The Name Of Your SMLLC

The name of your SMLLC in Massachusetts must include the words “Limited Liability Company”, “Limited Liability Company”, or possibly the abbreviation “LLC”, “LLC”, “LLC” in addition to “LC.” The name of an SMLLC can often include the name of an SMLLC member or expert. The name must not match the corporate name of an organization already initiated by the Massachusetts Division of Corporations (SOS). be deceptively similar.

Can you have a single member LLC in Massachusetts?

September 11, 2015SARL with sole member MA

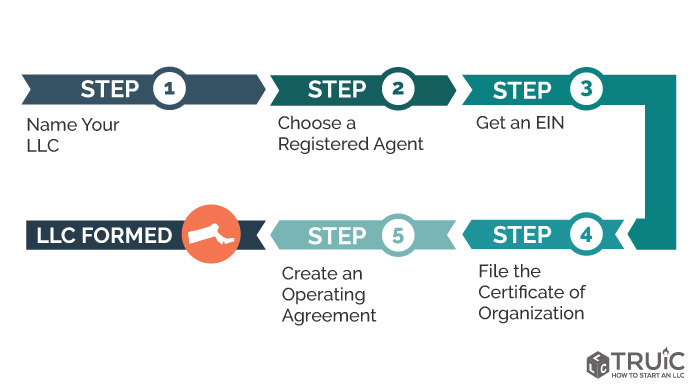

How To Start A Great Limited Liability Company In Massachusetts

Starting a new business starts with a lot of ?Problems, Implementation highlights some of the overview steps that should keep your business in line if your website decides to register a Massachusetts LLC. For more information on incorporating an LLC into your business, visit our webinar “What You Need to Know If You Decide Whether You Want to Incorporate Your Small Business.”

Massachusetts And Single Member LLCs

Massachusetts approved the formation of limited liability companies with one member in accordance with the law. In the past, some LLCs were required to have two members. you can now transform into a single affiliate limited company and enjoy liability protection from creditors.

It Is Easy To Form An LLC In Massachusetts

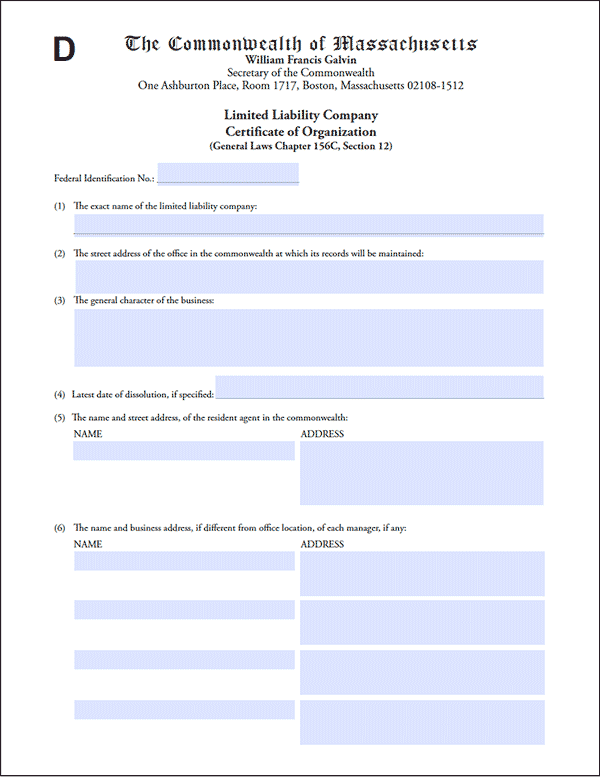

A LLC in Massachusetts. To form an LLC in Massachusetts, you must file a Certificate of Organization with the Secretary of the Commonwealth of Massachusetts, which costs $500. You can apply online or by mail. An organization certificate is usually a legal document that officially registers your company.Limited Liability Company in Massachusetts.

State Taxes

In Massachusetts, there are two main types of taxes for limited liability companies in each of our DORs. . This is the sum of state income tax and sales tax. You will most likely need to obtain a Massachusetts Tax Identification Number in order to pay.

Name Your Massachusetts LLC

Incorporating a Massachusetts LLC begins with choosing a name. As you list your options, keep in mind that there are state and federal rules that individuals can use to use certain words in company names.

Before You Register Your Limited Liability Company In Massachusetts< /h2> There Are A Few Important Details To Consider When Starting An LLC In Massachusetts. Please Read The Following Pages To Find Out What You Need To Do Before Starting Your LLC.

Reasons For A Single Member LLC In The Service Industry

In March In 2003 ?? Gov. Mitt Romney signed the bill into law, which is now legal. LLC “Single Member” in the state of Massachusetts (more precisely Massachusetts 50th state to pass such a law). Limited Liability Company (“LLC”) provides the same asset protection as a real business in Massachusetts and almost all other states. If you are displaying contracts on behalf of an LLC, then the LLC As an individual owner, you are unlikely to be responsible for the transaction. if the deal is not worth it, or if there is a lot of debt (which you, as kitchen workers, are not personally responsible and do not sign), subsequently your other personal property (e.g. house, car, investment, etc.) are covered by LLC creditors.

Can I Reserve A Business Registration In Massachusetts?

Yes, you can. If a person needs time to level up all your other bird before they form the awesome LLC with the coolest name, your first priority is to fill out a resuscitation application.Name verification and payment of the main fee of $30. booking is good to get 60 days. After 58 days, you can pay an additional $30 to extend your booking for another 60 days.

How To Open An LLC In Massachusetts

Before you, if you make your LLC in Massachusetts, you must have a legal company name. Choose one that is original, that tells people who you are and what alternatives you make or offer, and that appeals to your market. In any case, you must ensure that your name is not accidentally used by anyone else in the Commonwealth. It should also be well distinguishable and distinguishable. Minor in many forms the spelling, punctuation and suffix will not be appropriate. In accordance with Commonwealth Laws, do not use obscene language or words that appear to be pejorative in nature.

Does an LLC need to file an annual report in Massachusetts?

The MA LLC Annual Report is associated with several documents required to run a statewide business. This and several other documents are required to keep your business in good standing in Massachusetts. 3 minutes of reading

Do you have to renew your LLC Every year in Massachusetts?

All LLCs doing business in Massachusetts are required to file an annual return.

How is an LLC taxed in Massachusetts?

LLCs and LLPs are classified for Massachusetts tax purposes the same way they are for federal payroll tax purposes.