Does Missouri require a business license?

Starting a new business process can be intimidating. Many regulatory requirements, fees, insurance, and registrations are notrequired before you can open your doors. Follow my simple guide on how to get a business license in Missouri. We will guide you through the entire process to help the public launch your new business today.

What Is A Business License?

A business license is most likely a permit given to businesses by a government agency that allows an industry to operate in a particular area. Perhaps they come from the federal government, the state government, or the high street government. Generally, there are different licensing requirements for different businesses and different locations.

County Merchant License

In addition to the state tax registration of a business, some counties also require businesses to help obtain a business license. business. . Today, under Missouri law, §150.010 RSMo, a dealer is an individual, corporation, partnership, or association that sells merchandise, merchandise, and merchandise at any store, counter, or store.and the place associated with it. The target is busy.

Do I Need To Register My Own Business In Missouri?

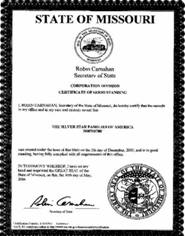

Most businesses must be registered in Missouri in order to operate in the state. The only exceptions are individual entrepreneurs and well-known partnerships operating under their own name, and this name does not necessarily indicate the existence of other owners. The actual type of registration depends on the type of business you have, such as corporation, limited liability company, limited liability partnership, etc. All businesses are also required to file a tax return and, depending on the type of business, may also be required to file tax on sale/unemployment.

Reseller License

State law requires a dealer license applicant to submit the best part of their dealer license application. their sales tax number or sales tax exemption notice from the Missouri Sales Tax Division Ministry of Revenue??c.

Trade License Application

Please complete the Trade License Application for the relevant corporation, corporation, partnership, limited liability company, limited liability partnership, professional sole trader, company, association . per person, etc. The Starter Business License fee is $50. The commercial license is valid until December 31 of each year. Refer to step 6 to learn how to renew your license for commercial use. If your business is related to any type of retail, you must submit two documents along with your application:

City Business License

This section contains general information about creating a professional (business) license in City Liberty and other useful information on how to start a business. For more information, contact the Commercial Licensing Department at 816-439-4457.

Is LLC a business license?

A license to sell is not the same as offering an LLC (Limited Liability Company) or other large legal entity.

Do I need a business license?

If you’re about to launch a startup, you’ve probably wondered, “Do I need a vendor license?”No matter what type of business we have – whether it’s a physical store or an online business – and whether it’s a small or large business, you’ll need to obtain and maintain a commercial license (maybe more than one).Understanding business licenses must be difficult. This article attempts to answer some of the most common questions field workers have about when, why, and how to get a business license.What is a commercial license?A business license is a mandatory permit or permit issued by an administrative authority that authorizes a business to operate in a particular jurisdiction. This license is always an additional requirement in addition to registering a business with a government mark. Whether a business needs to obtain a specific license depends on factors to consider such as the type of business, the types of products it sells,and any local government ordinances in which the particular business is located.What is a market license used for?Business licensing makes companies accountable for the actions and behavior of individuals and protects the health and safety of my audience.Professional licenses indicate the experience of a particular good professional.Sales of taxable goods require a sales tax license.The scheme uses licenses to track income for tax purposes.Who needs a business license?Almost every business with an income stream must have some form of business license, permit or registration in order to operate legally and in full compliance with u. With. regulations.Certain licenses are required for all controlling companies in the jurisdiction. This includes:Basic commercial licensesRegistration of payroll tax (if there are employees)Registration for VAT (for the sale of tangible goods and the possible provision of a taxable service)Many licenses areindustry. Commonly allowed industries include:Healthcare: pharmacy, drug wholesaler, DME, etc.Duty ?? Debt Collection Agency, Debt Buyer, Debt Settlement, etc.InsuranceConstruction – Roofing, Electrical, Plumbing, DIY, etc.charityTobacco?? wholesale then retailtelemarketingRetailSecurity – security, agencies, security companies, etc.energy brokerengineeringWhere can I get a business license?Business licenses are issued by all government agencies, and depending on the type of goods you want to sell, someone may need to obtain federal, state, and/or local business certification.Some small businesses require a federal industrial license, such as selling alcohol in any form or selling firearms.State business licenses vary from state to state, so be sure to check your state’s requirements.How to get a business license?First, pr?Imagine where your business will operate, with details, county and city.You can find your issue and city rules on the SBA website.Make sure you have your company’s federal tax identification number (EIN).Each type of business has a specific business code, so know your own code when applying for an industrial license.Check if you might need a new permit in addition to your business license, as some businesses do need both.Be sure to pay the return deposit, which can range from $50 to $400 or more.Depending on the type of business and state, you may be required to obtain a fingerprint.What if I don’t even get a commercial license?Your business may be held liable for significant damages and/or fines.No local, state or federal regulations protect you or your business.You may have to pay a fine.Your business is likely to be temporarily or permanently closed.Your company’s recognition may be tarnishedabout.You may be held personally liable.What happens after I get my personal business license?Many commercial licenses require annual or semi-annual renewals.Organizations must rely on their private internal compliance officers to complete business license renewals. While most licensing jurisdictions send renewal signals, companies should not rely on most of these reminders.Our partnership with LicenseLogix makes it easy for new and existing businesses to obtain most of the licenses and permits your business may need. Your Client Licensing Clearinghouse, together with CLiC, allows you to easily manage your commercial license renewal process and thus avoid forfeits and fines.Keep in mind that it’s not just new stores that need to think about licensing requirements. Existing companies need to be knowledgeable, not better. There are many situations that can cause your company to fail.? will meet the requirements. The following circumstances have been identified as circumstances in which your preferred existing commercial license requirements may change and your entire organization may need to upgrade their industrial license:Your company started doing business in a city, county or stateYour company has hired one of its new employeesYour business has started selling a new dietary supplement or serviceYou unlocked an additional location of opportunityyou closed the officeCompliance with a business license will be an important aspect of owning a business, but it doesn’t have to be tedious or tedious. However, some government agencies are easy to deal with and more efficient than others.Next: Commercial license or LLC in the first place?

What licenses do I need to open a business in Missouri?

How do I contact business tax registration in Missouri?

Do I need a sales tax license in Missouri?

Do I need to register with the state of Missouri?