Do I need to register as a foreign corporation in Massachusetts?

If you are registering a corporation in Massachusetts, you must file a Memorandum of Association with the Commonwealth Secretary and register at:

How Do I Get Proof Of Qualification From Massachusetts?

They won’t email you to the postman unless there’s a problem with all of your paperwork. If you don’t receive everything from their office within a week, you can check the status online, but you can check the registration confirmation printout on the website.e.

What Is A Massachusetts Certificate? Authority?

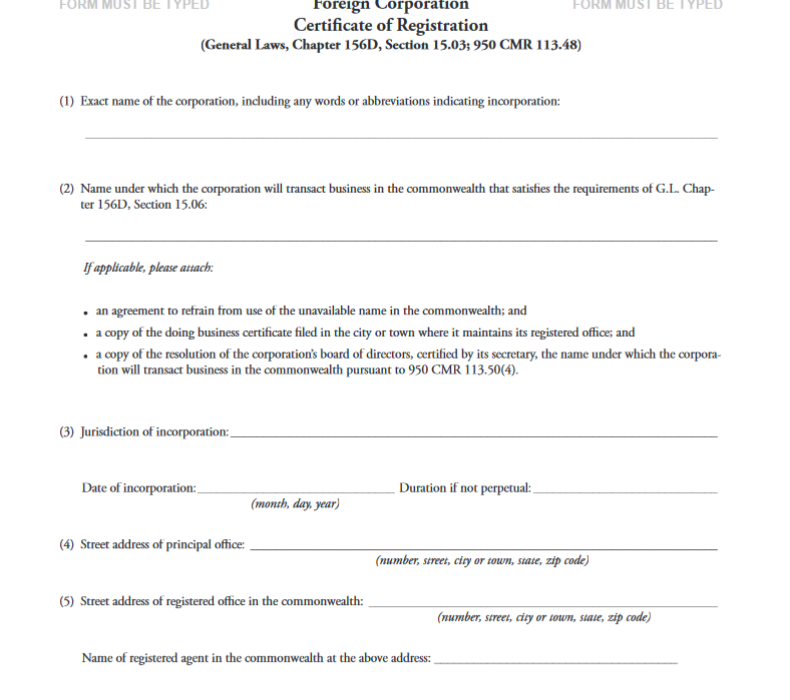

Corporations must sign documents with the Secretary of State of Massachusetts when doing business in Massachusetts. Out-of-town businesses usually require a Massachusetts voucher. This permanently registers the company as a foreign company and eliminates the need to include it in a real new legal entity.

Forms By Mail

For your protection, most of us do not accept any form or payment by mail as it is not a secure form of communication. Please return the forms to the Companies Division if online submission is not possible. ?) requires the following foreign corporate projects to be registered with the Secretary of State of Texas if the corporation is “doing business” in Texas:

Internal Forms BACK

Speak To An Expert About Foreign Qualifications At 888-366-9552

foreign is nothing more than the process of registering a business so that it operates legally in another state, it can become a processoh his current one. For example, a company in Maine that is unfortunate enough to open a store or that already has agents in Massachusetts must meet international requirements to do so legally.

When Did You Need To Do This? To License (or Register To Do Business) In Another State Abroad?

If you are currently evaluating if you want to work in a country other than your country, the first useful question is: do you need to apply for forex trading in the target country(s)?

All Individual Renewal Fees For Residents And Non-residents

Delay fees for all individual manufacturers:According to M.G.L. Chapter one hundred and seventy-five, section (8) 162m(c), if the actual licensee does not renew his license on the renewal date, he must reinstate his license, which will require double fees. He has up to 12 months to renew his license. After 12 months, the Massachusetts resident cannot be reinstated and must retake all major licensing exams. Non-residents do not needbut retake exams as long as they retain their resident status, but they can apply for a new license.

The Cost Of Registering A Foreign LLC In Massachusetts

If you already have an LLC registered in another state and you want to expand your business in Massachusetts, you must register your LLC as a foreign LLC in Massachusetts.

How To Register A Foreign Company In Massachusetts?

Welcome to the largest legal library, US Legal Forms. Here you can download (as many as you want/need) all samples, such as registration forms for foreign corporations in Massachusetts. Prepare official documents in a few hours, not weeks, and you will not have to deal with the law. Get a state-specific form in just a few clicks and be sure the device was built by our certified state attorneys.

How much does it cost to register a foreign LLC in Massachusetts?

If you do live and have an address in Massachusetts, then yes, you can be your own registered agent. You may also have a friend, relative, or colleague who lives in Massachusetts. However, as businesses begin to expand their operations to other states, many choose to hire registered agents to handle this important aspect of their business.

Who Must File Ma annual report?

If you do business in most of Massachusetts, be sure to apply in the state where you continue to do business by filing an annual return with the Division of Corporations each year.