Is an LLC operating agreement required in Iowa? No, Iowa law does not require you to enter into a proper operating agreement. You can create an LLC without it. However, it is still highly recommended to have an operating agreement as the game presents important details such as who owns the LLC as a whole and other matters regarding their company.

By Type (2)

Operational ?Single member LLC agreement: for use only by owners (sole proprietors) to create a secret daily journal containing business reports, company policies, etc., protecting the owner among other Aspects of real business.

< h2>Why does an Iowa LLC have a good operating agreement?

An Iowa LLC must have a great operating agreement because a corporation cannot operate An LLC needs real people (and other legal entities) to run its business.

Is an operating agreement required for an LLC in Iowa?

An LLC in Iowa must have some form of operating agreement, as a corporation cannot operate alone. An LLC needs real people (and other organizations) to run the business.

Benefits Of An Operating Agreement

An operating agreement with an LLC provides protection to participants by separating participants. personal records and financial accounts from those of the business. The Operating Agreement also facilitates tax benefits that the LLC would not have received without the existence of the document.

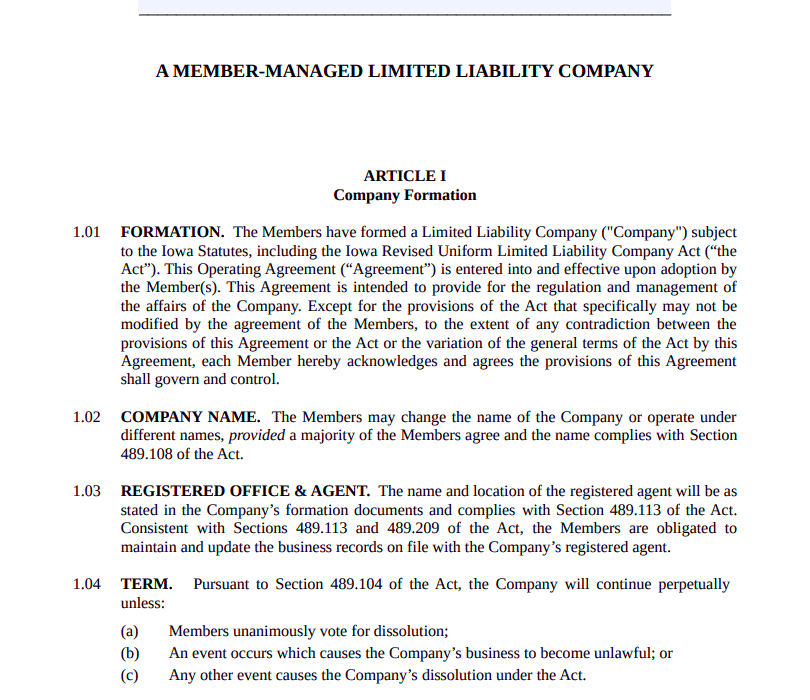

Contents Of The Iowa LLC Operating Agreement

The Use Agreement is a legal document in what I would call organizational structure and operating procedures of the LLC. Topics covered are not limited to a single member plus a multi-member LLC. Although ?Which definitions do not affect daily activities, many people should be involved for legal reasons.

â? ? LLC Naming Requires An LLC To Operate, As Well As A Name That Is Not Shared, And Another Legal Entity In Iowa. To Check Availability, You Can Search The Secretary Of State’s Online Repository Here.

Iowa LLC Model Operating Agreement

A free download of the LLC Operating Agreement provided to you by RocketLawyer LawDepot will assist you with government and legal matters so you can access an operating agreement that is right for your business. You’ll also get custom company forms, contracts, and other important white papers for their entire library.

Here Are The Basic Steps Required To Set Up A Limited Liability Company (LLC) Website. In Iowa.

A Limited Liability Company (LLC) is a legal way to structure a business. It combines complex corporate responsibility with a lack of flexibility and formality.? the relevant partnership or individual entrepreneur. Any private sector attempting to limit the personal liability of their loved ones for debts and business affairs should consider forming an LLC.

How Much Does It Cost To Form An LLC In Iowa?

Forming an LLC in Iowa depends on where you submit it. Filing a state fine costs only $50, while filing an unknown charge costs $100. You will most likely submit your LLC record to the Iowa Secretary of State’s Commercial Services Office.

More Information

By using this site, you agree to the protection and oversight of the exam. For security reasons and to ensure that the public service is still available to users, this government IT service uses network traffic monitoring programs to detect unauthorized attempts to download or transmit information or cause damage, such as attempts to use the service to deny users.

Choose A Suitable Name

The first step is to send a powerful requestand on the name reservation, to reserve an appointment with the name of the secretary of state through the online portal to arrange the registration of business entities. . State law allows a name to be reserved for one hundred and twenty days (§ 489.109).

Can I write my own operating agreement?

Do you need an operating agreement when the owners form a limited liability company (LLC)? As a reminder, the Operating Agreements are regulatory documents that ensure the proper functioning of the LLC and protect the personal liability of the business. In most of the United States, LLCs do not require our document, so many LLCs do not want to use this help to create a document.