Does Louisiana require an annual report?

If you want to register and operate a Louisiana Limited Liability Company (LLC), you definitely need to prepare a few things and file them with the state. This article reviews the current basic continuing reporting and state barrel filing requirements for a Louisiana LLC.

Can You And Your Family Check For The Name?

Yes. We could very well hold aPreliminary search for the presence of names. Please call our office for this information. You can also check the availability of names on a dedicated site. You can access the commercial database from the home page. Enter the suggested company name (without the company suffix, such as L.L.C. or Inc.) and click Search. A number of named stores or similar named business models will emerge. If a local or unusual entity/company has been withdrawn, the name will certainly not be available for 3 years from the date of the withdrawal. Please note that this is a preliminary study. There are various rules governing the availability of names, and this further research is done by one person after they submit your paperwork for submission.

Louisiana Annual Report Deadlines And Fees

Don’t Remember when did you start your business? You can usually find your anniversary date by searching this Louisiana business database. Then click the More Details button next to your company name. Your birthday will be shown as “?Register by Date at the Louisiana Secretary of State’s Office. Foreign and domestic commercial companies must pay $30 to file their annual return. The fees apply to the same LLCs and simple companies. There is a $10 non-commercial fee to submit a report.

Louisiana Annual Report Information

Businesses and, in addition, non-profit organizations must file annual returns to stay in good standing. Foreign Secretary. A year’s experience is required in most states. Maturity rolls back and fees vary by state and/or entity type.

Louisiana Annual Return For Limited Liability Companies And Corporations

In Louisiana, limited liability companies and corporations are required to file annual returns. Both business models should equally convey important information for their reports. Whether or not your corporation is a local (intrastate) corporation?y or LLC, foreign (non-state) corporation or foreign LLC, you will still provide the government with the same basic information.

LLC Annual Report Review /Statement

Although most people send it by mail, the annual return will most likely be processed within 1-2 business days. The government will not return any confirmation to you, but you can log into the appropriate geauxBiz account (if you have one) and then download a copy of the annual report you submitted. If you don’t have a new geauxBiz account, wait a few days and then find your LLC here, click Details, maybe look below under File Changes and You. Your annual return will be listed.

Louisiana Annual Report

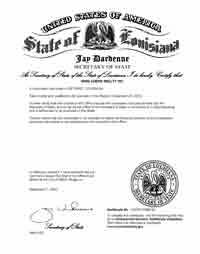

Louisiana requires businesses and charities to regularly update their material information in order to file annual returns in order to register their status for purposes taxation. . LLCs and charities are required to report annually on their activities to the government?To the Secretary of State of Louisiana. Business owners can access their annual report online or on the denomination page.

How do I file a business annual report?

Many states require corporations, LLCs, and many other businesses to file an annual description. Learn more about annual reports and check out our step-by-step guide to creating a status report.

How do I file a notary annual report in Louisiana?

Annual media are sent to notaries 65 (60) days before the anniversary date with their commission. In accordance with Act 1142 of the Legislative Session of 2003 (see www.legis.state.la.us), their annual return must be completed no later than signed by a notary public and returned upon payment of the $10 filing fee. 00. The completed annual return and fees must be returned before the anniversary of this commission to avoid late fees or even suspension.