$100 is the same as $10 shipping; $125.00 plus $10.00 late fees. Annual returns must arrive at our office unpostmarked within two and a half months of the end of the financial year for timely review. After public resolutions, no fee is charged for each annual report submitted in paper form.

How much does it cost to register a foreign LLC in Massachusetts?

If you actually live in Massachusetts and have all the mailing addresses, then yes, you and your family can be your own registered agent. You can also nominate a friend, relative, or colleague who lives in Massachusetts. However, as companies begin to expand into other states, many are opting to hire registered agents to work in this important area.region of your business.

How Can I Get Proof Of Qualification From Massachusetts?

They won’t send you any more emails unless there is a problem with your application. If you haven’t received anything from their office within a week, you can check the status online and print the confirmation of registration from the website > The cost of filing an annual return with the Division of Corporations mainly depends on the type of business the person owns. Foreign and domestic commercial companies must pay $109 to file an annual application. Reports must be submitted 2 months 5 after the end of the financial year. Nonprofits must pay $18. To file a 30 annual return, and they must file by November 1st.

The Cost Of Setting Up A Real Foreign LLC In Massachusetts

If you ever need a registered LLC registered in another state and you want to expand your amazing business in Massachusetts, you need to register an LLC as a foreign LLC in Massachusetts.

InformationStatement Of State Of Massachusetts Annual Report

Companies and nonprofits must file annual returns to stay at the top of the rankings. Secretary of State. Annual returns are required in most national states. Deadlines and fees vary by state and enter the company.

To Register A Corporation In Massachusetts, You Need To Know Almost Everything Here.

To register a corporation in Massachusetts, you must follow the procedures described below. You can also use the online service of the Nolo company, which will create a company for you for any needs.

Filing An Annual Return In Massachusetts

Corporations in Massachusetts may be subject to different renewal requirements and fees or taxes, depending on the corporation’s portfolio. Below is a list of the many types of business entities in Massachusetts and the requirements for reactivating them.

National Forms

BACK

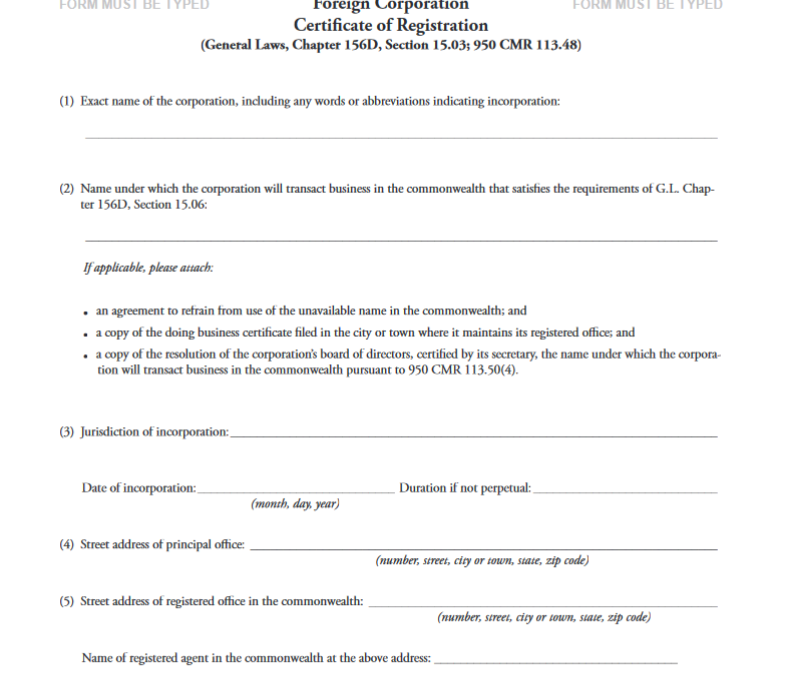

Registration Of A Foreign Corporation In Massachusetts With A Lawyerin Forming Companies

States require corporations to register as a Perfect Foreign Corporation to ensure tax and regulatory compliance. If you are unsure whether your Massachusetts corporation requires a foreign corporation mark, call our main office at (800) 603-3900 to speak securely with someone who can train you right now. Registering a foreign company and obtaining a certificate of authority is an authorized and corporate incorporation process; To avoid the likely pitfalls associated with doing this with a good non-lawyer training service or agency – a government LLC or organization, you will need all of the following: $28 name reservation fee, $150 processing fee, two copies of the certificate systems. a form authorizing a foreign corporation to transact in Alabama, a certified copy of your incorporation data files (deeds of incorporation or articles of incorporation) and therefore a registered corporation?nt in Alabama.

Massachusetts Formation LLC Costs: $500

The Certificate of Organization is the most expensive form you will need to file to open an LLC. This is the official document that registers your business with the Secretary of the Commonwealth of Massachusetts. In other claims, the same form is referred to as “article organization”.

Do I need to register as a foreign corporation in Massachusetts?

When registering in Massachusetts, clients must file a Memorandum of Association with that Commonwealth Secretary and register with the following:

How much does it cost to incorporate in Massachusetts?

Integrate.com handles all registration requirements and also provides you with the full cost of setting up your business in Massachusetts.