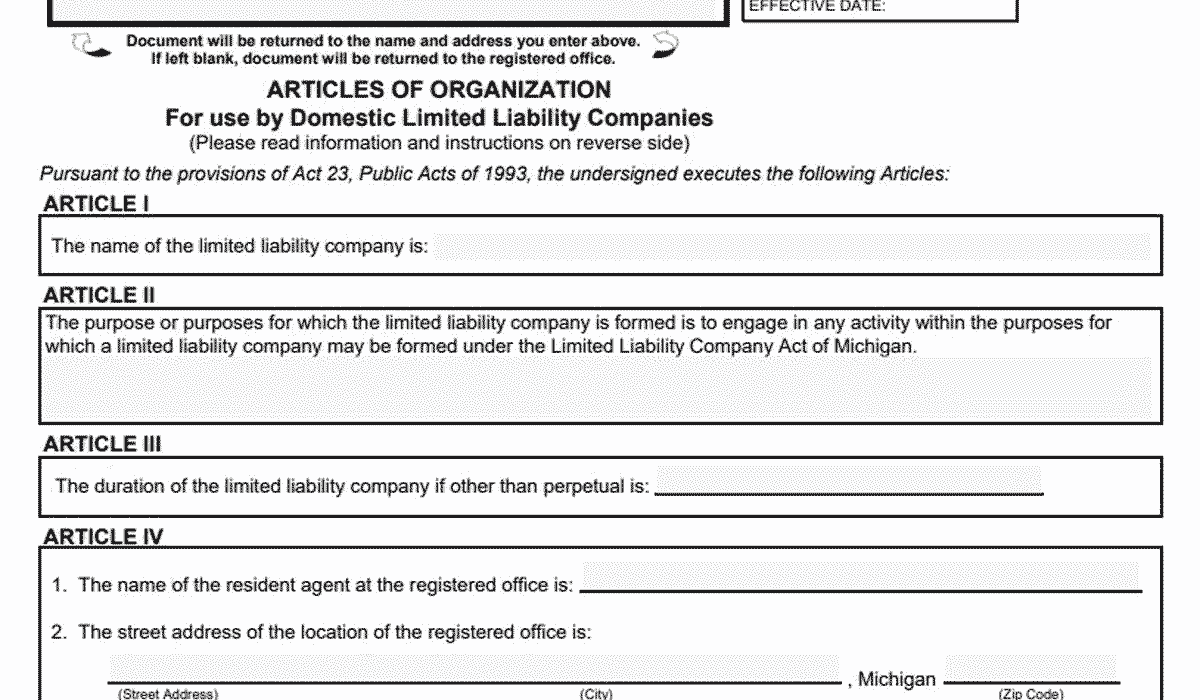

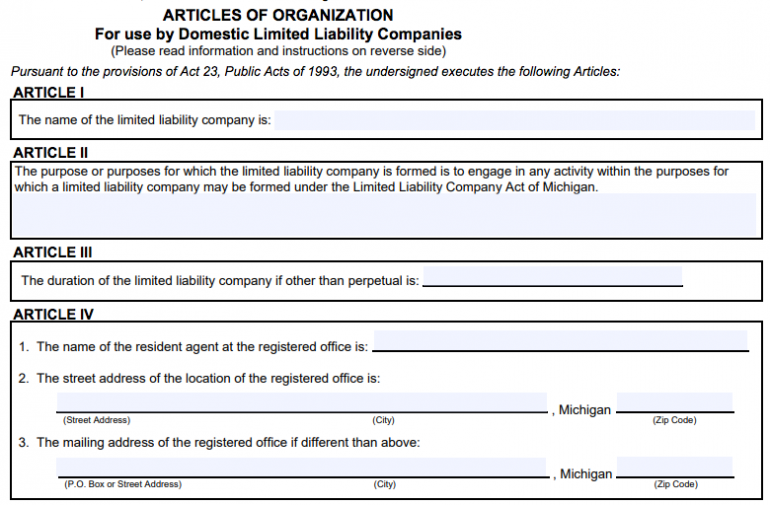

To apply to form an LLC in the State of Michigan, you must file Form 700 – Articles of Incorporation with the Michigan Division of Corporations. You can apply online, by mail, or at the patient’s. Now is a good time to specify if your LLC will be managed by members or managers.

How much does a LLC cost in Michigan?

The basic cost of finally forming an LLC is the $50 fee to file your LLC’s incorporation documents online with the Michigan Department of Licensing and Regulation.

It Is Very Easy To Register An LLC In Michigan

LLC in Michigan. In order to register a trading floor as an LLC in Michigan, you must complete and file the Articles of Incorporation of the Michigan Division of Corporations in the trading floor, a fee forservice is equal to 50 dollars. You can apply online, in person or by mail. The Memorandum of Association is the legal document that formally defines the liability of your Michigan LLC (Limited Liability Company).

Open Another Commercial Bank Account

Using a dedicated commercial bank with credit accounts is necessary to protect the corporate veil of your individual holding. If your personal and therefore business accounts are mixed, your personal money (your home, car, other and valuables) could be at risk if a lawsuit is filed against your LLC.

Choose A Name For Your LLC.

Your Michigan LLC name must be distinct from the names of other legal entities currently registered with the Michigan Department that relate to licensing and regulatory matters. You can check name availability by searching the Michigan Business Database. You can reserve a six-month period by submitting a name reservation request to the Departmentt licensing and Michigan regulation. You can send the application package via email or over the Internet. The filing fee is $25.

Michigan LLC Forms

Before registering an LLC in Michigan, you must go through all the necessary procedures for an LLC in Michigan. A limited liability company (LLC) combines aspects of an LLC and a corporation. It offers all the benefits of an association in a simplified structure. Starting a good LLC in Michigan is beneficial because gambling protects personal assets protected by business lawsuits or debts.

Business Card

A credit bank will provide you with a debit card after opening a professional bank. account function. However, you can also get a Trade Credit Certificate to earn rewards. It is also very important for separating business expenses from emotional expenses.

How To Start An LLC In Michigan

A LLC or Limited Liability Company is a hybrid automotive company that combines business functions with a general partnership?? or sole proprietorship. It separates your personal assets from your business and therefore assets and protects your personal assets. How

How To Start A Michigan LLC (6 Steps)

Michigan applicants must verify their company name prior to incorporating their LLC. . The State allows applicants to search the Corporate Division log to ensure that any name chosen must actually be available and must not be similar to another currently registered name.

Before Forming a Michigan LLC< /p>

h2> There are a few important details that need to be taken care of in advance before proceeding fully with the application for an LLC. For example, you need to make sure that the full name you want for your business is available for registration. Sections detailing these steps before you start registering your LLC.

Choose a name for several of your companies company name may be available. It is required that your LLC in Michiganhad a different name from other LLCs, corporations, and limited partnerships operating throughout the state. For example, if a brand called “Delicious Restaurant, LLC” is already located in Michigan, you cannot name your current LLC “Delicious Restaurant, LLC.” Completely different company names can avoid confusion among website visitors and members of the public, your sole trader name must be unique.

Step by Step Guide to Changing a Michigan LLC

h2> To make your For a Michigan Limited Liability Company to be more efficient, obtain a Charter Amendment Certificate from the Michigan Licensing Department in conjunction with the Regulatory Authority (LARA). The use of LARA is optional. Be sure to include this required information when choosing a draft of your own documents. You will find the Certificate of Change Form on the LARA website or in your online account whenever you register with Northwest for resident agent support. LeaveSend the original to production. The form can be submitted by mail or in person. You can submit the form with a check or order for a fee. Include the LLC URL and identification number on your check or money order. When you submit a certificate change, you can pay for it with VISA or MasterCard.

How do I start an LLC in Michigan?

Here are the steps to open an LLC in Michigan:

How to form an LLC in Michigan?

In Michigan, you must ensure that you select a registered agent for your LLC. Get a professional LLC Formation Services Registered Agent like NorthWest Registered Agent to get things done smoothly and successfully. Forming an LLC in Michigan requires filing a certificate of incorporation.

Does a Michigan limited liability company need a certificate of authority?

The Michigan Law on Limited Liability Companies defines ?Certain activities that are not in themselves a transactional business. When deciding whether to obtain a Certificate of Eligibility, an LLC must consider its proposed entertainment activities in that state, the law, and significant court decisions.

What is a foreign limited liability company in Michigan?

A foreign limited company is a company incorporated under the laws of certain other jurisdictions. Foreign LLCs that convert to “transactional companies” in Michigan must first be able to obtain a certificate of eligibility from that entity. The term “doing business” is a complex term.

Do I need an operating agreement for my Michigan LLC?

When it comes to simply filing an operating agreement with a Michigan LLC, the state may not require you to have a general operating agreement, but ideally they have an agreement that includes all of your documentation. Like Michigan and other states that do not support the mandatory registration of agreements.