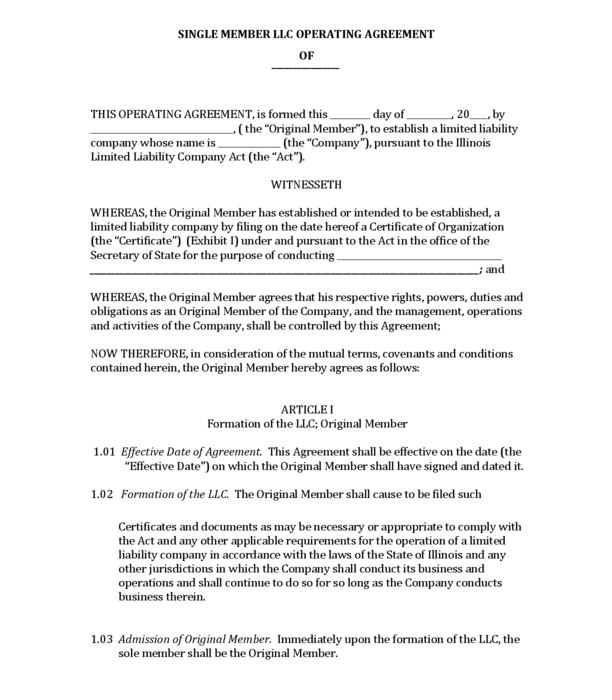

The Illinois Single Member LLC Operating Agreement is a legal document for a Sole Proprietor (Sole Trader) that establishes rules, procedures, and ownership rights in accordance with our own agreement between the owner and the actual content.

Does Illinois require operating agreements for an LLC?

The name of your LLC must end in a recognizable way from the names of various other business entities already registered with the Secretary of State of Illinois. You can verify that a name is being offered by searching the Secretary of State’s Names Database for Trade Services. You can payReserve a specific name for up to 90 days by submitting a Name Reservation Request (LLC Form-1.15). The registration fee is 25 USD.

How To Register An LLC In Illinois (5 Steps)

To start registering an LLC, look up your company name on the official records of the Secretary of State to verify that the case is currently available. Otherwise, your application will be rejected altogether. In addition, the full name must include the words Limited Liability Company or the abbreviation L.L.C./LLC.

Why Does An Illinois LLC Need To Have An Operating Agreement?

This type of LLC must have an operating agreement, because that hardly any company can act on its own behalf. An LLC requires real people (and legal entities) to perform other supplier transactions.

Operating Agreement For Your Illinois LLC

A business license works for companies of any size. It allows members to describe operating procedures and policies. You see, Illinois limited liability companies don’t need to file a transaction.This agreement is with the state, but it is still recommended.

Domestic Limited

Domestic Limited, newly registered businesses, appearing in Illinois, must submit articles to the organization via the Internet or print and mail the LLC Form 5.5. A Series LLC (a corporation consisting of several corporations) can be qualified through the same website or by filing most of the Articles of Organization (Series) LLC (Form 5.5 (S)).

Here You Are The Basic Steps You Need To Follow To Set Up An Illinois Limited Liability Company (LLC).

A Workplace Limited Liability Company (LLC) is a way to easily structure a business. It combines the limited liability of a corporation with the activities and informality of a general partnership or sole proprietorship. Any buyer of a business wishing to limit their personal liability for business debts and legal issues should consider forming an LLC. ComplementsFor more information about starting an LLC in any state, see How to Start an LLC.

What Is The Illinois LLC Operating Agreement?

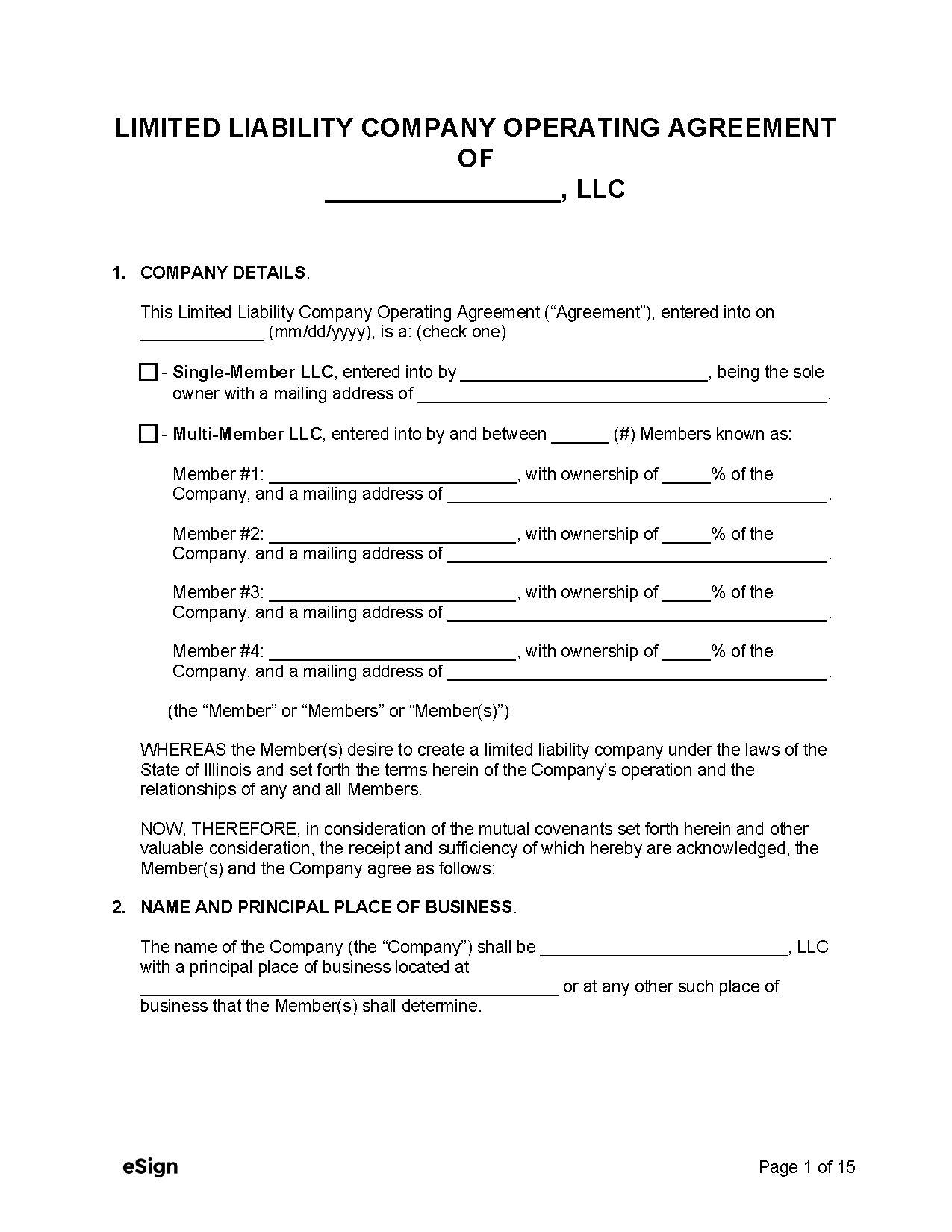

One of the steps in creating this Illinois LLC agreement is in the process of being finalized operating contracts. An operating agreement is a legal document that you and your business partners draw up together and, once signed, becomes a legally binding agreement.

Contents Of An Illinois LLC Operating Agreement

the organizational structure of the LLC in addition to the order of operation. Topics not limited to one or more LLC members will be covered. While these provisions do not affect day-to-day operations, they must be included for legal reasons.

Illinois LLC Operating Agreement Free Preview

This agreement applies to a limited liability company. with a single member. This plan may be ideal for an LLC and was created by one person. You make changes that suit your needs by addingthose descriptions related to your business. About 10 pages. This allows the possible addition of new members to the LLC.

What Is A Single Member LLC Operating Agreement?

A single member LLC agreement is the legal document containing the rules and bylaws of each corporation. This operating agreement is often drafted with an internal company arrangement clause and applies to sole proprietorship LLCs. LLC liability requires operating agreements to protect their liability.

How do I file an operating agreement for an LLC in Illinois?

An LLC in Illinois must have a performance agreement because the corporation cannot take care of itself. To operate, LLCs use real people (and others) to carry out business transactions.

How do I form a single member LLC in Illinois?

If you finally want to know how to start an LLC in Illinois, this guide is for you.

How much does it cost to start an LLC in Illinois?

The main cost of forming an LLC is the $150 fee to file the LLC Articles of Association online with the Secretary of State of Illinois.