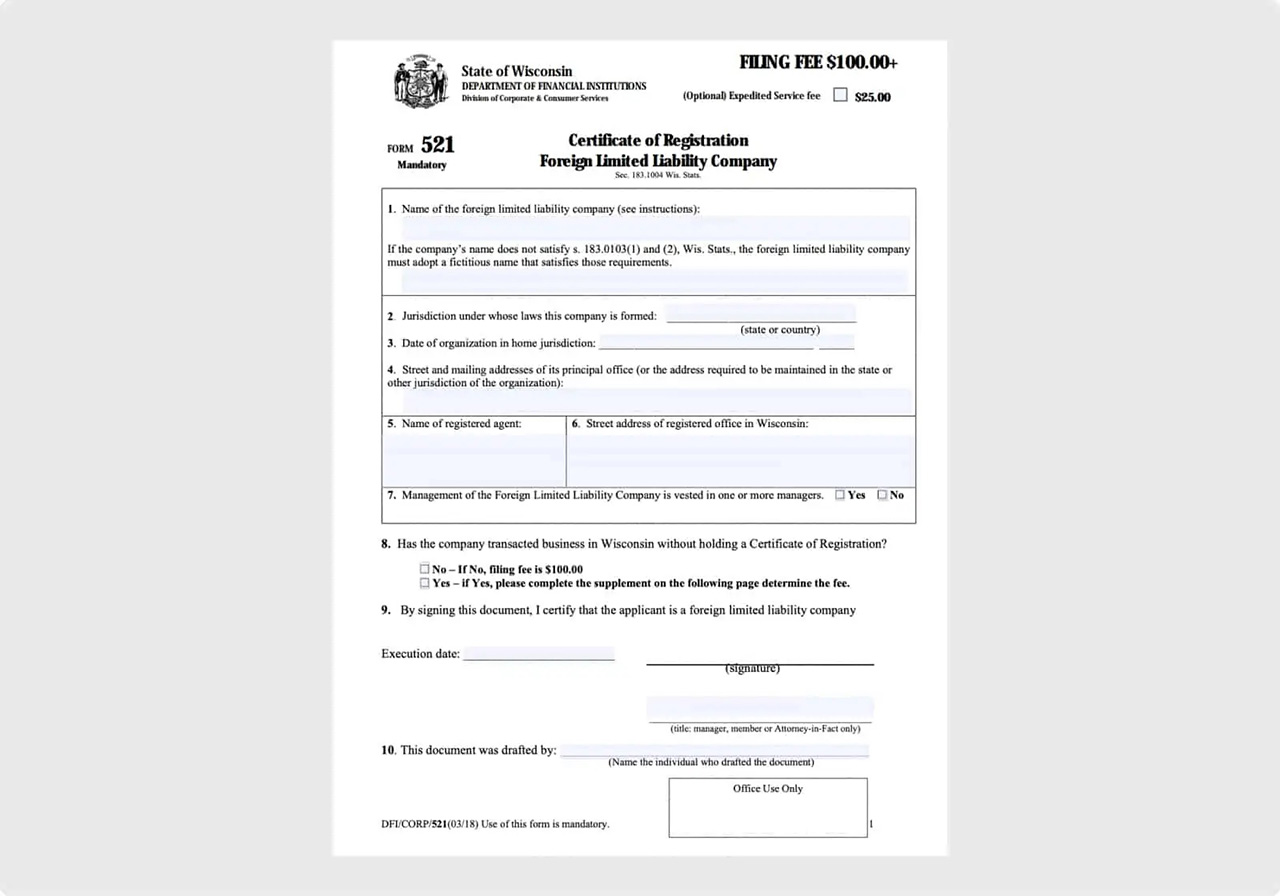

The Cost Of Setting Up A Foreign LLC In Wisconsin

If clients already have an LLC registered in another state and you want toWant to be able to expand your business in Wisconsin, do you need to DO? ll to register your LLC as another LLC in Wisconsin.

Certificate Of Incorporation Filing Costs

The Wisconsin Certificate of Incorporation actually pays for most of the costs, also depends on how you determine whether you are establishing a domestic or foreign GmbH. However, you can file both applications with the Wisconsin Department of Revenue.

State Tax On Business

When the income tax program comes in, most LLCs will no doubt be taxed. In other words, the responsibility for paying taxes from the federal budget passes through the LLC itself and through thresholds to individual members of the LLC. By default, LLCs don’t pay commission on profits, only their members. Some states levy a separate tax or fee on an LLC for the privilege of operating a business entity in the state. However, Wisconsin is hardly one of those states.

Submit A Specific Annual Return

As mentioned earlier, as a local LLC, you can simply visit the Wisconsin DFI website to submityour annual report. or email if you want. If you are a new Wisconsin Foreign LLC, you can mail in your annual return. You may first obtain this document from your registered agent, who will receive a hard copy of the documents before the deadline. You will have enough time to collect the documents and send all the information online or by mail.

Total Costs Of Starting An LLC In Wisconsin

Do you have the perfect name for a large company? Spirit? You can protect it by making an alias reservation. This is a great option if your business is not yet ready to open its own agency. The reservation costs $15 and will hold the name of your choice for 120 days.

Just One Question: How Much Does An LLC With Wi Alone Cost?

How much does it cost? OOO means in Wisconsin? The Wisconsin Department of Financial Institutions charges a $170 fee for mail-in filings and $130 for online filings. Do I have to renew my LLC in Wisconsin every year? The State of Wisconsin requires you toprovided annual returns for your LLC. The annual report was always required to be submitted at the end of the working quarter of the month in which the LLC was formed. For example, if your LLC was incorporated on July 15th, your information must be submitted by September, but then. The filing fee is currently $25.

Processing Time

The Wisconsin Department of Financial Institutions typically files articles of incorporation within 5 business days or more of receipt. For an additional $25, you can speed up shipping. These requests will be posted the next business day after they are received.

Wisconsin Annual Report Information

Businesses and non-profit organizations are encouraged to submit annual reports to maintain a good reputation in the public eye. State registrar. Annual reports exist in most states. Deadlines and fees vary by state and enter from the entity.

Preparing The Best OperationAgreement For Wisconsin LLC

The Management Agreement is an internal document that governs the LLC structure itself. This document regulates issues such as ownership rights, obligations of participants and profit and loss distribution strategy as well.

How Much Does An LLC Cost For A Large Corporation?

Corporation Limited Liability Company (LLC) ) registration fees are the base cost for each state. Fees vary by state, but typically range from $40 to $500. There are two ways to create an LLC: you can do it yourself (for a small fee); You or you can hire a very professional service.

What is the average LLC annual fee in 2021?

As of 2021, the prevailing US LLC annual fee is valued at $91. Most states refer to it as an annual report, but it has many other names: