These terms are usually used interchangeably, but have different legal interpretations. Liquidation is the pre-processing of all of our business winding-up matters. Termination relating to a legal entity occurs when a legal entity ceases to exist.

How do I dissolve a business in Minnesota?

Each operating Minnesota LLC has different tax accounts, which are still managed by different departments of the Minnesota government. Before you can dissolve your existing LLC, you must first pay any taxes and/or penalties associated with these personal accounts.

How To Dissolve A Corporation In Minnesota?

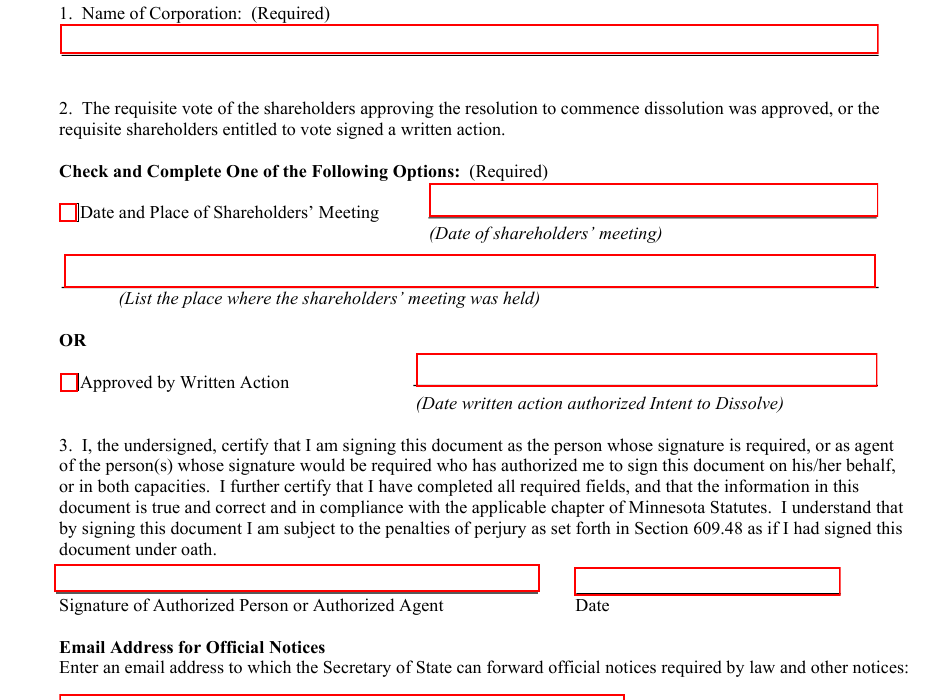

Companies that could issue shares:To dissolve your Minnesota corporation after it has issued shares, you may first file a Dissolution Clause at the link of the Minnesota Secretary of State (SOS). The corporation will then file for liquidation under section 302A.7291 or 302A.727.

What Does Liquidation Mean?

In any state, there are a number of things that must be followed in order to ?Violently dissolve the corporation. Although the process is somewhat different from what will be said, for the most part this basic plan should be followed (unless the company has already issued shares and started operations, to which we will return shortly):

Notice Of Dissolution

Once you have chosen to dissolve the LLC, you must file a final notice of dissolution with the Secretary of State. The notice of dissolution specifies where and when the meeting took place. It must also contain a single statement that the required number of votes have been received from each of our members (in other words, in which they have approved a majority of the voting rights for dissolution).

C A Single Corporation

/h2>Incorporating A Corporation Usually Requires The Preparation And Filing Of A Certificate Of Incorporation With The Minister Of State, Indicating The State In Which You Choose To Incorporate The Company. Once Incorporated, The Company Becomes A Separate Legal Entity And Is Even Governed By The Laws Of The Suppliers In The State Of Incorporation.

MN Secretary, Including State LLC

Minnesota Secretary of State ?Involves the formation of your Minnesota LLC, which requires you to always submit certain instructions to the Minnesota Secretary of State’s office. The Minnesota Secretary of State website guarantees the following LLC forms:

The Importance Of Formally Dissolving Your Corporation In Minnesota

There are almost every reason why a voluntary dissolution in Minnesota can be considered a good opportunity. Market conditions can lead to stagnation or loss of business. Termination can help avoid bankruptcy. It is important to remember that even if your business is a separate business, it is still run by people and not everyone wants to be in the same business. Differences or better opportunities can be the main reason for breaking up, a good option.

Possible Options For Liquidation

Companies can close for various reasons and circumstances. However, in general, it can be useful to separate these reasons into voluntary and forced divorces.

How do I file last year of an LLC in Minnesota?

If you want to form and operate a limited liability company (LLC) in Minnesota, you must prepare and file various computer data with the state. This article often covers the basic continuing filing and state tax filing requirements for a Minnesota LLC.

How do I Close my Business in Minnesota through e-services?

To close a deal and your entire tax balance with e-services, you need to be an amazing business e-services wizard. You can also email [email protected] or call 651-282-5225 or 1-800-657-3605 (callfree).

How do I file a statement of termination in Minnesota?

To file this form, the organization must have already been dissolved for the function specified in Minnesota Articles of Association 322C.0701. A separate form of termination is then required under Minnesota Statutes Chapter 322C.0702.

Who can be a registered agent for a business in Minnesota?

The registered agent must be a Minnesota corporation, a Minnesota corporation, or a dangerous corporation licensed to do business in a particular state. Use this form to submit all of your annual renewals once per calendar year.