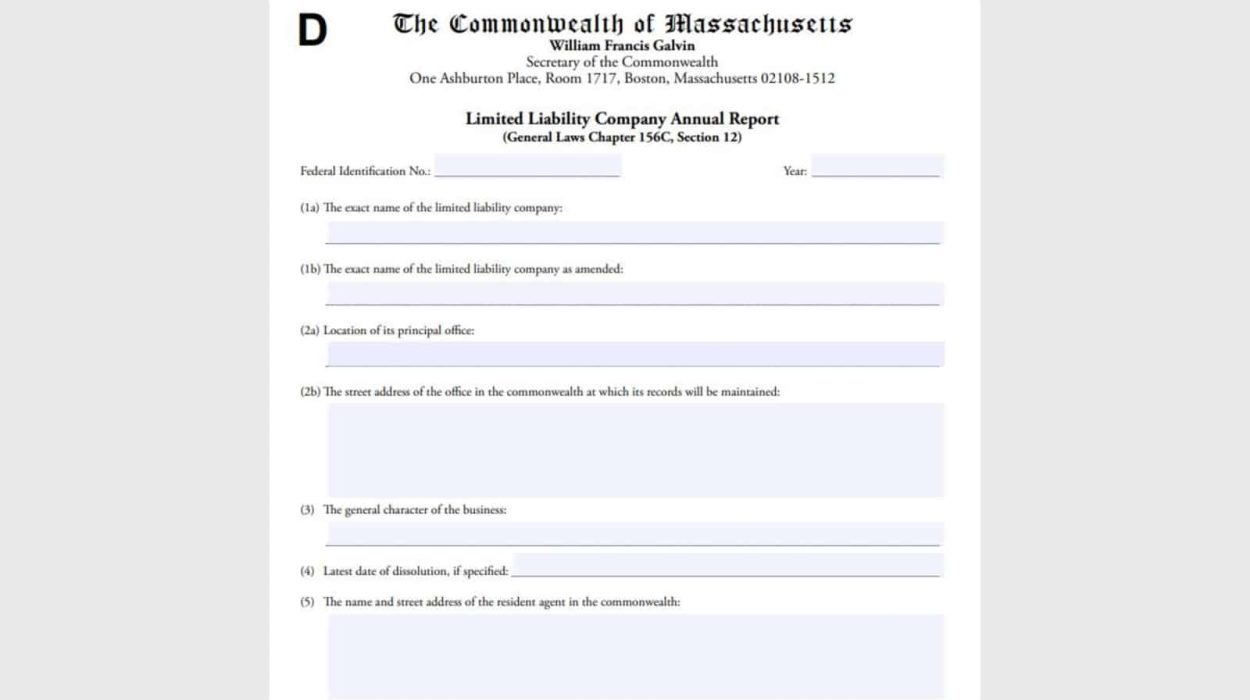

In Massachusetts, the budget report is the regular documentation that their LLC must file annually to process information about your business, including: company name and address. The general nature of the business. Name and address of registered agent.

Massachusetts Annual Return Guidelines And Fees

The cost of preparing an annual return for the Division of Corporations depends on the type of organization you have.Anization or possibly an annual report. Reports must be submitted 2.5 months after the end of the financial year. Nonprofits must pay $18.50 to file their annual financial statements and annual returns by November 1.

Does an LLC need to file an annual report in Massachusetts?

LLCs are also required to file an annual return with the Secretary of the Commonwealth.

Get The Massachusetts Annual Reporting Service Today!

START START

What Is Massachusetts Annual Income?

Legal registration is the first step in many state reporting requirements. In addition to filing an annual tax return, LLCs and Massachusetts corporations must file an elective return. Failure to file can result in heavy fines and liquidation or cancellation of your entire business.

Organization Certificate

The ideal first step in filing for any Massachusetts LLC would be an organization certificate. You must complete a Certificate of Organization from the Secretary of the Commonwealth Companies Department in order to form an LLC. The certificate is a fairly simple document in which you indicate the exact name and official address of your new LLC, the subject and address.The weight of the registrant of the LLC, a summary of the reasons or nature of the LLC, and some other basic details. . p>

Filing An Annual Return In Massachusetts

Corporations in Massachusetts are subject to different renewal requirements and associated fees or taxes, depending on the type of entity. Below is a list of various Massachusetts business entities and their reinstatement requirements.

Application To Change Resident/Office Agent

LLCs are not required to appoint a registered agent only if they determine these products in your business. If the registered association changes address, you may apply to change resident agent/resident office.

Annual Return Contents

Your annual return will normally be filed by Massachusetts LLC (or other commercial receiving business) containing all information relating to their business and members. Criteria for the contents of an annual return or an annual franchise tax return:

What Is A Massachusetts Annual Return? Why Is It Important? Consider A YearCommonwealth Marketing Report, Which Will Review Your LLC Each Year. It’s Like Getting Them On The Census, Because Their Goal Is To Collect The Necessary Contacts And Basic Information About Every Business In Massachusetts.

You Can Also Ask What Happens If I Don’t. Do This. Can I Manually File An Annual Return In Massachusetts?

Of course, what happens if I don’t file an annual return in Massachusetts? Massachusetts corporations are the only corporations subject to a $25 late fee for failure to file a budget return. However, all companies must be formally liquidated if they remain in default for two years or more. When are annual reports due? Annual returns for all corporations, limited partnerships, limited partnerships, and limited financial partnerships must be filed between January 1 and May 1 of each year. Submission of the annual report by a certain time allowsavoid late fees.

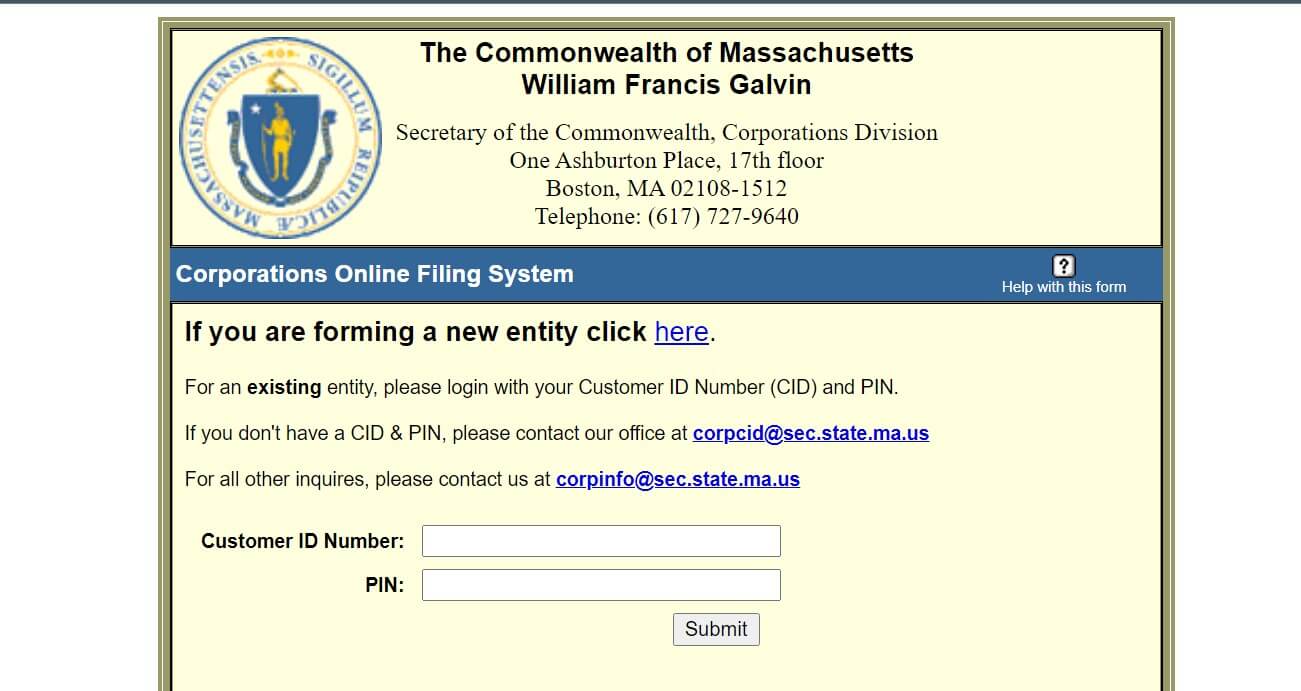

Registering A Business In Massachusetts

Our simple checkout process will help a person get the information they need and in the current matter A new professional unit is being formed in Massachusetts these days. We think about the “unknowns” taken off the shelf and put an end to this confusion. Our fast and secure online ordering process and easy shipping options allow you to focus on your new business…not the show.

Do I have to renew my LLC Every year in Massachusetts?

All LLCs operating in Massachusetts are required to file an annual return every year.

Is there an annual fee for an LLC in Massachusetts?

The first important government document for any LLC in Massachusetts is the Organization Certificate. You must file a Certificate of Organization with the Companies Division of the Secretary of the Commonwealth in order to register your LLC. The certificate is a fairly simple computer file in which you provide the standard name and address of your new LLC, the name and address of the registered agent of the LLC, a summary of the purpose or nature of the LLC, and some other basic information.