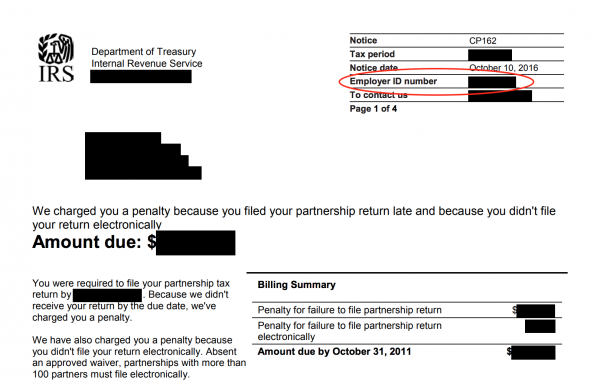

This could be the 9-digit number assigned to your businesses when you registered with the federal government. You need it when opening a business bank account, simply when applying for a business loan, or when opening a credit transfer.

Explanation Of Tax ObligationsEmployer Employers (Publications 15, 15-A, And 15B)

Publication 15PDF contains information on employer tax liability in relation to taxable wages, withholding more complex payroll tax reporting, and income tax issues are discussed in Publication 15 -APDF, and taxation procedures for many outsourced services can be found in Publication 10. We encourage employers to download these from IRS.gov publications) or call 1-800-TAX-FORM.

Is Michigan ID same as EIN?

The Michigan Tax Identification Number is similar to the EIN issued by the IRS. Despite the name of the device, EIN has little to do with business operations. 7 minutes of playing time

ID Number Employer (EIN)

EIN is your own nine-digit number that identifies the company to the government. It works in the same way as a social security number to contact an individual. In an EIN, the first two digits and the last seven digits can be separated by a hyphen, which helps to distinguish the EIN from a social action set. You can apply for an EIN with the IRS for free.

What Is An EIN?

EIN stands for Employer Identification Number and is assigned to your LLC by the Internal Revenue Service (IRS). EIN identifies your company to the IRS in the same way as a social security number.insurance identifies a person.

What Is A Michigan Taxpayer Identification Number (EIN)?

The Michigan Federal Taxpayer Identification Number, also known as Employer Identification Number (EIN) or Federal Tax Identification Number number, is a nine-digit unique identifier established by the Internal Revenue Service for the purposes of taxation of corporations, non-profit organizations, trusts and estates. A taxpayer ID or EIN is used to easily identify a legal entity, just as a social security number is used to uniquely identify individuals.

Michigan Taxpayer ID

To obtain your state federal taxpayer identification number Michigan (EIN), you will probably also need a valid Michigan Tax Identification Number. This ID was required to pay income tax, state income tax, and/or sales tax on items that you and yourfamily are selling. Typically, a State Taxpayer Identification Number can be used for the following purposes:

What Is An Employer Identification Number (EIN)?

EIN is short for Employer Identification Number, sometimes referred to as Federal number. Number. Employer Identification Number, FEIN, Federal Tax Identification Number, or Federal Taxpayer Identification Number. This is a unique nine-digit number that is the same as an individual’s social security number, but uniquely identifies the company.

Michigan Tax Identification Number

A state tax identification number, such as FEIN, is used to identify your company if it is an individual. It is also customary to monitor compliance with tax laws. In Michigan, the state tax ID is a nine-digit number known as the employer’s Unemployment Insurance Agency (UIA) account number. Businesses need guidanceUIA to apply for certain university loans and local licenses/permits.

Personal Information

How do I restart my online alumni enrollment? You can access your online profile if you are registered on this site. Please note that, unlike you, changes may be made but may not take effect within 3-5 business days.

What Is The Literal Meaning Of The EIN?

They must provide you with the following information when you apply for an EIN: the name of the specific person in charge of the business (usually the sales owner), social security number, individual taxpayer identification number or highly responsible political party number, employer identification. internet company name. So, is the business identification number the same as? Is a corporation tax number the same as a good EIN? Yes, the business tax number is also called the employer number. Number or EIN.

How Can I Get This Number Online?

You canapply online. Customers are encouraged to communicate their EIN purposes online as this is the most efficient way for us. Once the application is completed, the accuracy of the information will be verified during the online session and an EIN will be generated.

Do I need an EIN for my LLC in Michigan?

The name of your LLC must be different from the personal names of other commercial entities already registered with the Michigan Department of Licensing and Regulation. You can check frame availability by searching the Michigan Corporation database. You can reserve a name for six months by submitting a name reservation request to the Michigan Department of Licensing and Regulation. Most likely, you will submit your application by mail or apply online. The registration fee is 25 USD.

Is a EIN free in Michigan?

You can see your EIN LLC in Michigan in different ways. However, they all mean the same thing.