The Maryland Annual Report, also known as the Personal Location Report, is a comprehensive report that an outstanding company presents every year. It contains know-how about the company’s activities in the coming year.

CORPORATE TAXPAYER SERVICE FORMS

E-mail: [email protected]. Due to the fact that the legal requirements for incorporation and operation of corporations and the effectiveness of a UCC funding report involve more than filing documents while you are in our office, we recommend that you consult with this lawyer, accountant or other professional. Our employees could not speakas consultants.

How do I file an annual report in Maryland?

To successfully file Maryland’s annual return, you must complete the following steps:

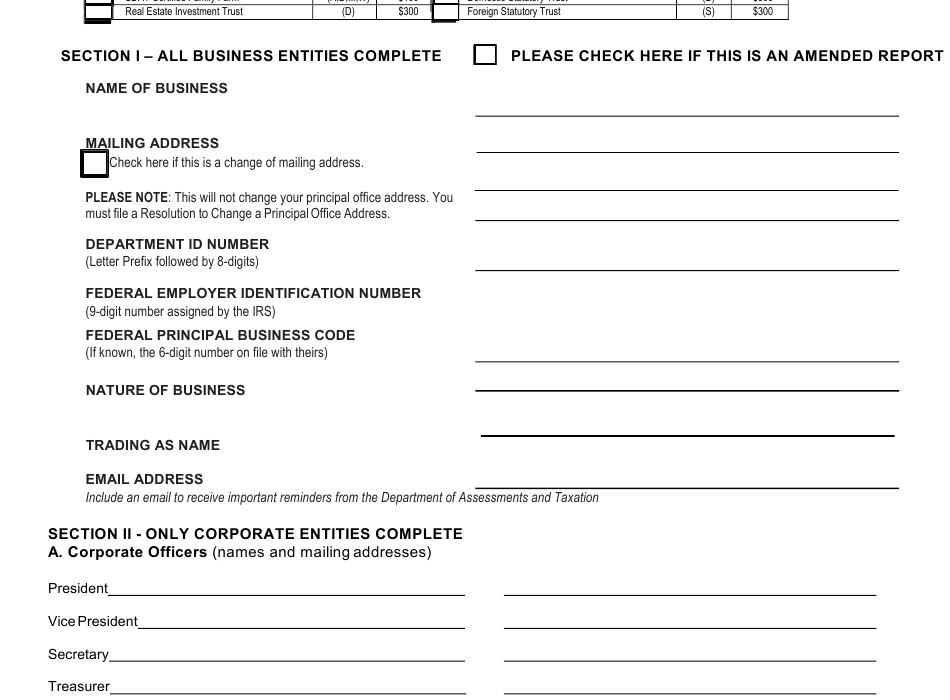

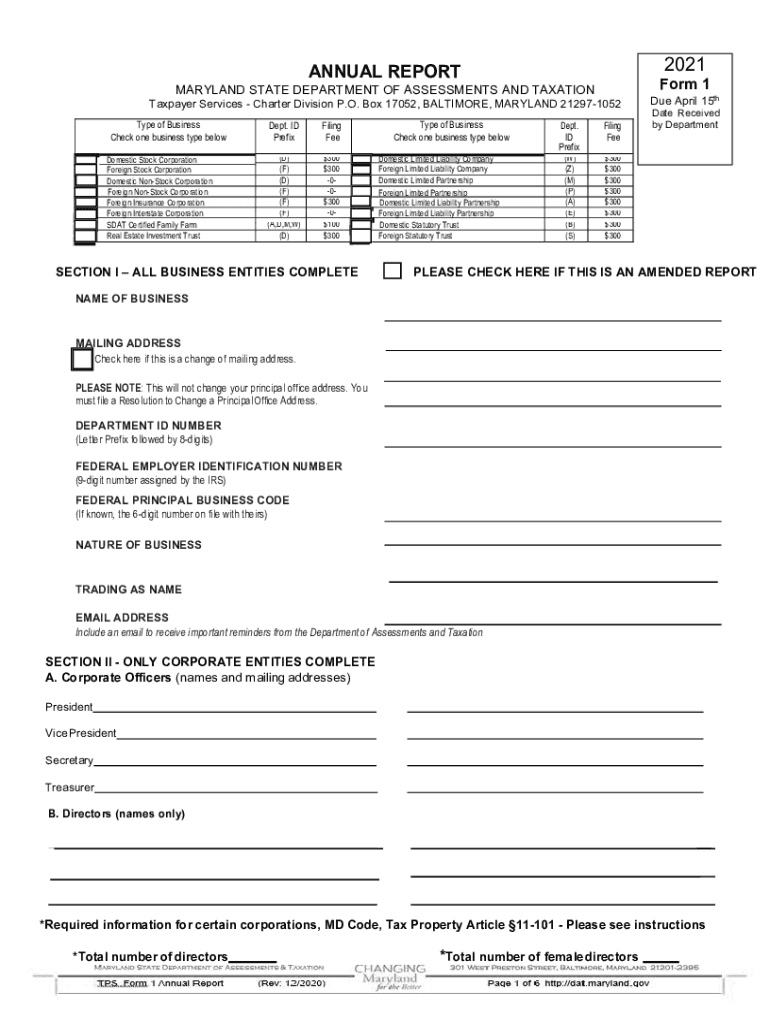

Fees And Instructions For Filing An Annual Return In Maryland

The cost of filing an annual return and filing property tax is undoubtedly a little higher than expensive. in added states. There is a $300 fee to submit a report. This is a true standard package for all groups. However, non-profit organizations are not required to help you pay any fees if they file their paperwork with the State Department of Grades and then with the Internal Revenue Service.

P> H2 > Late Payment Fee: Your Business May Be Charged 0.001% Of Total Tax Assets OR A Base Penalty, Whichever Is Greater. In Addition, You Will Continue To Earn 2% Per Annum For Every Month You Are Late. Below Is The Most Recent Table Detailing The Base Fee.

Maryland Annual Report Review

The Maryland Report, also known as Another Personal Property Restitution Report, is a comprehensive report that which biznes presents every summer. It contains information about business tasks for the past year. And shareholders and various other parties who invest in the company often use the report to obtain important information about our company’s operations and financial condition.

Maryland Annual Information Report

Businesses and non-profit organizations must file reports every 12 months to stay in good standing. Foreign Secretary. Annual returns are required in most states. Deadlines and fees vary by state and object type.

Personal Property Taxes

Part of the personal property tax form that the PTA filed in previous years appears to have come from the Maryland Department of Appraisal and Taxation (SDAT) to allow these forms must be submitted by April 11, 2018 or later. The old figure was split into two separate evolutions -??? annual report and personal property declaration.*

Submit Personal Property Declaration 1)

Subject of personal property declaration form (form 1) is accountable to the title of all personal property (c. ), and can also be submitted online via Maryland Business Express.

Do you have to renew your LLC every year in Maryland?

All registered, qualified, or proposed businesses in Maryland are required to file an annual return each year. If that company can answer “yes” to any of the following questions, it must also file a property tax return with an annual return available: