How much does it cost to incorporate in Massachusetts?

Integrate.com will take care of all the necessary requirements and provide you with the necessary expenses to start your business in Massachusetts.

Fees And Instructions For Filing An Annual ReturnMassachusetts State Board

The cost of filing an annual return with the Division of Corporations depends on the type of business you are acquiring. Companies that make profits both abroad and domestically must pay $109 to file financial statements. Reports are due 2.5 hours after the fabulous close of the financial year. Nonprofits must pay an annual filing fee of $18.50 and must register by November 1.

The Costs Of Forming A Foreign LLC In Massachusetts

If you already have an LLC registered in out of state and you want to expand your new business in Massachusetts, you must join your LLC as a foreign LLC in Massachusetts.

Get Service Massachusetts Annual Report Today!

H2> START START

Massachusetts LLC Expenses: Where To Start? ð???

To form a fantastic Massachusetts LLC, you must submit an excellent Certificate of Organization to the Secretary of the Commonwealth of Massachusetts. They can be done on file, by mail, by fax, also called online. With our servicegoy to create an LLC in Massachusetts, we can register your LLC in the last 5-10 minutes for only $49 + registration fee. It’s easy!

Annual Return

The State of Massachusetts requires you to file a 12 month return for your LLC. You can write a report or fill it out on the corporate department website. You must have a customer number and PIN to ultimately access the online form. Few information is required to complete the report, such as the LLC’s legal name, its required office location, street address, and local agent URL.

Find Everything You Need To Know About Registering A Company In Massachusetts. Corporation Here.

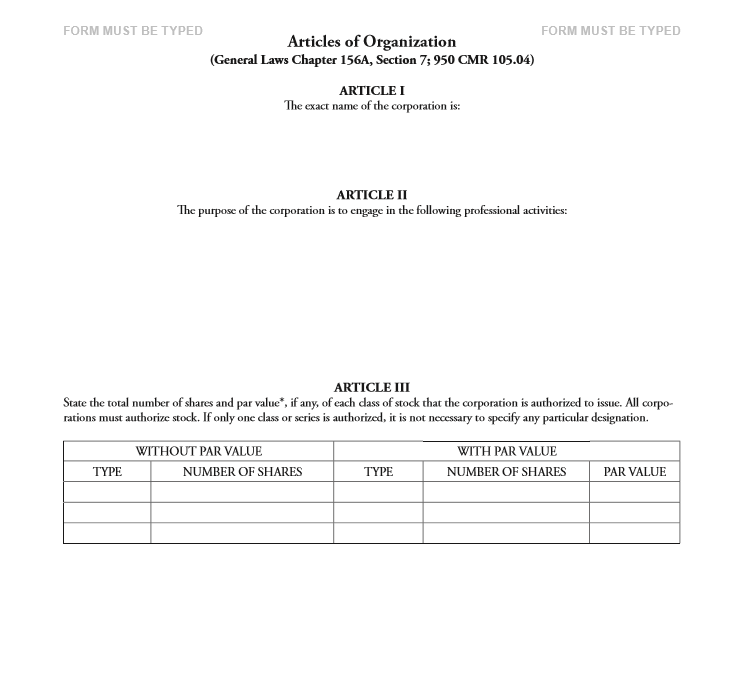

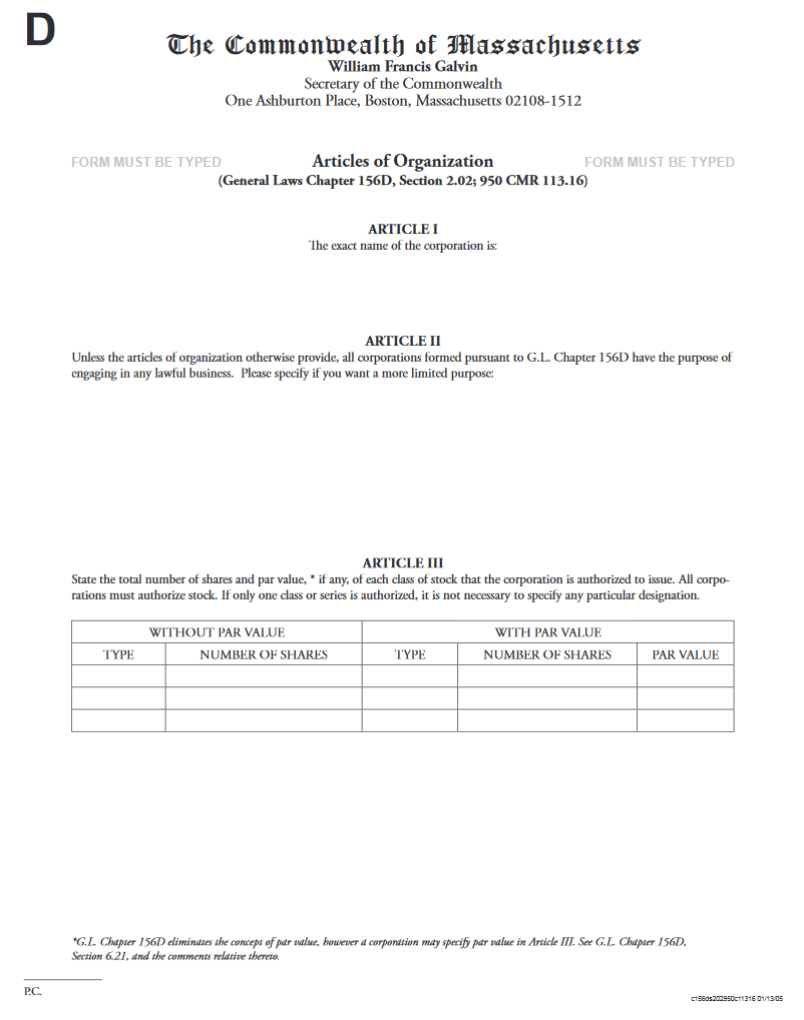

To register a corporation in Massachusetts, you need to follow the steps described. You can also use the Nolo online corporate service, which includes everything you need to form a corporation of your choice.

How To Register A Company In Massachusetts

If you are interested in deciding on registration in Massachusetts, include. com will take care of all the details.We will check the availability of your company name, assist you in the preparation and subsequent filing of your articles of association with the Companies Section of the Commonwealth Secretary, and expedite the payment of fees. In many cases, we can also take care of many of your basic business monitoring tasks, including requirements, preparing, and filing your annual return.

Ready To File Your Annual Return In Massachusetts?

Social media has always been the preferred method for companies to connect with clients, colleagues and potential clients. We are committed to sharing useful information and tools to help you grow your new business.

Annual Return Fees, Deadlines, Filing, And Procedure

Annual Return Fees and Deadlines will be charged due to whether your company is a for-profit or non-profit. a profitable company, as well as a foreign or regional company. The registration fees are as follows:

Total Cost Of Setting Up A Massachusetts LLC

You have a name for your new company in mind, but are not yet ready to start. You may want to consider it.For protection by filling out a name reservation. Reserving a corporate URL is not a requirement to form an LLC, but unfortunately it is a good option. Reserving a name for 60 days costs $30. After that, you can also renew it for an additional $30. But when your business is ready to go, filing an organization certificate right away will save you money because it will make it easy for your name to be registered in your state.

How much is the Massachusetts annual report?

This site promises information on how to file the Massachusetts annual return. Our mobile phone See Massachusetts Annual Returns and Filing Deadlines Chart. Tariffs for each type of object. We also offer a managed annual return service that takes the stress out of your annual return. tells honestly. We track your due dates and manually record the time every time.

How much is the filing fee for an LLC in Massachusetts?

The basic selling price of forming an LLC is the $500 fee to file an LLC certificate for an online organization with the Secretary of State of Massachusetts who is a Commonwealth affiliate.

How do I file an S Corp in Massachusetts?

S corporations have a few restrictions, such as not much for 1 share class and 1 shareholder. Check out all the details in our guide “What is S Corporation”.