How much does it cost to file an annual report?

The annual report fee is only $85 for local corporations, $150 for international corporations, and $35 for local or even foreign non-profit corporations. Companies that applied on the site last year can review and update their information, if necessary, before submitting a report for this year.?t year.

Who Is Required To File An Annual Return In Maine?

After beginning employment in Maine, any authorized representative may sign an annual return in Maine. An authorized person who is part of your business will allow them to act on their behalf. It will certainly be someone in the company (such as a director or manager), a person or entourage of the company you are hiring, who will present your report. When hiring a Northwest agent registered with the Business Renewal Service, individuals complete and submit their Maine Annual Return.

Maine Annual Report Information

Businesses and non-profit organizations are required to document annual returns to stay in good standing. City secretary. Annual returns are usually required by the states. Deadlines and fees vary by state courtesy – and kind of company.

Deadlines For Filing Annual Returns

The deadlines for filing the first of all annual reports that the company files, each time from January 1 to June 1, tied to the year in accordance withcalendar. year you created your business. This deadline for the first annual report is the same for a foreign company that has unfortunately submitted a foreign qualification certificate. The deadline for charities is November 30.

Maine Annual Return Instructions And Fees

The cost of filing an Annual Return in Maine mainly depends on: Where you are located. You have registered your business. If you originally registered in Maine, your costs will be slightly lower than if you registered out of state. Statement

Annual Return

Maine Requires You To File A Return For Your LLC. . You Can Submit The Report Or Complete It Online With The Secretary Of State. To Access The Online Form, You Will Need The State Registration Number Of Your LLC. Little Information Is Required To Complete The Report, Such As A Brief Description Of The Identity Created By Your Business, And The Name And Address Of At Least One LLC Employee.

1. Page

1. Purpose of your business State the overall purpose of your business. It doesn’t have to be special?Simple and obvious (unless you want to) and you don’t have to do it all the time. You can always change the purpose of your entire business as it grows.

The Contents Of This Annual Report

Typically, an annual report issued by Maine LLC (or another good commercial organization for that respect) will contain all information relating to his company and its members. The standard content of any annual report or annual report makes reporting difficult:

What Is A Maine Annual Report? Why Is This Important?

See the full annual status review report of this LLC. It is like a census, the purpose of which is to collect the necessary contact and structural information about every business in Maine.

When are the Maine State annual reports due for 2021?

AUGUST, Maine. Annual returns are due Tuesday for all commercial and nonprofit organizations whose full-time secretary of state positions begin in December. Secretary of State Shanna Bellows reminds those who need to file that they can do so quickly by simply using the Secretary of State’s filing system.

When do I need to file an annual report?

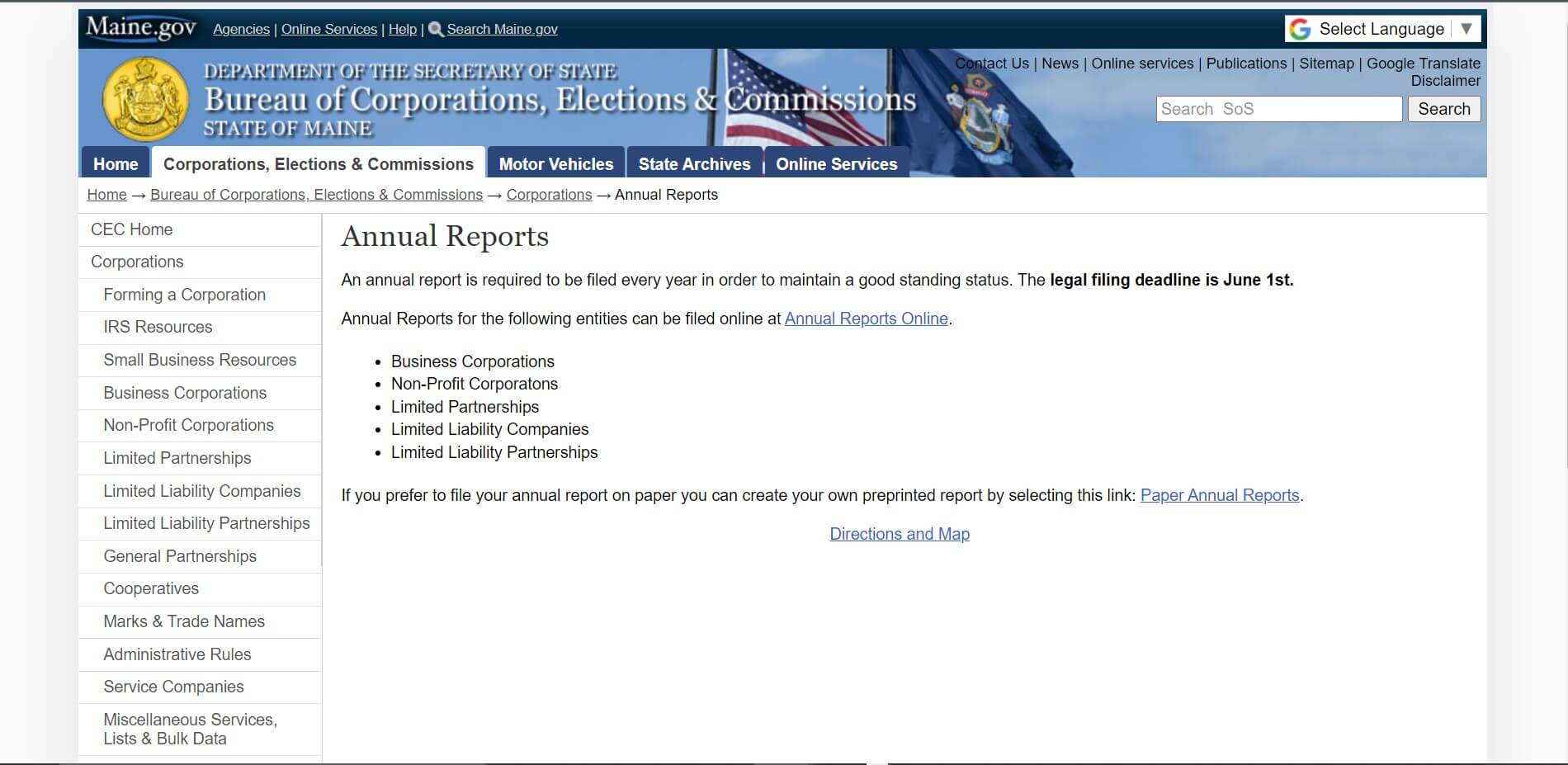

An annual report must be submitted each year to maintain good condition. The allowed submission deadline is June 1st. Annual reports for the following companies can be submitted online at Annual Reports Online.

How do I contact the Maine Division of corporations?

The department can be contacted at (207) 624-7752 or email [email protected].