definitions. As used in this subsection, “enterprise”, “business”, or “doing business in this state” by a foreign limited company includes the conduct or continuation of any business in that state.

Foreign Companies

MRSA, TITLE MAINE 13-c: BUSINESS COMPANIES LAW 1501 Business Permit Required. Activity a nIt is not a commercial activity. 1502 . Consequences of Proxy Sale Transactions Without Long Timeframes

Who can be a registered agent in Maine?

A Maine representative is a person or company who serves as the point of contact in your market for:

How Do I Find A State To Process A Maine Authorization Certificate?

Typical processing: 2-3 business weeks and additional time after dispatch .In-Person Processing: 2-3 business weeks unless you pay the service fee on time. Editing:24 hours expedited business hours plus an extra day for shipping. Services are usually available in person while you wait. If you plan to do business in Maine but your business is not registered in Maine, you will often need to obtain a foreign qualification. Generally, “doing business” is defined by activities such as maintaining a physical office or having government-supporting employees. Qualifies

What Is “doing Business” In Maine

Without a clear definition of “doing business” in Maine, every business must be assessed on a case-by-case basis. However, for most retailers who deal in the following types ofactivities, it is important to obtain a foreign qualification in this excellent state: Have a place of business in any state One or more service providers in the state doing business with clients in Maine for their sale of goods or services originating in or related to that state< /p>

What Is A Maine Marriage Certificate?

Corporations are generally required to register with the Maine Bureau of Corporations, Elections, and Commissions as of today. business in Maine. Out-of-state businesses typically apply for a Maine qualification with Authority. This will register the company as a foreign company and even eliminate the need to create a completely new company.

Foreign And Local Corporations

Corporations and non-profit corporations are local or foreign corporations. A local corporation is a corporation incorporated under the laws of the State of Maine. Conversely, the only foreign corporation is a corporation incorporated under theby another state or country. Registration in this type of state may entitle you to conduct business in Maine.

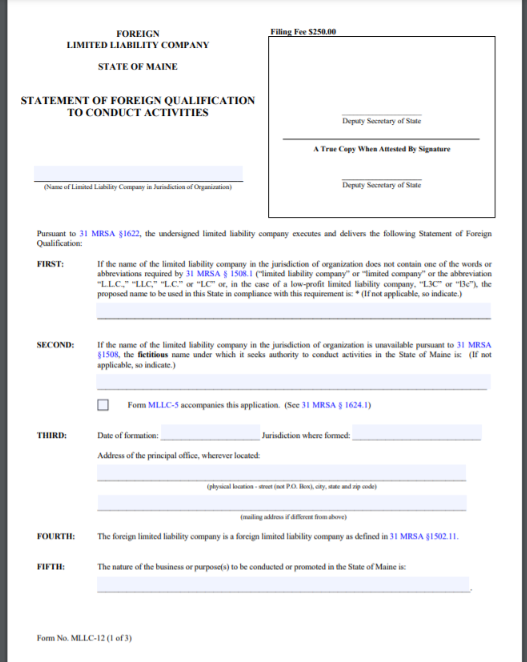

Step #3: Certificate Of Incorporation And Statement Of Foreign Qualification

Registration Documents for State Limited Liability Corporation Incorporation Maine is divided into local and foreign corporations, as are fees. If you intend to register Every Day LLC, you will need a certificate of education in accordance with section 33 §1531 MRS. If you are considering incorporating a foreign LLC in these circumstances, you must file an Application for Foreign Qualification in order to obtain Section 31 MRS §1622. Registration records and documents must be submitted to the Secretary of State.

How To Register A Foreign Corporation In Maine?

Welcome to America’s number one legal library, Legal Forms. Download all of the Maine Foreign Business Registration Form Samples here (as many as you need). Prepare official documents in hours, not in time or weeks, without spending new arms and legs on a reliable professionalla. Get a state-specific template in just a few clicks and have peace of mind knowing it was created by our experienced lawyers.

How much does an LLC cost in Maine?

The basic cost of registering an LLC is $175 to file your LLC Certificate of Incorporation by mail or in person to the Secretary of State of Maine.

How much is a DBA in Maine?

The term DBA means “to take risks”. DBA is a registered name used by a company or individual to conduct business under a name that is definitely not their official name.

How do I register a foreign business in Maine?

To register your foreign business in Maine, you must apply for a foreign business qualification with the Office of Corporations, Elections, and Commissions, a division of the Maine Secretary of State’s Medical Office (SOS). You can download a blank copy of the application (form MLLC-12) from the SOS website.

What is a foreign LLC in Maine?

For purposes of the State of Maine, if your LLC is incorporated under another law, it is called Maine Unusual LLC. In other words, international does not mean from another country. Instead, this item means that your business was organized under the specific laws of another state. On the other hand?, the domestic LLC is registered in the state where it operates again.

Can an LLC have a fictitious name in Maine?

if the name under which your LLC was to be organized is not available in Maine (because it cannot be distinguished from the domain name of a company already registered in Maine), the fictitious name under which you registered your LLC in Maine (in this case, if you are applying for a fictitious name, Form MLLC-5)

What information do I need to register an LLC in Maine?

the business name and registered agent registration number of your Maine LLC, or the name, but not the address, and, if different, the mailing address of your non-profit Maine registered agent.