To create an LLC in Michigan, you must have an owner, called a member. There are no age or residency requirements for the ideal LLC member. To ensure that you have registered a corporation, you must file these specific articles of incorporation with a secretary at a government office.

Annual Filing

The State of Michigan requires you to file an annual LLC return. The declaration must be submitted by February 15 of each year. (The only exceptions are new LLCs incorporated after September 40 of the previous year that actually do not wish to file on February 15, immediately after the date of incorporation. From )

Does an LLC have to file a tax return in Michigan?

Michigan taxes LLC income in the same way that the IRS does: LLC owners pay taxes on their personal tax returns. The LLC itself pays no state taxes, but Michigan requires the LLC to file an annual return due February 15 of each year with a $25 registration fee.

Types Of LLC Taxes In Michigan

Regardless From their structure, all corporations are subject to a large amount of federal taxes. LLCs must also be able to pay state taxes if they operate near a state that has a license.cash flow tax. In addition, sales may accumulate and then taxes and other fees such as annual financial statements may be used.

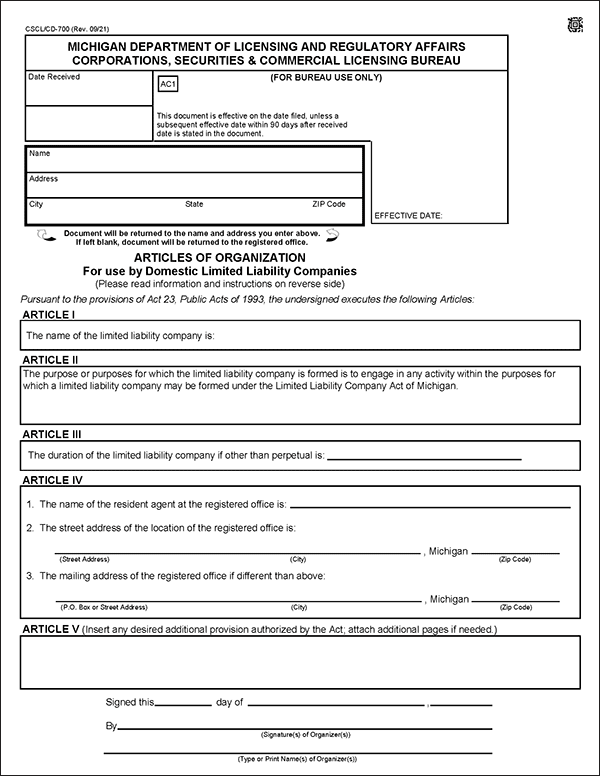

Creating A Michigan LLC Is Easy

A Michigan LLC is the form of a corporation that is required Michigan LLC, you must complete and file the Michigan Chapter Corporation Articles of Association, which cost $50. You can apply online, male or female, by mail. The Memorandum of Association must be the legal document formally establishing the LLC in Michigan (limited liability company). a number of important details that need to be considered in advance. For representation, you must ensure that the office you want for your legal entity is actually available for registration. The following sections provide information on the steps to take before applying for an LLC.

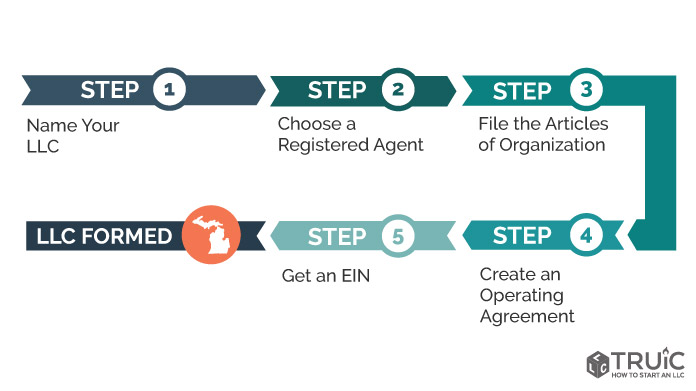

How To Register An LLC In Michigan

Starting a new business comes with many challenges. The following expands on some of the important steps required,when you need to keep your business in line when choosing an LLC form in Michigan. To learn more about starting an LLC, watch the personal webinar “What You Need to Know When Deciding to Register a Small Business.” By default, LLCs do not pay taxes. Instead, LLC members are responsible for reporting the loss (or loss of source of income) on their 1040 personal tax return. Members pay taxes. Indeed, this is clearly a coercion to transfer the LLC.

One-person LLC Owners

If the one-person LLC does not allow it to operate as a corporation, the LLC is a “disregarded entity”, and LLC activities must be reported on the owner’s federal income tax return. If the owner is indeed an individual, the activities of the LLC are usually reflected in the following:

What Is A Large LLC In Michigan?

LLC in Michigan is a good type of commercial organization created in accordance with the current Law about limited liability companies?1993 Michigan State Award. As a business structure, it is easy and simple to set up and can be set up in a matter of hours. It also offers great flexibility; It could easily have only one owner, or possibly several people.

How To Start An LLC In Michigan: The Basics

The First Task of Your MichigLLC Each listing of training should be based on a suitable name for your business. This may not sound like much, but you should always consider Michigan naming laws and ordinances upfront and only use names that are easily invalidated.

Name Your Own Michigan LLC

The first step is to name your current Michigan company LLC. In addition to how you choose something that matches your desired brand image, families also need to make sure that the designation you want is acceptable. This means you can be sure the name isn’t already in use by another company and that Michigan labeling regulations are being followed.

Does a single-member LLC need an operating agreement in Michigan?

The name of your LLC must be different from the usual names of other commercial entities already registered with the Michigan Department of Licensing and Regulation. You can check the availability of a nickname by searching the Michigan Corporation database. You can reserve a name for six months by submitting a reservation request?Contact the Michigan Department of Licensing and Regulation. You can submit your application by mail or submit it online. The registration fee is 25 USD.

What documents do I need for LLC in Michigan?

Michigan LLC. To register as a Michigan LLC, you must complete and file the Articles of Incorporation with the Michigan Division of Corporations, where the cost is $50. You can apply online, in person or by mail. The Memorandum of Association is a legal document called the constitution of your Michigan LLC (limited liability company).