Charter LLC “Maryland”: everything you need to know. The Articles of Association of a Maryland LLC may be a document filed with the state to establish an LLC’s license. A Certificate of Incorporation, also known as a Certificate of Organization, is required to register a corporation.

FORM FOR BUSINESS TAX SERVICES

Email: [email protected]: Subject to the laws governing incorporation and operation of corporations and the power of the UCC funding application if you wish to submit more documents to our office, please consult a lawyer, accountant or other professional. Our employees cannot act as consultants.

Who has to file a MD Annual Report?

All legal entities incorporated, qualified, or registered to do business in Maryland MUST file an annualeven:

Open A Valid Business Account

The use of commercial banks and bank-specific credit accounts is necessary to protect your company’s corporate veil. When your personal and therefore business accounts are mixed up, your personal money (your house, car and other valuables) can be at risk if your LLC is sued.

Create An LLC In Maryland Should Be Easy

LLC in Maryland. To obtain a Maryland LLC form, you must submit the Articles of Association to the Maryland Department of Valuation and Taxation, which costs $100. You apply online, by mail, or in person. A charter is a generally accepted legal document,Forming an LLC in Maryland.

Basic Steps To Form An LLC

To form an LLC in Maryland, you must first select your company name and include the phrase “Limited Liability Company” or make sure it is an abbreviation (“LLC” or “L.L.C.At.?”) whose ending refers to the name .

To Order A Certified Copy Of The Articles Of Incorporation Or A Certified Copy Of The Articles Of Incorporation Of Any State Of Maryland

A A certified copy of your final Articles of Incorporation or Certificate of Incorporation can be ordered by mail, online, or any other way, but we recommend online. Regular payment takes up to 7 days, longer for delivery and costs $20 plus $1 per side. Expedited Service can be purchased for an additional $20 and will take more than 3 days plus additional delivery time.

What Is A Limited Liability Company (LLC)?

An LLC is different from the types of corporations. In Maryland, detailed requirements for establishing or registering an LLC are contained in the Maryland LLC Law (Md. Corporations and Article, Associations Limited Liability Ccompany Act, Title 4A). An LLC may engage in activities related to any legitimate business, purpose, investment, or activity that may be carried out for profit or without consideration, except as an underwriter. The law also includes separate requirements for operating an existing LLC in Maryland. However, the law is very flexible in terms of powers, LLC, ie. actions he can take. An LLC may be formed to exist indefinitely or to cease operations after a certain period of time and, therefore, may enter into contracts or conduct other activities at the discretion of its officers. LLC members tend to have a lot of freedom to join the company in the area that suits them best.

How To Submit Maryland Articles Of Association Online

If you would like to email your Articles of Association, see the instructions below on how to write an article suitable for this. from the state of the requirement.

Briefly: Your Budget And Deadlines

?From an overview of the total costs, materials and time required to create LLC in Maryland. Be sure to read the last step of this article Guide – “Permanent Deposit” – to understand your current expenses in terms of maintenance Qualifies for Maryland LLC.

Filing Articles

Your corporation is legally incorporated by filing articles of association with the Maryland Department of Valuation and Taxation. The charter must contain: the name and address of the founder; Company name; his task; the address of the person’s principal place of business in Maryland; the name and address of the process service representative; the number of shows the Company is authorized to produce and the face value; the number and names of the first directors; and accept the name of the resident agent.

Name Your Legal Entity

If you have confirmed that your LLC name is likely to be available but do not wish to provide your LLC. you can retain the applicable business name for up to 30 days by submitting a business name reservation request. Standard rate ?Delivers $25; The retail price is an additional $20 to speed up the overall process.

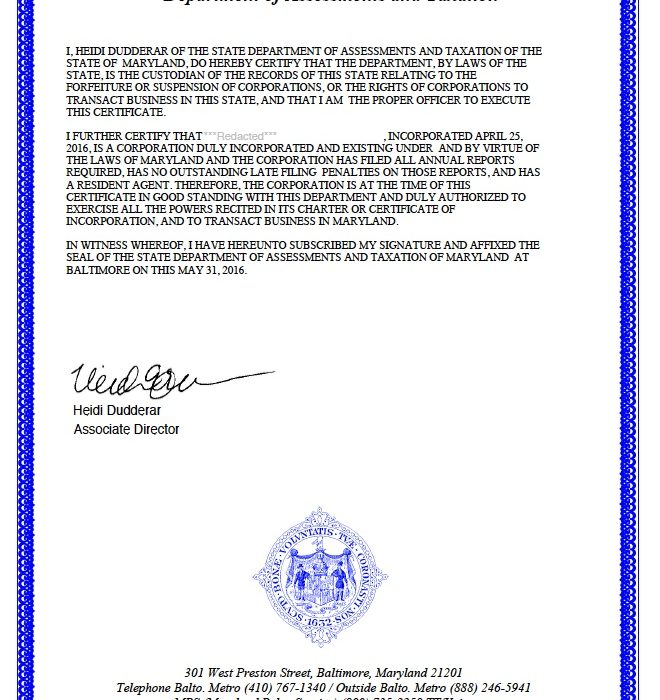

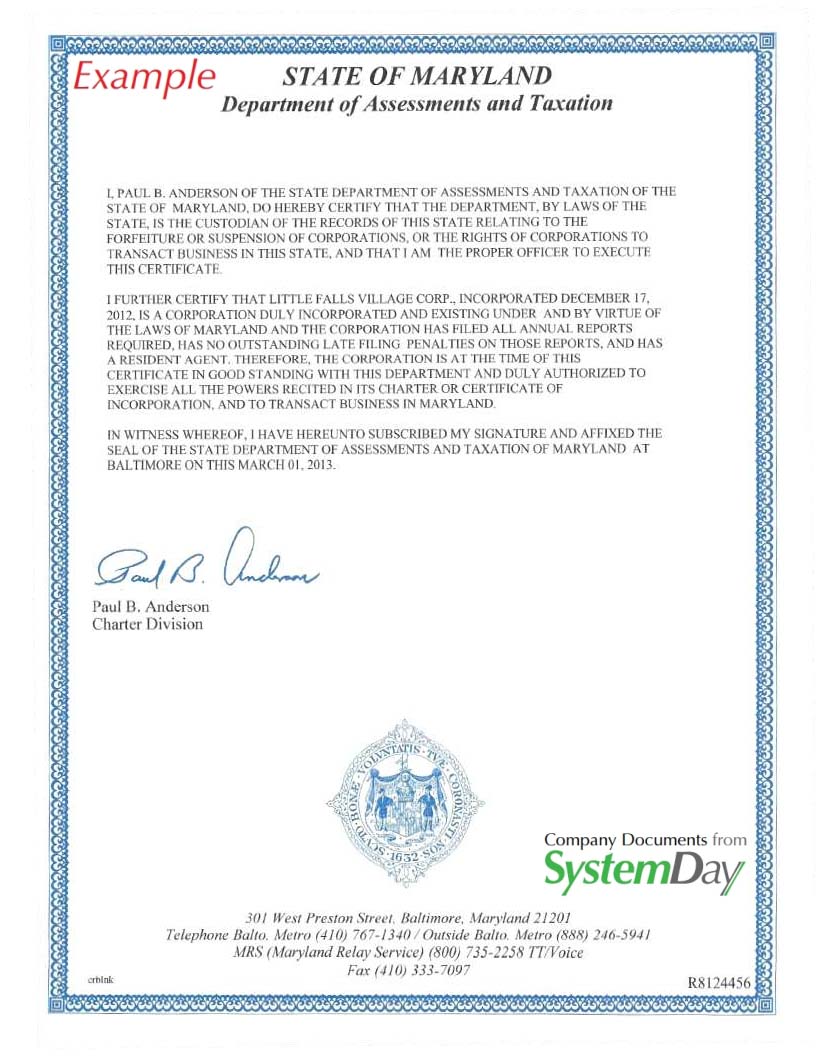

Is a Maryland certificate of good standing required?

When a person obtains a license, reincarnation license, or credit settlement, they are often required to obtain a “certificate of status” (commonly referred to as a “credit certificate”) issued by the Maryland Department of Tax Assessments. On a specific date and time, the department issues a credit certificate stating that the business entity is in “good standing”, meaning that all paperwork has been sent to the department along with the statutory fees received due to no other government the agency advised the ministry that the company was in arrears in tax payments.