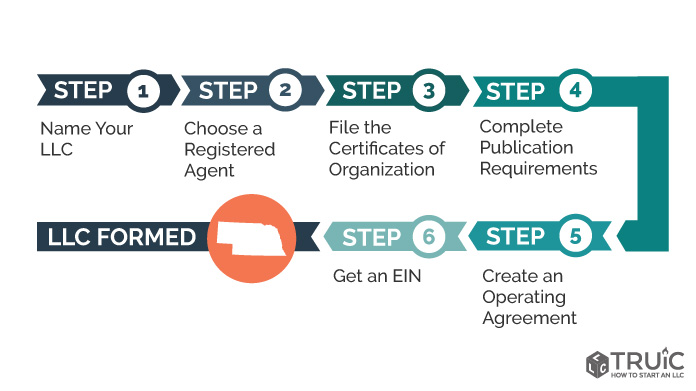

Choose a name for your LLC.Designate a registered agent.Provide proof of organization.Prepare an operating agreement.Release requirements.Get a TIN.Submit biennial reports.

How much does it cost to get an LLC in Nebraska?

The initial cost of forming an LLC is a $100 fee to file your LLC’s Certificate of Organization online with the Secretary of State of Nebraska.

Establishing An LLC In Nebraska Is Very Rewarding? Just

OOO Nebraska. To register an LLC in Nebraska, you must present your Certificate of Organization to the new Secretary of State of Nebraska, which costs $100. You can apply online. A Certificate of Organization is a legal document certifying that your Nebraska Limited Company is registered.

Here Are All The Steps You Need To Take To Register A Limited Liability Company (LLC) In The Getting Started Section In Nebraska.” .

A limited liability company (LLC) is usually a way to legally structure a business. It combines the limited liability of a small corporation with the flexibility and absence of formal partnerships or individual ownership. Any business owner wishing to establish personal liability for business debt settlement and litigation should consider forming an LLC.

What Is The Difference Between The Legal Entity Of My LLC And The Company Name?

The legal name of your LLC is listed on your certificate of organization. A business corporation (sometimes called a DBA) is any other name under which your LLC operates. Trade names must be registered with this Nebraska minister. To register your company name in Nebraska, you must complete the Company Name Application and submit it to the Secretary of State online ($100) or on paper ($110). After applying, you must write a legal notice in the local newspaper advertising your company name. The newspaper will then submit an affidavit for publication, which you will file with the Nebraska Secretary of State. You have 45 days from the time you register your business name to take care of the publishing requirements.

More Content Awaits After Registration.

Some states will require additional paperwork or steps outside of registration times, such as filing county paperwork, publishing an LLC expansion notice in the locality.to your newspaper or filing a covert report. Nebraska requires the following:

Get Any Certificate From The State

The state will provide you with a certificate that the LLC officially exists after the LLC Articles of Association have been submitted and approved. If you mail the LLC documents, the Secretary of State will send you an approved, stamped copy of your Articles of Incorporation. If you apply online, you can download the upload certificate.

Register With The Nebraska Department Of Revenue

Some LLCs operating in Nebraska must register with the Nebraska Department. income to fulfill obligations under the tax burden of the state. This includes LLCs that collect transactions for taxable retail items and LLCs that have employees. LLCs incorporated in Nebraska must meet this requirement along with foreign LLCs doing business throughout the state. form a large LLC in Nebraska. You have members, your entire business plan, and some medical capital, and you’re on the right track. Now you must compose andQuote your founding documents.

Incorporation; Organization Of The CertificateAnd Various Types Of Sending.

(RULLCA201) (a) One or more persons must act as organizers for the formation of liabilityCompany by signing and presenting to the Secretary of State for filing any type of certificateorganization and, if available, a certificate of valid registrationas set out in Sections 21-185–21-189.

How To Form An LLC In Nebraska

A LLC or Limited Liability Company is a corporate merger involving an incorporated company. . s features in addition to a partnership or sole proprietorship. It sits between your private assets and your asset sector, offering you personal asset protection.

Training Package LLC “Nebraska”:$253Generally

Our Nebraska LLC training package may be the best deal in the state! Our experienced local Lincoln representatives are well aware of the rules of doing business in Nebraska! No one but Nebraska offers better LLC ownership at a more affordable price.ORDER YOUR NEBRASKA LLC NOW!Our conchUrents cannot beat anything offered by Nebraska Registered Agent LLC:Nebraska LLC Vocational Training Companiesfree agreement, membership certificates, first solutions and moreMaintain your privacy with the free use of our address in founding documentsInstant service for registered agentsReal-time Annual Report RemindersLifetime customer support365 days from the Nebraska Registered Agent ServiceAn employment contract with a specific structure: for one person, for several people, etc.Online account to monitor, track and retrieve important business documentsDocument delivery systemAccess to additional company servicesNo hidden fees!Your money goes here:Many registration services in Nebraska hide their fees rather than properly showing what you get for your money. But we believe in integrity at Nebraska Registered Agent LLC and we will never surprise you with any hidden fees.rendering ?ServantsexpensesNebraska state fees104 dollarsOur LLC Formation Services Fees100 dollarsRegistered agent service for one year$49Generally$253

Do I need a registered agent for my LLC in Nebraska?

At a minimum, your registered agent in Nebraska will process large legal documents on behalf of your business at a very physical location in the state (called your corporate office). In other words, the Registered Agent’s address acts as the generally accepted destination for all legal documents and official mail from your Nebraska LLC, Nebraska Corporation, or Nebraska non-profit organization to be sent on an ongoing basis.

How long does it take to set up an LLC in Nebraska?

How to form an LLC in Nebraska? You are here This quick guide provides a brief overview of how to set up an LLC in Nebraska.

What are the requirements for advertising an LLC in Nebraska?

Do I need to file a Business Report in Nebraska?

What happens if I don’t publish my LLC in Nebraska?

What is a notice of organization for a Nebraska LLC?