Corporate Tax

. When it comes to income tax, most LLCs, likeusually taxed. In other words, the responsibility for paying excess federal income tax passes through Itself LLC and falls on the individual members of the LLC. In fact, LLCs themselves do not pay income tax, only members pay. Some states levy a separate tax or fee on an LLC for the privilege of doing business using the state. However, Missouri is not one of those states.

LLC Name

The name of an LLC must end with “Limited Liability Company”, “LC Limited Liability Company”, “LLC”, or “LLC”. It must not contain any words or slogans that indicate that the LLC is its own public entity or that it is operated for any purpose other than the proper purpose for which an LLC may be organized or the laws of the State of Missouri. It must be different from a U.S. or foreign LLC, syndicate, limited partnership, or state registered name.

What are the tax requirements for a single-member LLC in Missouri?

Before Registering An LLC In Missouri

There are a few thingswhich you need to take care of before the LLC documents are issued as they are critical to getting your business off to a successful start and avoiding costly delays. . See the sections below for more information.

It Is Very Easy To Register An LLC In Missouri

LLC in Missouri. To register an LLC in Missouri, you must complete a Memorandum of Incorporation with the initiator of the Secretary of Missouri. state registration protocol, which costs $50 on the Internet. You can apply online or by mail. The Articles of Association is the legal document that formally establishes your LLC in Missouri.

Individual Ownership

1. Sole Proprietorship: Sole proprietors in Missouri can choose to own as the simplest form of business in terms of organization. This is not recommended given the overall responsibility that a sole proprietor assumes in connection with owning a business. The Missouri Secretary of State plate is not explicitly required, but it is recommended to register a fictitious oneName if you are going to hire delegates and then also get an EIN.

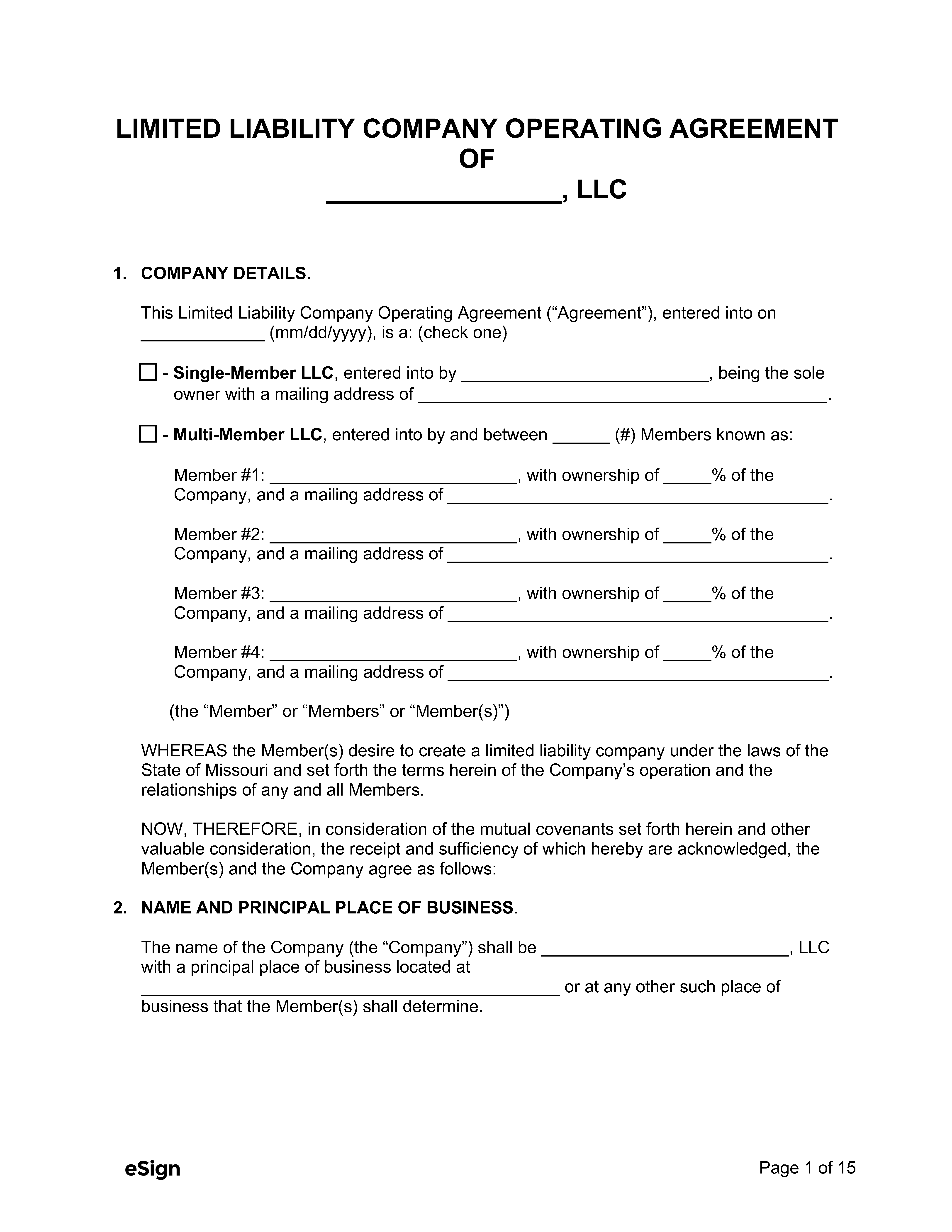

Member LLC

the couple who own it), the corporation is an LLC with one member. This sole shareholder exercises full control over the business itself and its operation. When a new LLC has two or more owners, it is a multi-member LLC. A multi-member LLC can have an unlimited number of people (unless they choose the S corporation tax regime, which limits ownership to one hundred members or fewer). All Share LLC controls its entire multi-member LLC, with the roles, responsibilities and profit sharing set out in the LLC Operating Agreement.

Can I Reserve A Business Name In Missouri?

If you are not yet ready to file your Articles of Association, you may retain your corporate name for up to one hundred and eighty days by filing a Name Reservation Request and paying a fee of$25.

p>

When Filing All Taxes With Missouri LLC LLC

, the company is treated as a pass-through company because it passes on a certain type of income and earns self-employment income. LLC members are now subject to an independence or incorporation tax on all income they receive through the parent LLC. The LLC must pay franchise tax on its profits. In addition to the independence tax, there are certain requirements that an LLC must meet, for example:

How Do I Register An LLC In Missouri? Don’t Let Bureaucracy Get In The Way Of Starting The Business Of Your Dreams. After All, As Missouri Native Twain Mark Remarked, “The Secret To Moving Forward Is To Find A Beginning. Undoubtedly, The Secret To Getting Started Is To Break Down A Complex Overload Into Trivial, Manageable Tasks And Start From The First.

Perhaps the first thing most business owners need to do is come up with a suitable nickname for their business. Missouri’s naming policy applies to manyMany types of businesses, including LLCs. Every business should be aware of the rules for setting up non-state businesses.

Does Missouri allow single member LLC?

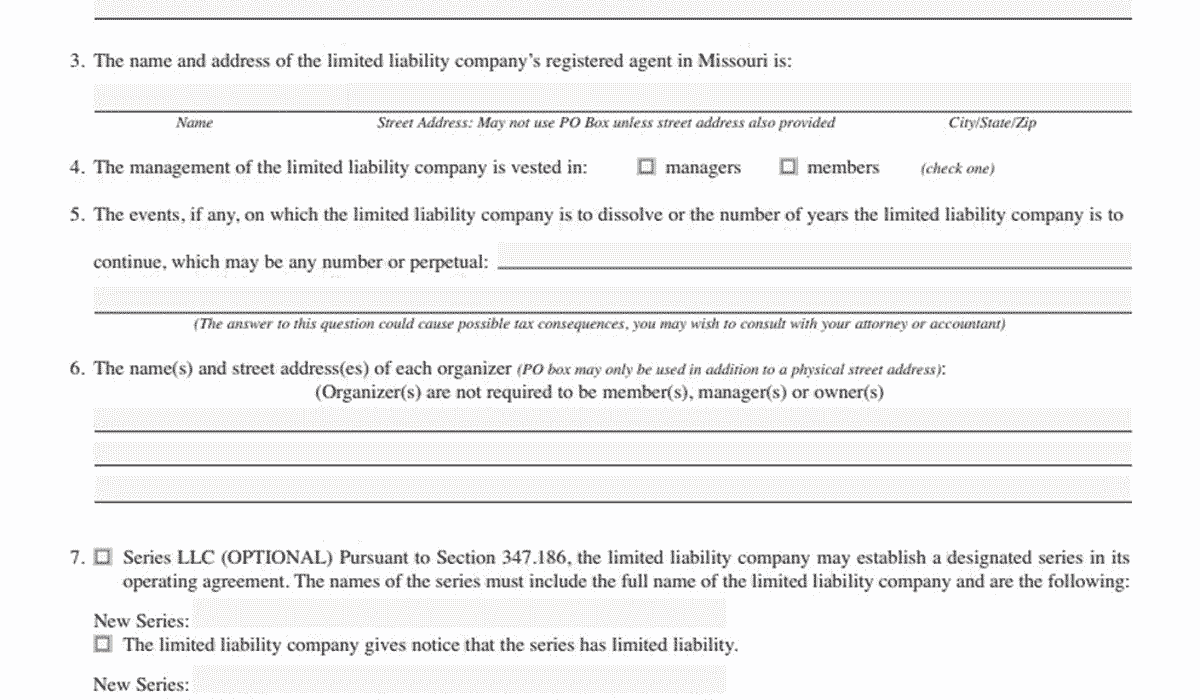

Missouri LLC Formation Process: When forming a Missouri LLC, the Missouri Articles of Association must be filed with the Secretary of State of Missouri. Missouri’s charter must include the following:

Does an LLC need to file an annual report in Missouri?

If your whole family wants to register and operate a limited liability company (LLC) in Missouri, you should definitely prepare and submit various documents to any state. This article covers the main current filing and tax filing steps for an LLC in Missouri.

How do I set up a single member LLC in Missouri?

Here are the steps to form an LLC in Missouri. For more information on creating LLC versions in any state, see Nolo’s article “How to Create an LLC”.

Does an LLC file Missouri corporate income tax?

Missouri law may require individuals to work as sole proprietors. Income and expenses are accounted for in a kind of federal income tax return by the owner and even vice versa Income is siphoned off from Missouri personal tax returns.

How do I file taxes for an LLC in Missouri?

What is the Missouri form mo-1120 for LLCs?

Does a Missouri LLC need to file an annual report?