definitions. As used in this subsection of the Guide, “business”, “business”, or possibly even “business carried on in this state” by a large foreign company limited by shares, means the management or practice of employment in that state.

How do I set up a corporation in Maine?

Create a free account and use our many online tools to start your Maine business today. Includes registration in Maine, maintenance and preparation of corporate documents. Everything is free – pay only the state duty.

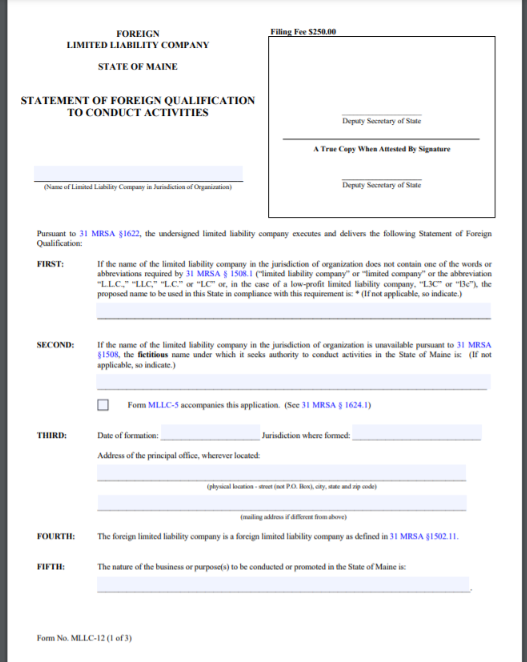

Foreign Companies

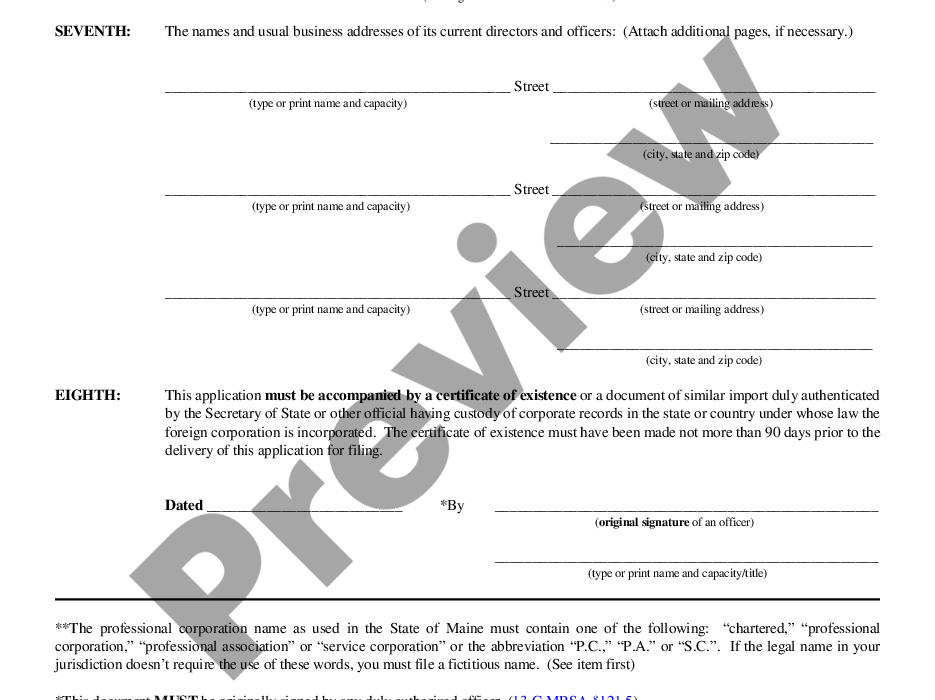

MRSA SECTION 13-C: MAIN BUSINESS COMPANY ACT 1501. Permit to conduct planned activities – business activities not related to apprenticeship 1502 Consequences of Unauthorized Business Transactions

How Long Does It Take For The State To ProcessMaine Individual Certificate Of Authority?

Normal processing: 2-3 business weeks plus more time to ship.Personal processing: 2-3 business weeks unless expedited.Expedited Processing: 24 business hours plus delivery time. During a shutdown, you may be contacted in person.

What Is Another Maine Certificate Of Authority?

Corporations are often required to register with the Maine Bureau of Corporations, Elections, and Commissions before doing so. Shop anywhere in Maine. Out-of-state businesses typically apply for a Maine certificate from Authority. This registers the company as a foreign company and eliminates the need to register a new company.

Foreign Companies And Corporations

Domestic commercial and non-commercial corporations are considered domestic or foreign corporations. A national organization is an organization registered under the laws of the State of Maine. Conversely, a foreign company is a company whose majorityswarm is registered under the laws of another state or country. By registering in that particular state, you can obtain a Maine business license.

How Do I Know If I Need A Maine Certificate?

If you plan to do business in Maine, but your business is not registered in Maine, you will often need help obtaining a foreign qualification. As a general rule, “running a business” has always been defined by activities such as maintaining a physical office or hiring staff in the current state.

What It Means To Run A Business

One of these things that entrepreneurs understand a necessity when offering to do business in Maine. While there is certainly no strict definition, this article lists some of the activities that are considered doing business in Maine and require a foreign qualification to obtain results:

Step 3: Certification Of Registration Qualifications

Registration of foreign documents for registration of an LLC in the state of Maine is carried out separately for domestic and foreignbusiness entities, and therefore a fee is charged. If you are considering incorporating a local LLC, someone must file a certificate of incorporation under MRS 31 §1531. If you are considering incorporating a cash limited company in the state, you will likely need to file a “statement of foreign qualification” under MRS 31 Game §1622. Registration documents must be submitted to the Secretary of State.

What Is Considered “doing Business”? In Maine

Without an open definition of “doing business” in Maine, each business must be assessed on a case-by-case basis. However, most businesses involved in the following activities will need to help you obtain a foreign qualification in that state: Have a residence in the state One or more persons providing services in any state Goods or services obtained through purchases or attributable to the sources of this guide

How To Complete The Registration Of A Foreign Company In Maine?

WelcomeTo the largest library of trust files, legal forms in the USA. Here you can get all templates like Maine Foreign Business Registration Forms and download business packages (which you then want/need to have). Create official documents in hours instead of days or time without hiring a lawyer. Get a country-specific template in just a few clicks and trust the features developed by our licensed lawyers.

Separate Your Personal And Business Assets

If your personal and business asset accounts are completely confusing, your personal property (your home, car, and other valuables) is at risk when a lawsuit is filed against your Maine Is llc. In web business law, this is called a corporate veil.

How much does it cost to incorporate in Maine?

How can I review the annual return in Maine? Limited liability companies and Maine corporations must file their valuable annual returns by mail or online at the Secretary of State’s website.