Typically, “doing business” is defined as activities such as running a physical office or hiring employees on staff. Minnesota’s official online store lists various activities that are not considered state businesses.

Does Minnesota require a registered agent?

A registered agent in the state of Minnesota is required by law and is available to any official state entity using Minnesota. The registered agent receives all approved documents from the state of Minnesota, these persons also receive all legal benefits that can be granted to the new company in court.

What Is A Minnesota Certificate?

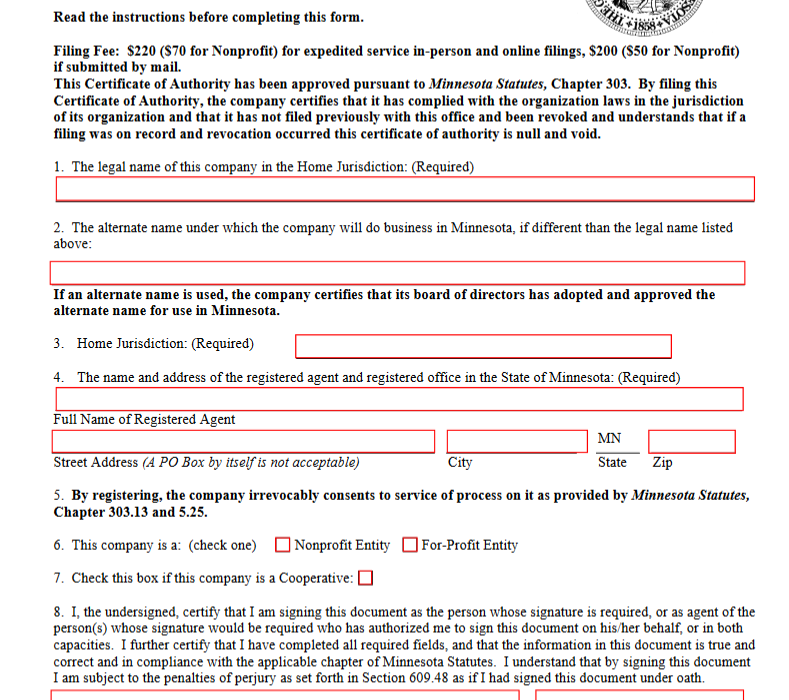

It is very important that corporationsRegistered with the Minister of State of Minnesota before doing business in Minnesota. Out-of-state corporations typically apply for a Minnesota Power Certification. This registers his company as a foreign entity and eliminates the need for a new legal entity.

Subd. 2. Change Or Cancellation Of The Declaration.

In order to modify or even revoke the Power of Attorney Statement, which is filed from time to time with the Secretary of State at Square 322C.0205, Subdivision 1, it is necessary to have a corporation limited liability file. with the Secretary of State in any form of notice of change or revocation:

How To Obtain A Minnesota Designated Authority Certificate:

Minnesota requires computer software to be filed with a $205 claim per LLC $220 for incorporation or $70 for a non-profit corporation. You must also designate, create, and maintain a registered agent in Minnesota at all times. We can now offer this service for $99/year.

WellDo I Have A Resident Agent From Minnesota For My Business?

Yes, if you ask about Northwest as a registered agent, what’s the deal? It’s an absolute flat rate of $125 per year, you have an online account that keeps track of your terms, the cities you registered in, when your year’s business with us ended, and any files we receive locally for you, will be immediately added to your account for full discovery. If or when you receive a lawsuit, we can send an email to up to 4 people and your lawyer at the same time to receive full information about the lawsuit in real time. Get annual survey reminders for your MN business. It’s the same price every year and there are some really weird fees or cancellation fees.

MN Secretary Associated With State LLC.

The Minnesota Secretary of State proposes to form your Minnesota LLC, in which you may be required to provide certain details to the Minnesota Secretary of State’s office. On the government websiteMinnesota clerk has the following forms of LLC:

MN Foreign Corporation

If you are a corporation incorporated in a state other than Minnesota and you have time to transact business in Minnesota, you need certificate of authority from the State of Minnesota. You can get it when you apply as a foreign corporation to any Minnesota Secretary of State, Department of Corporations. After you submit your forms, the State of Minnesota will send you a completed Certificate of Eligibility. A foreign supplier from Minnesota should not be confused with any foreign company. Any corporation that is not actually registered (incorporated) in Minnesota is a foreign corporation.

How To Complete The Registration Form

If you file the Minnesota Articles of Incorporation, you will also have your family options for processing online, by mail or in person. Downloadable forms and online applications are available on the Minnesota Secretary of State (SOS) website. The company website, and therefore the privilege service, allows you to prepare your business documents.You are online. Forms registered overseas (out of state) are also available on the SOS website.

Choose A Company Name

Your company name must contain one of the following words or an abbreviation of them: ” Incorporated”, “Company”, “corporation”, or “Limited”. The word “company” may not be replaced by the word “and” or any logo that identifies it as such “&” Modernization of certain terms in tax rules, Minnesota rules, parts 8001.0300, subsection 2; 8038.0100, parts eight and 6, 8; 8093.0200 bases 1, 1b and 2; 8130.6400, 1 base from 3; 8130.6600; 8130.8100 subsection 2; and 8160.0500 Subpart 1; Reviewer ID R-04653

Certificate Authority Within: Definition

Certificate Authority demonstrates that your website is authorized to do business in an appropriate state other than that in which it is originally appeared. A certificate of authority is required in most states.

What is MN Statute 322C?

At the request of our office of the Minnesota Secretary of State, the Committee on Partnerships and Limited Liability of the Department of Commercial Law of the Minnesota Bar Association has prepared these brief findings on the implications of Section 322C of the Minnesota Statutes. Revised Minnesota Uniform Limited Liability Company Law â?? with respect to limited liability companies currently operating under chapter 322B of the Minnesota law, if section 322C becomes applicable to such limited liability companies on January 2, 2018.

How do I remove a partner from my LLC in Minnesota?

The process of adding a member to a Minnesota LLC may involve amending a particular company’s bylaws to include the best member. Under the terms of this agreement, current LLC members may be required to vote for the change to take effect. If you are a single member LLC and you add a new member, it can become a multimember LLC by changing its tax status from pass-through to corporate or partnership. You can also manage multiple businesses under a single LLC through complex DBAs (“doing business as”) or under a single LLC name. An LLC can be a member of another LLC and own a single member LLC. LLC may haveany number of participants.

What is a statement of denial in Minnesota?

The disclaimer may be a limitation of the full?Whose, as provided in the Minnesota Statute, ch. 323A.33(d), then (e). Signature of at least 2 partners with an authorized representative is required. Use this method if you are merging one or more general partnerships or limited partnerships that are parties to complete the merger with a limited liability company.

How do I form a limited liability partnership in Minnesota?

The signature of at least 2 partners or authorized representatives is essential to create the ideal Limited Liability Company. See Minnesota Bylaws 323A for more information. NOTE. If you are forming a Limited Liability Partnership that will be a “Business” (see below), additional wording is required on your company’s qualifying application.

How do I remove a power of attorney in Minnesota?

Note. We allow Federal Form 2848 to be used to submit or collect customer information if it mentions Minnesota or the Minnesota Form. You may submit fabrications or documents by email, fax or submission. Revoke the power of attorney by completing Form REV184r Revoke Power of Attorney.