A multi-member LLC, also known as an MMLLC, is a limited liability (LLC) entity with more than one member.

LLC

In 2017, “LLC outperformed[ed] more than two to one” in Delaware (a leading US state for corporate policies and registrations) . LLCs are even more common in Colorado. This popularity is largely due to the liability protection provided to LLC members.

Intro Video

Your browser does not support video.

What Is A Colorado LLC?

A Colorado LLC is a type of business structure established by state law. It is used to run a business, or it can even be used to store financial assets such as real estate, boats, aircraft, etc.

Here Are The Basic Steps You Can Follow In A Limited Liability Company ( LLC) In Colorado, You Mustmake A Contribution. A Limited Liability Company (LLC) Is A Way To Legally Structure A Large Business. It Combines The Limited Legal Liability Of A Corporation With The Flexibility And Lack Of Formality Of A Romantic Relationship Or Individual Ownership. Any Business Owner Wishing To Limit Their Professional Liability For Debts And Lawsuits Should Consider Forming An LLC.

Can I Reserve A Company Name In Colorado?

Yes. If you are not yet able to register your LLC, consider reserving your company name for up to 120 days by completing a Name Reservation Application with the Minister of State of Colorado (online only) and spending the money on a $25 deposit.

How do I add multiple members to my LLC?

As a particular multi-member LLC, you have some control over how your corporation’s income taxes are actually administered. By default, the IRS treats a number of member-owned LLCs as partnerships. Like this one-person LLC, a multi-partner LLC does not necessarily pay taxes on the company’s income. Instead, our own owners (members) pay personal income tax on their tax return, which is structured according to their share of the profits. At the time of paying sales tax, the LLC must file an Applicationon incorporation (Form 1065, with Schedule K-1 prepared for each member), and each member must then report their income on Schedule E of Form 1040. As with a general partnership, members of an LLC are generally required to pay tax for self-employment (Social Security and Medicare taxes) based on their LLC income experience.

How Do I Add A Member To An LLC?

Add a member to an LLC by reviewing the Operating Agreement, before moving on to a direct new member, you need to review the Limited Company Employment Agreement Program debt. OperationUnion agreements should always include details of how decisions of this type are to be made, as well as what operations the current participants must perform when they are made.

Forming An LLC In Colorado

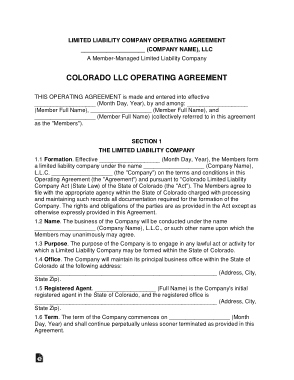

Creating An LLC In Colorado Is A Fairly Affordable Process. One Member Is The Sole Master Or Sole Owner To Form A Good Solid One Member Organization. An LLC With Multiple Members Is A Job Or Corporation That Has More Than One Managing Member.What Is A Colorado LLC Operating Agreement?

The Colorado Operating Agreement explains in detail how a Colorado company makes decisions. Whether your producer is making a decision about money, commitment, management, or your operating agreement, you need to determine the factors to consider, their evaluation, and the final decision-making process.

How do I add a co owner to an LLC in Colorado?

Adding a member to your LLC is usually an important step in growing your business. Perhaps you are looking for a business partner. Or you have an investor who is willing to invest money to help it grow and expand. Or maybe you have a dedicated employee who you would like to reward or recognize for years of hard work.