Annual Return

The State of Louisiana requires you to file an annual return for your LLC. Can you submit your global annual report on the SOS website? They will also go online to print out the annual report for mailing. The annual report must be submitted no later than the anniversary of your LLC’s growth. The registration fee is currently $30.

LLC Taxation

Business owners who decide to form an LLC often do so because of the benefits this structure offers. It should not only protect the owners’ personal assets, also called items, but it should also allow the company to support you in your choice of tax deferral. This means that our members report business gains and losses on their personal income to the IRS. If you don’t have the perfect Louisiana account, check out this tutorial. If you have a full accountWith geauxBIZ, you can create a full business account with the Los Angeles Department of Revenue here: http://revenue.louisiana.gov/Businesses/BusinessRegistration

Employer Payroll Tax Withholding

H2> All Employers Must Withhold Federal Taxes From Their Employees. You Are Getting. You Will Withhold 7.65% Of Your Taxable Wages And Your Employees Will Also Be Liable For 7.65%, Bringing The Current Federal Tax Rate To 15.3%. Surname

The name

Llc Must End With “Limited Liability Company”, “LC”, “LLC” Or “L.L.C.” The Words “state”, “security” And “security” Are Not Used In The Title. Words Such As “bank”, “cooperative”, “loan”, “guarantee”, “mutual”, “savings”, “trust” And Others Require Approval From The Central Office Of Financial Institutions.

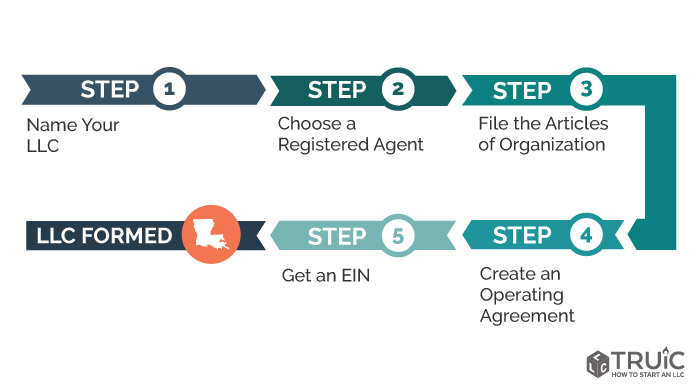

It Is Very Easy To Register An LLC In Louisiana

LLC Louisiana. To register the best LLC in Louisiana, you must submit articles related to the organization to the Secretary of State of Louisiana, 100 US – cost.? in dollars. You can apply virtually or by mail. The Articles of Incorporation is the legal document that formally leads to the formation of your Louisiana limited liability company.

Does an LLC in Louisiana have to file a tax return?

Control roomLouisiana Limited Liability Company (LLC) will help you understand all the paperwork you may need to prepare and file with this state.

Determining Your Corporation’s Tax Liability In Louisiana

If your institution receives tax deductions in the state, which puts a burden on people generally want to see a part of you, action. Louisiana is no exception. The Louisiana Department of Revenue collects business revenue and excise taxes based on the type of business. Corporations in most states are taxed at the state corporate income tax rate. However, if you are a sole trader as a limited liability company (LLC), partnership or sole proprietorship, they are considered to be through businesses in all respects. This means that the barrel “passes” to the owners, who end up paying taxes according to the state’s tax rate. Louisiana is unique in that the total corporate rateThe tax in Louisiana for S corporations is the same as for ordinary corporations. In most other states, S-Corporations have always been treated as cross-cutting organizations.

The Name Of Your Louisiana LLC

One of the first big decisions you really have to make is what name you need for your Louisiana LLC. You must ensure that the name is not already in use and complies with state regulations, including:

Louisiana Franchise Tax Deadlines

Franchise Tax must actually be paid by the 15th of the month . fifth month after the end of two financial years. For example, for participating companies in a calendar year, the due date would be May 15.

LLC Vs. Corporations

LLCs and corporations provide liability protection for corporation owners. This means that every business organization acts as a shield between the staff and the physical store, so in the event of a lawsuit or bankruptcy, my business owners will not be able to see their personal assets (cars, houses, savings, investments, etc.). .. ) can be used for windows?The effective repayment of debts. But beyond that, most of them don’t fully understand the difference between AND LLC. The asset is about to lose some knowledge. Let’s take a look at some of the structural aspects of the game between corporations and LLCs. People looking to register a business often ask if their new business will allow them to set up or create an LLC. As usual in life, the answer depends. Below are three factors we believe will help you make an informed decision.

How are LLCs taxed in Louisiana?

An LLC is supported and taxed in the same way as income tax in Louisiana.federal revenue for financial purposes. If an LLC is taxed as a corporation under federal tax practice, the LLC willbe taxed like any other type of corporation for income tax purposes in Louisiana. If an LLC is considered a partnership to win the federal governmentFor income tax purposes, which is usually the most common situation, an LLC is treated like a partnership for income tax purposes in Louisiana.

Do I have to file an annual report for my LLC in Louisiana?

Every Louisiana LLC is required to file an annual return each year.

Who is required to file a Louisiana tax return?

Revised Law 47:103 allows for a six-month extension of the filing deadline. An income tax return is issued upon request. Renewal request must be sent As of today, the filing deadline for the state income tax return is May 15 for the calendar year. applicant or the fifteenth day of the fifth month following the end of the person’s financial year.