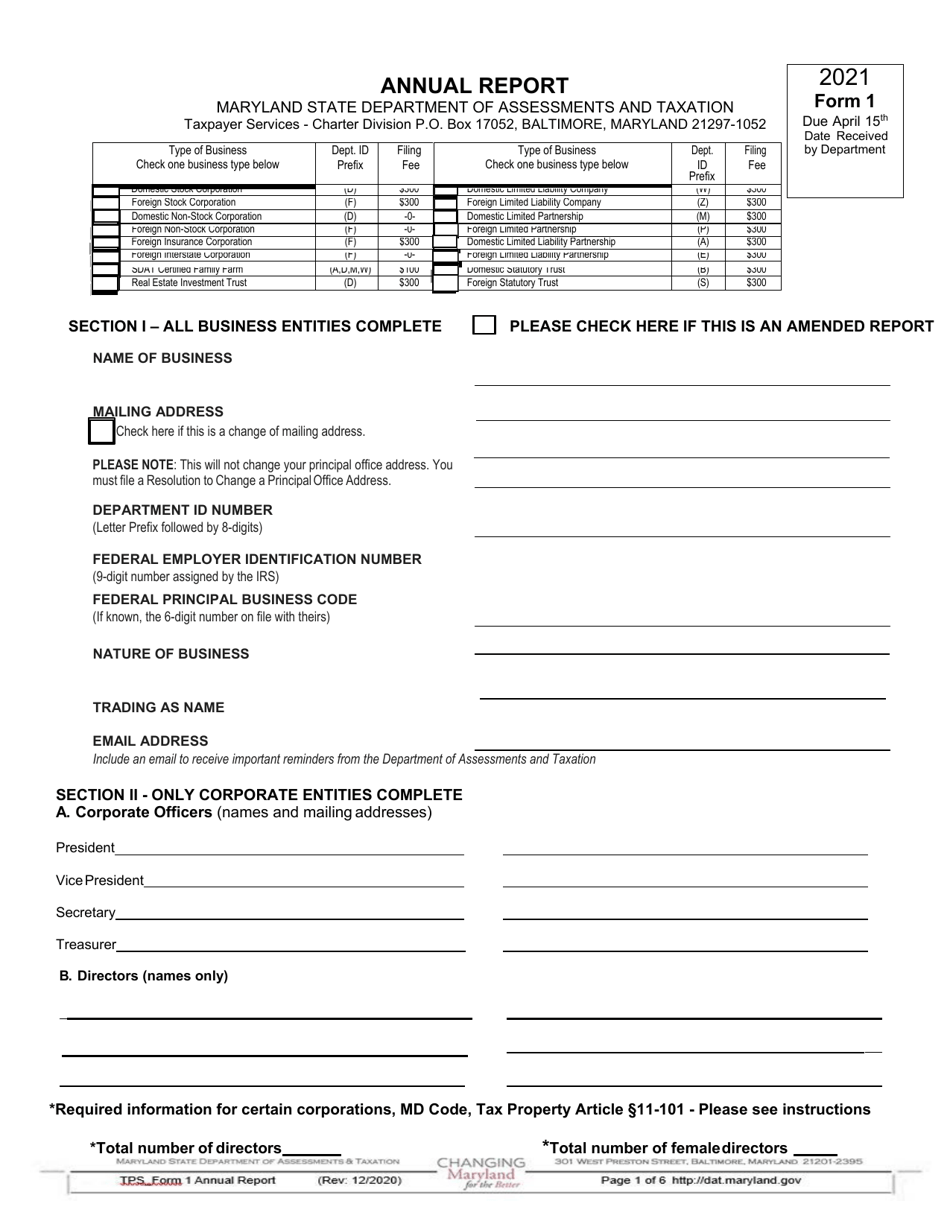

The Maryland Annual Report, also known as the Return of Ownership Report, is the comprehensive documentation that a company submits each year. It contains information about business activities for the entire previous year.

Taxpayer Service Forms For Business

Email: [email protected] documents at one of my offices, we encourage you to consultTalk to a lawyer, accountant, or other professional. Our employees cannot change consultants.

Who must file a Maryland annual report?

All proposed businesses registered, qualified, or registered to do business in Maryland MUST file an excellent annual return:

Annual Due Dates On The Maryland Report Plus Fees

Delay fees: Your business will be charged 0.001% of total property tax OR a penalty on the property, regardless of the height accumulates more. In addition, you will always be charged an interest rate of 2% for every month you are late. In fact, below is a table showing the amount of the fine.

About The Maryland Annual Report

It is imperative that corporations and non-profit organizations file annual returns in order to maintain a good reputation in the eyes of corporations. state administrator. Annual returns are required in most states. Deadlines and fees vary by state and Art Corporation.

Filing Annual Return Fees And Instructions In Maryland

The cost of filing an annual return and property tax return is slightly higher than in other states. It is consideredThere is a $300 fee to file the actual report. This is a fixed rate, standard for all businesses. However, non-commercial websites do not have to pay a fee when filing a report with the State Department of Appraisal and Taxation.

Does Maryland have an annual report?

To successfully submit Maryland’s annual return, you must complete the following steps:

Who must file a Maryland personal property return?

Even if the company has not received this application, it still bears a great responsibility for receiving and sending it. All corporations, limited liability commercial companies (LLCs), limited liability partnerships (LLPs), and private limited partnerships are required to file personal property declarations with this valuation and taxation department.