Accepted Names / DBA

Here is a brief overview of the main types of business structures in Minnesota. You may want to consult with a lawyer, accountant, or other resource before making an entirely new decision about what type of service to create.

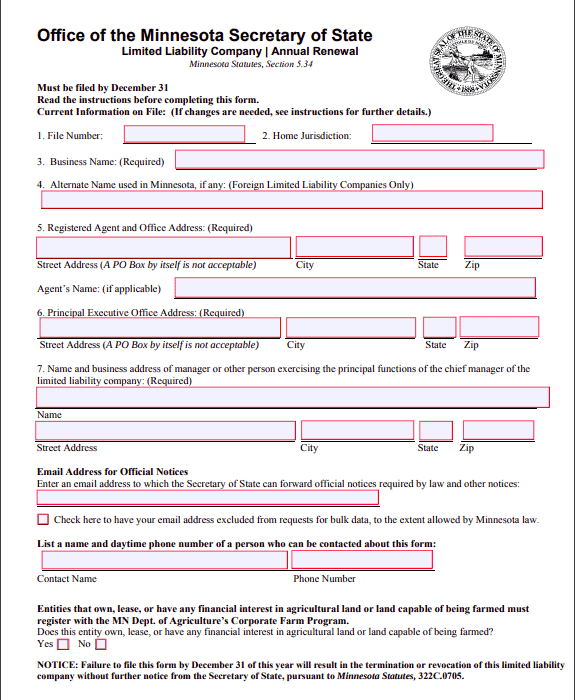

Minnesota Annual Return Fees And Instructions

If you own an efficient corporation or LLC, you probably won’t have to pay registration fees. However, you still have until December 31st to submit your report. Minnesota is unique in that they currently do not charge annual returns. The only type of company that is required to pay a fee is a foreign company, which must pay $135 to file an okfinal report to the office of the secretary of state. Partnerships are not required to file an annual return in Minnesota. The state doesn’t charge late filing fees, but somehow you’ll have to pay $45 to get your business back if the state goes broke.

Minnesota Annual Report Deadlines And Fees

H2> The Minnesota Annual Report Can Be Submitted Online, In Person, Or By Mail. To Obtain A Paper Form Or Submit It Online, You Must Visit The Minister Of All Minnesota Website.

Two Ways To Renew Your Annual Return

offers two options for submission: online or by mail. While you can choose which method works best for you, the incentive is to register more companies online. The reason for this is that the following allows for faster time and processing, and is even easier to complete. If you’re sending by mail, the process can take four to seven days, while sending online seems to be immediate.

State M Annual Report Informationinnesota

Corporations and nonprofits are required to file annual returns to help keep you in good standing. Foreign Secretary. Annual returns are required in most states. Payment terms and fees vary by state or object type.

How much does it cost to renew an LLC in Minnesota?

For now, here are the steps to form an LLC in Minnesota. For more information about starting an LLC in any state, see Nolo’s article How to Start an LLC.

Here Are The Steps You Need To Take To Form A Limited Liability Company (LLC) In Minnesota.

A limited liability company (LLC) bond is a way to legally structure a corporation. It combines all the limited liability of a corporation with some of the flexibility and informality offered by a partnership or sole trader. Any individual owner trying to limit their or even their personal liability for business debts and lawsuits should consider forming an LLC.

What Is Annual Minnesota?

Minnesota then requires the LLC to file an annual renewal, known in other states as an annual filing. The application is submitted by the rulerthe state with up-to-date information about your business. Foreign and even domestic corporations and LLCs must apply for an annual renewal. National nonprofits also seem to be required.

How do I file last year of an LLC in Minnesota?

If you want to register and manage a limited liability company (LLC) in Minnesota, you must prepare and submit various forms to the state. This article reviews some of the most important current State tax burden reporting and reporting requirements for a Minnesota LLC.

How much is an LLC in Minnesota?

Do you want to form an LLC in Minnesota? You’re not alone. It is estimated that by 2021 there will be about 60,000 LLCs. While the registration process for all LLCs in the United States is similar, there are key differences between states. Business owners and members forming a new unified organization in Minnesota must be aware of local laws and requirements. With that in mind, we have put together a specific guide to setting up an LLC in Minnesota. Here’s what you need to know.

How do I reinstate my corporation in Minnesota?

The Minnesota Secretary of State (SOS) authorizes the restoration of National and Mystery Businesses after dissolution or suspension of operations. SOS accepts reintegration documents by mail, in person or online. You can pay the Minnesota SOS application fee yourself in cash, for example. Makes submissions in respect of fees payable to the MN Secretary with the State.

When do I have to renew my LLC in Minnesota?

By December 31, 2010, the Minnesota Secretary of State’s application for a business renewal for an LLC must be filed in order for the LLC to remain in a favorable position with the state. 3-minute study 1. Two ways to apply for a yearlyone renewal 2. How much does it cost to apply for an LLC business renewal? 3. What happens if you don’t renew your subscription? four.

What is the MN Secretary of state business renewal?

The Minnesota Secretary of State’s business renewal application for an LLC must be filed by December 31 of that year in order for the LLC to remain in good standing with the state. In many jurisdictions, a corporate renewal or what Minnesota refers to as an “annual LLC renewal” is referred to as an “annual return”.

What is an annual renewal in Minnesota?

All LLCs doing business in Minnesota must file a proper annual renewal each year. Most states recommend it as “annual return”, but Minnesota uses the term “annual renewal”.

How do I reinstate my dissolved LLC in Minnesota?

If your LLC has been administratively dissolved (closed) so that it has no history of filing annual renewals, you will be required to pay a $25 filing fee at this stage if you wish to reinstate the LLC. If so, prepare a glare or money order and pay it to the minister of state of Minnesota.