A limited liability company (LLC) is still a business structure that combines some of the characteristics of corporations and partnerships. Limited companies that are located in Minnesota or do business in Minnesota but are located in another state must register their articles of association with the Minnesota Minister.

How much does it cost to start an LLC in Minnesota?

Here are the steps to form an LLC in Minnesota. For more information on starting an exclusive LLC in any state, see Nolo’s written article, How to Start an LLC.

Name Your LLC In Minnesota

Choosing a name for your business is definitely the first step in starting an LLC in Minnesota. This is a chance to get creative and discover what your organization and business has to offer. When considering how to name your LLC, always remember that your name must be unique and descriptive. The best name to search for your Minnesota LLC should be:

STEP 1: Name Minnesota LLC

Choosing a company name is the first and most important step in registering a Minnesota LLC. Be sure to select a URL that is correctly named in Minnesota and easy for potential customers to find.

Can I Reserve A New Company Name In Minnesota?

Yes. If someone wants to call Dibs toIf you know the name of the company but are not ready to deal with your LLC, you can file a name reservation form with the Secretary of State of Minnesota and pay a $35 fee ($55 online) to reserve yours. The company name is retained for up to one year. Articles of Association

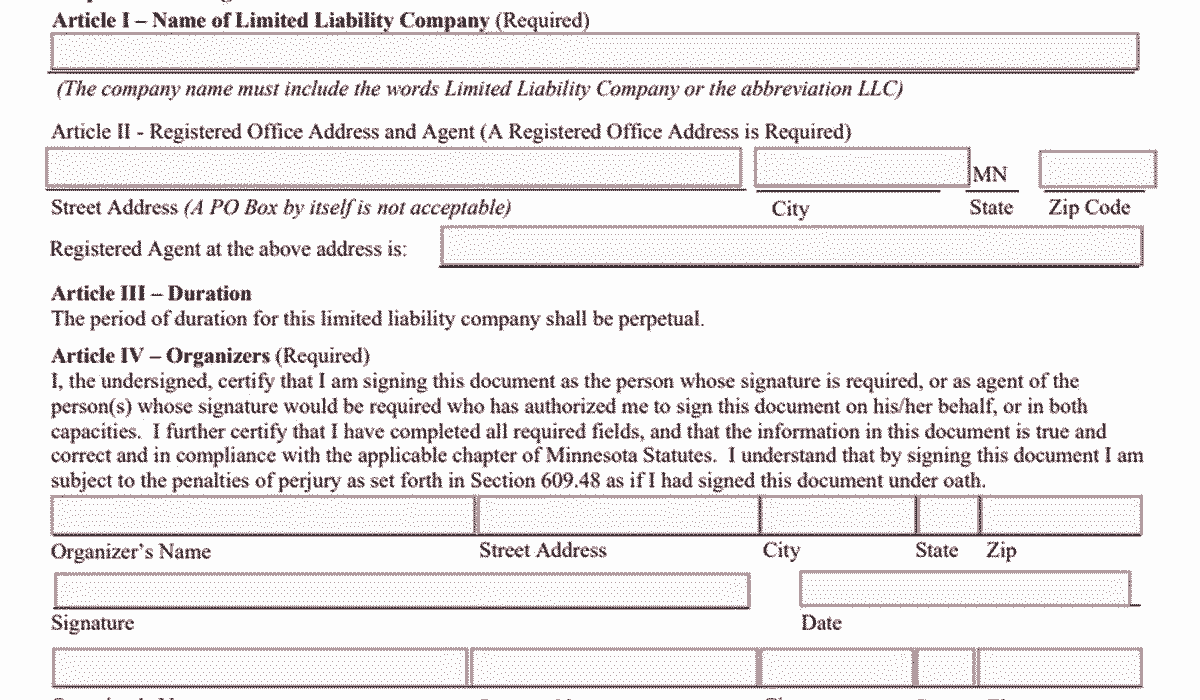

Organization

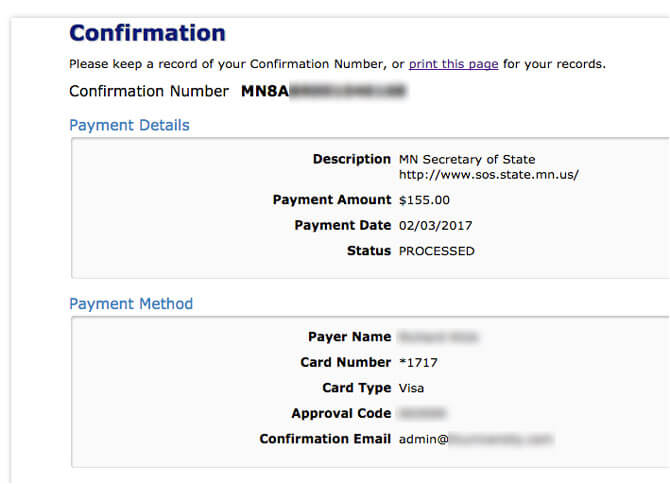

The LLC is formed in Minnesota with the current filing of the articles of association with the Secretary of State of Minnesota. Articles can be submitted online or by mail. Online filing costs $155 and mailing is $135.

Quick Facts: Your Budget And Schedule

Here’s an overview of all the paperwork, costs, and time spent filing it. LLC in Minnesota. Be sure to read the last step Tips and tricks – “Permanent Deposit” – to get an idea of ??your current expenses in Qualifies for Minnesota LLC.

Step 1: Have A Registered Agent

If you plan to jointly incorporate a Minnesota LLC, you must maintain a state registered agent at all times in accordance with Minnesota law. ??stating 322C.0114 of 2017. This law applies to both domestic limited companies and foreign limited companies. We would like to take this opportunity to share with you the basic fact that we are one of the leading registered agents in the state serving over 11,494 Minnesota businesses. We can help anyone start a Minnesota Business LLC.

Choose A Meaningful Name For Your Minnesota LLC

The very first step in setting up a Minnesota LLC is assigning an appropriate label. to your GmbH. Before naming your company, you should know that the name must be easy to remember, available in all states, and everything must comply with LLC naming rules.

Name Your LLC In Minnesota

H2 > To Register Minnesota You LLC, You Will Need Your LLC Family Name, Which The Secretary Of State Can Approve. The Name You Choose Must Be Different From The Name Of Another Minnesota LLC, Corporation, Limited Partnership.New Or Ultra Low Liability Corporations That Are Already Registered With The Minister Of State Of Minnesota. It Must Also Be Different From Any Proposed Or Proposed Name, Service Mark, Or Identifier Registered In Minnesota.

How Long Does It Take To Register An LLC In Each State?

Important: The fact that one is considered faster than the other, does not mean that you will enter your LLC into it. If you are changing an LLC out of state, you must register as a foreign LLC in your home state. For more information, see Satisfying the Best State to Register an LLC.

Taxes, Expenses, And Basic Fees

Filing annual returns as part of renewal is also free in Minnesota, as there are no changes to your own company or registered agent contact information. If we need to update certain information, you must pay a $35 change fee.

How long does it take for an LLC to be approved in MN?

What is the timeframe for registering an LLC? This is the longest time it takes the State of Minnesota to verify and enter your LLC registration into its system.mu. Once the LLC is approved, the State will return the approved documents to you electronically or by mail in a timely manner.

How are LLCs taxed in MN?

When it comes to income tax, most LLCs tend to be taxable entities. In other words, the responsibility for paying barrels of federal income passes through the LLC itself and falls on the individual members of the LLC. Without paying, LLCs themselves do not pay income tax, only their members. However, Minnesota actually charges an LLC a separate fee for the privilege of doing business in the current state. The fee is tiered and available to LLCs that have $500,000 or more in public assets, payroll, sales, and/or receipts.