The Minnesota Certificate of Good Standing certifies that a limited liability company (LLC) or corporation is legally incorporated and properly managed.

Subd. 3. Certificate.

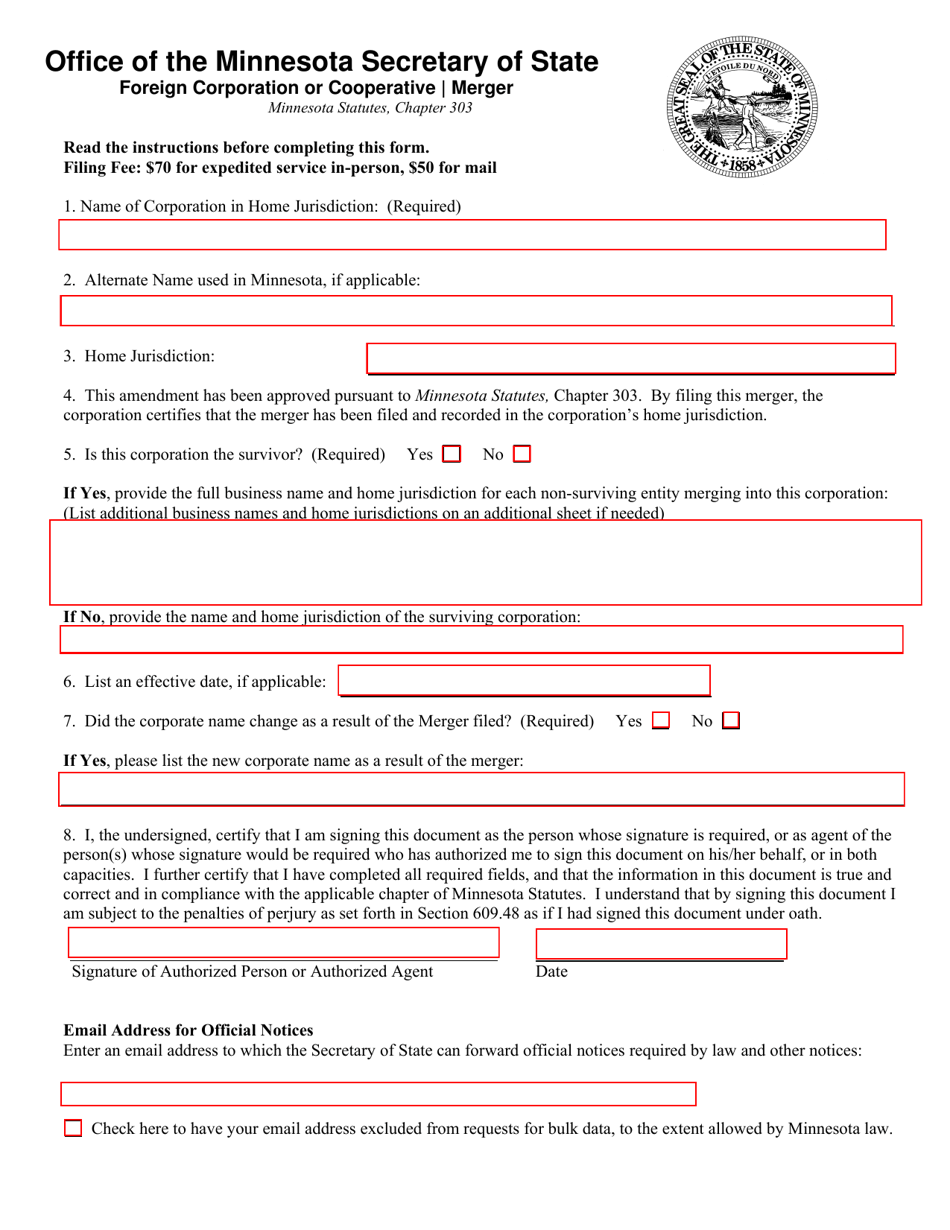

The State Assistant issues a deed of merger to the remaining body or its legal representative and a deed of exchange to the acquiring body or its legal representative.

More

By using the website, your the company agrees to security monitoring and testing. For security reasons and to ensure continuous accessibilityMember Services This public computer system uses network traffic monitoring programs to detect unauthorized attempts to download or modify information, or attempts to cause harm, including attempts to sell a service to users.

Merger Of Minnesota Churches â?? Statutory Provisions While Minnesota Chapter 315 And Minnesota Chapter 317A Provide Statutory Procedures For Merging Or Consolidating Your Church Corporation, Any Type Of Chapter 315 Religious Corporation Cannot Be Merged Or Combined At The Same Time As Step 317A That Is Not A For-profit Corporation. Although In Fact It Is A Church.

Why A Merger Or Acquisition Can Be Beneficial

Business owners should not only look for opportunities to attract new capital and new intellectuals to become owners, adds new talent to your organization. One way to do this is to merge or acquire other companies. It may happen that a company and a major competitor compete for the respectiveyour current headquarters. Or another company might find new, better ways to finally make a product. If that happens, the idea of ??treating a real takeover or merger as a buyout could benefit both companies.

Sub. 3. Certificate.

The Member of State issues a Certificate of Compliance to the surviving entity or its legal representative in most mergers and a Certificate of Adjustment to the acquiring entity or its offender’s representative.

About Us This Dynamic Program The Current Fierce Competition The Environment In The Corporate Environment Is Conducive To Increased Merger And Divestiture Activity Across The Entire Business Spectrum. Organizations Large And Small, Public And Private, Multinational And Regional, Therefore, All Recognize The Opportunity And Potential Value Of Mergers And Acquisitions. Therefore, Leaders Of All Types Of Organizations Should Be Given The Opportunity To Strategically Assess And Assess These Opportunities. Through Case Studies, Simulations And Discussions With ExperiencedWith Speakers, Carlson School Business Leaders, Experienced Guest Speakers And Peers, You Are Likely To Learn Best Practices For All Elements Involved In The M&A Process, Including Strategy, Suitability, Valuation, Negotiation, Due Diligence. , Offerings, Culture, And Inclusion.

When Application Is Required

An individual or partnership doing or doing business in Minnesota under a unique name that is different from their full name, and Each business owner must register the name of the corporation by filing a fictitious name certificate with the Minister of State. A corporation, abbreviated general partnership, limited liability company, or limited liability company operating under a heading that differs from the exact legal designation permitted by law must also submit a fictitious name certificate for the trade designation. The intended business name is also required when a general or limited partnership, which is clearly not also a limited partnership.a limited liability company (or its associates), wishes to make statements to the management of the company, declarations of rejection, declarations of merger, declarations of dissolution, declarations of dissolution of the association, or modification or cancellation of these holidays. (Note that such a partnership does not even “take on” the corporate name by filing a whole series of documents; instead, the reason the secretary of state makes some sort of loan name registration certificate requires them to be filed before such words can be presented.) For example, if John Smith, an individual owner, trades under the management of an agent of Smith’s Realty, he must present a card with a fictitious name. No paperwork is required if John Smith, the sole manager, is acting as “John Smith Estate”. Likewise, if the Able Building Company does business as “ABC Construction”? It must have the alias “ABC Construction”. However, when Able Building Company does business as Able Building Company, it is not necessary to submit a certificate of intended name. p>

How do I close a business in Minnesota?

Each operating Minnesota LLC has different tax accounts maintained by different departments of the Minnesota government. Before you can dissolve an LLC, you must first pay fees and/or penalties on these accounts.

How do I close an S corporation in Minnesota?

Companies that sent shares:To liquidate your Minnesota corporation after the site has issued stock, you must first file an intent to liquidate form with the Minister of State of Minnesota (SOS). Our own company will then file sections of resolution Chapter 302A.7291 or 302A.727.