Simplified tax filing and potential tax benefits.Fast and easy registration, administration, compliance, control and administration.Protect your private assets from corporate liabilities and debts.Low initial cost ($200)

Incorporation Of Your Local Limited Company Or Registration Of Your Foreign Limited Company

Certificate of incorporation of a local limited company and application for registration as a Foreign Limited company are available. To get it, see the File Downloads/Links section at the bottom of this page. Organizations, our business upload page has many other forms to request a certificate and apply.

What is the downside to an LLC?

Step 1. Select the state in which you want to register your main LLC.While you can register an operating LLC in any state—even if the LLC does not do business there—mosto LLC owners prefer to register an LLC in the state in which they want to operate. In many cases, this is likely to be the state they live in. One concern is that if an LLC is incorporated in a state where this method does not do business, and Delaware is the usual choice for such LLCs, the LLC will retain registration as a foreign LLC (also known as a foreign qualified) to operate in each of our states in which it does business, which can increase registration and administration costs.

PStarting A Business For New Businesses

We can help you register a new business in Alabama so you can take advantage of the benefits such as tax credits, incentives, and rebates that the government gives you for new businesses. This will provide incredible long-term growth and profitability for businesses, partnerships and more.

LLC In Alabama

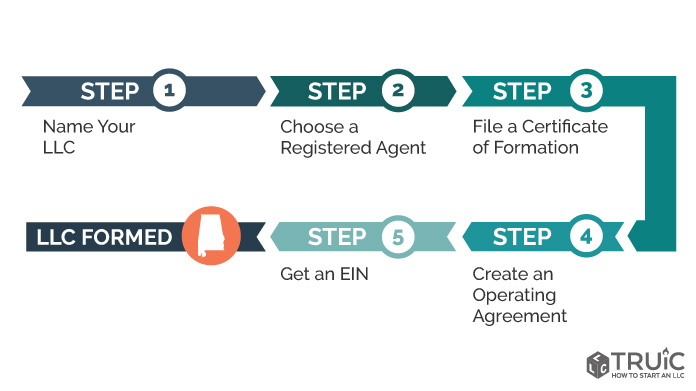

Starting an LLC in Alabama is similar to starting an LLC in another state with a few exceptions. You need to find just about any name for your LLC, register with the state, obtain the proper permits and licenses, enable a registered agent, set up a tax filing system, and obtain an EID for IRS tax purposes.

STEP 1: Name Your Company LLC

Choosing your Alabama company name is the first and several important steps in starting an Alabama LLC. Make sure you select a brand that meets Alabama naming requirements and is also easily searchable by potential customers.is that they primarily provide personal information of members with evasion of responsibility. This means that the owner’s personal fund assets are not at risk if the LLC goes into debt or is sued.

What Are The Requirements For The Name Of An LLC In Alabama?

h2> The Name Of An LLC Must End With The Words “Limited Liability Company”, “LLC”, Or “LLC”. It Should Not Contain Words That Indicate That This Is A Business Application Other Than Articles Related To The Organization. The Name Should Not Be Our Own Name, Or A Confusion-like Name Already In Use, Or A Chosen Or Reserved Name.

Effective Date

This is an optional field if you want to record the LLC registration date. By default, the LLC was formally incorporated after the date the probate judge formatted the Alabama LLC registration certificate. A common reason for a delay in the first effective date is that an LLC is in development at the end of the four-season schedule and is postponing the start when filing a tax filing.declarations are only a few weeks away.

Benefits Of An Alabama Limited Liability Company: Limitation Of Liability

Limitation of Liability is probably the main reason why businesses choose a Limited Liability Company for Special Owner ( participant). Subject to certain limitations, the limited liability creditor owner is not personally liable for any debt incurred by the LLC.

Check If Your Family Business Name Is Available

The first step to finally launching your new LLC “Alabama” will be in choosing a name for your business. The company name you choose should always be memorable and different from your nationality, so it’s best to spend some time in the marketplace to think about the best full name for your entire business.

< pChanges to

Certificate Of Alabama LLC Registration

2021: The 2020-73 Act changed the way Alabama LLCs are registered. Alabama LLC previously had a relationship with the probate judge’s office.I didn’t apply online. Limited Liability Companies in Alabama virtually no longer need to go to a probate judge. Applications are now submitted directly by the Department of State and will be submitted online.

What are two benefits to an LLC?

Initial paperwork and fees for an LLC are relatively minimal, although there are wide variations in how states collect fees and taxes. The process is so simple that the owners let them negotiate without any special knowledge, although hiring a lawyer and an accountant is a new good idea. Current requirements are usually received annually.

Is there a benefit of having an LLC?

The main advantages of an LLC are liability protection, legitimacy, tax flexibility and ease of registration.

Why form an LLC in Alabama?

A limited liability company (LLC) offers liability protection and tax incentives, among other benefits for small businesses. Setting up an LLC in Alabama is always easy. Just follow these eight steps and you are on your way.

How to start an LLC in Alabama in 2022?

The basic requirements for registering an LLC in Alabama are filing a state registration certificate and paying a $200 registration fee. There are a few additional steps?What are the steps you need to take to register your LLC in Alabama. The steps below describe everything you need to register your LLC in Alabama in 2022. Let’s get started!

What are the business name requirements in Alabama?

Names must comply with the requirements of the state of Alabama. Here are the most important requirements to keep in mind: Your company name must contain the words and phrases “Limited Liability Company”, LLC or LLC. Your name must be different from the general company name in the state.

What is the best business structure for a small business in Alabama?

A Limited Liability Company (LLC) is a popular business structure for many small businesses in Alabama. The LLC business structure was created under state law and offers exclusive liability protection and has the potential if you want to save on taxes.