To form an LLC in the state of Montana, you must file the Memorandum of Association with the Secretary of State of Montana, which costs $70. You can apply online. The Memorandum of Association is the legal document that formally establishes your Montana LLC.

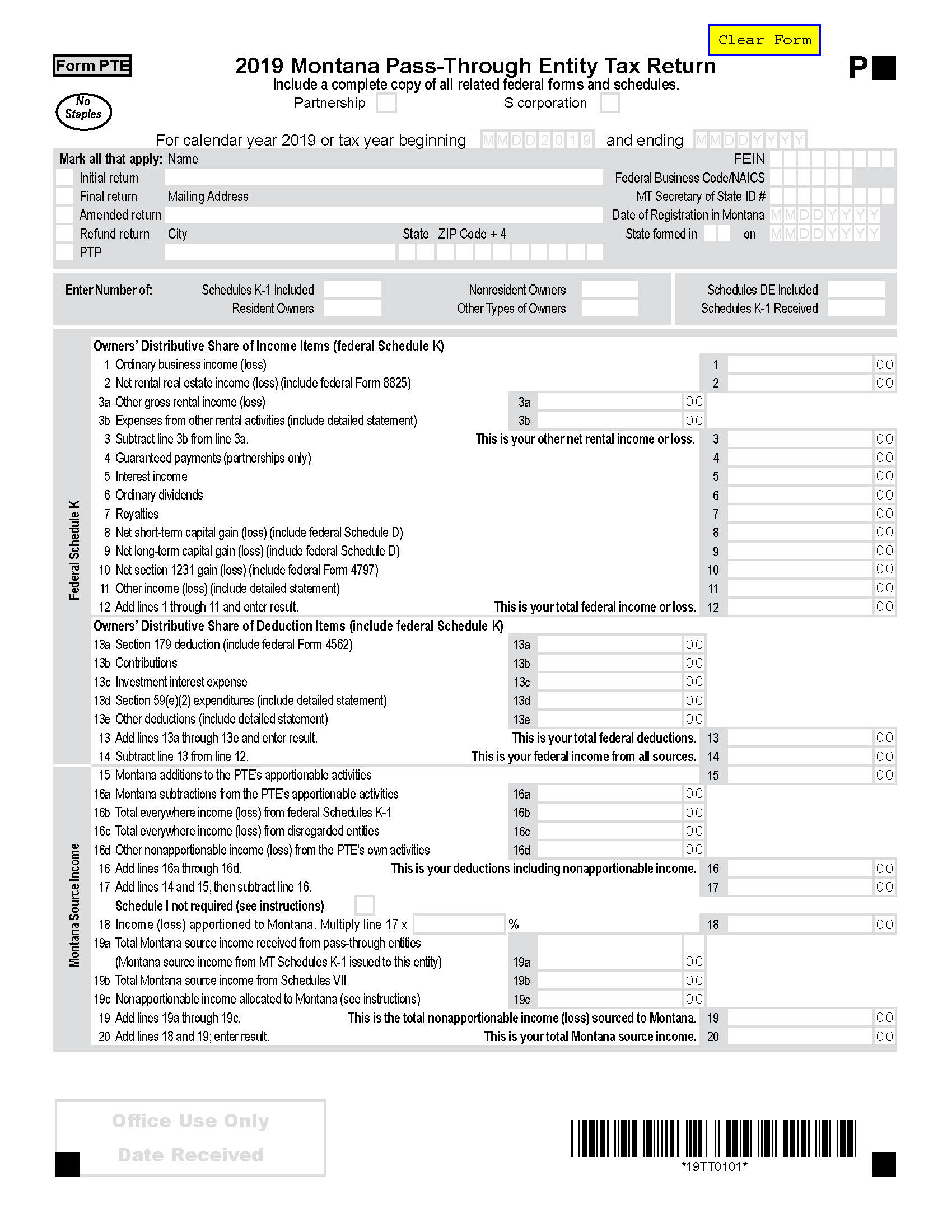

Ignored Legal Entities Owned By Partnerships Or S Corporations

Limited Liability Companies (SMLCs) managed by partnerships or S corporations must receive their income from Montana sources listed on the Montana Passport – analysis of its owner. Declaration Fee for Legal Entity (Form PTE), Appendix VII and Appendix DE. You will no longer file a Montana Disregarded Entity Tax Return (Form DER-1).

Annual Return

The State of Montana requires you to provide an annual history to file your LLC. The deadline for submitting the annual report is 15 April. The Annual Fee Statement is $15 if submitted manually by the due date. (The fee for reports filed after April is $30.)

Choose A Title For YourHis LLC

In accordance with the policy of the State of Montana, a registered LLC must go through the following stages: “Limited Liability Company”, “Limited Liability Company” or the abbreviations “LLC”, “L.L.C.” or “LC”. To register as a company as an LLC, the fictitious name must be distinguished from the business of existing registered business entities manually registered with the Minister of State of Montana. An LLC in Montana is formed by filing the articles of incorporation with the Secretary of State of Montana.

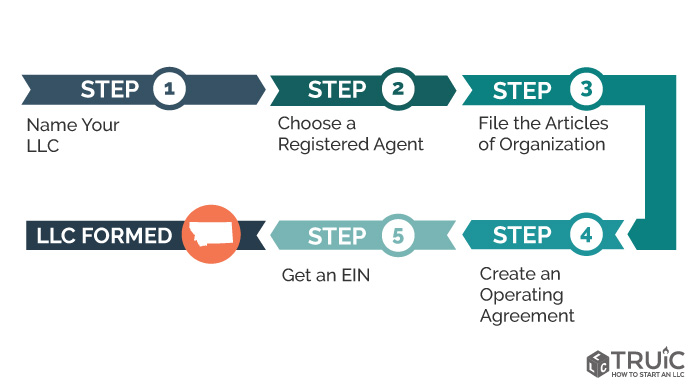

Creating An LLC In Montana Is Easy

To form an LLC, you must, Montana, explain the Articles of Incorporation with the Secretary of State of Montana which costs $70. You can apply online. The Memorandum of Association is the legal document by which your state of Montana legally registers a limited liability corporation

Can I Reserve A Company Name In Montana?

Yes. If you would like to reserve aYour real business name, you are ready to officially register your LLC. Anyone can do so for up to 130 days by completing a Name Reservation Application for the Office of the Secretary of State of Montana, which must be done on the Secretary of State of Montana website. There is a $10 application fee.

Do It Yourself In Montana

Other taxes Depends on your industry and location of your business, how you are taxed by the IRS, and since there are also employees, additional taxes and forms must be paid.

LLC Name

The name of the LLC must end with the words “Limited Liability Company”, “Limited Liability Company”, “LC”, “LLC” plus “L.L.C.” The name must be authorized by the LLC in which you are authorized to do business in the State, any reserved or registered name, intended trade name, limited partnership name, trade name, trademark and/orpossibly a service mark.

Your Name Is Montana LLC

One of the most important first decisions you need to make in any kind of business is choosing a brand for your business. The name For Your Good LLC must meet several criteria. Ideally, this will help promote and market your brand, be distinctive and memorable, and follow Montana’s LLC naming rules to the smallest detail. -through business because it allows income to pass through and become income from self-employment. Members of an LLC are required to pay an independent or income tax on any profits they receive from the LLC. The LLC must pay franchise tax on its profits. In addition to sales tax for the self-employed, there are several other requirements that good LLCs must consider, such as: h2> The LLC formation stage is choosing a unique and distinctive LLC name for your core business. You will need this name to complete the bylaws in the next step. You must also make sure that your name complies with the calling rules.ova of the state of Montana.