What is Nevada PLC? Nevada PLLC is a limited liability company (LLC) specifically created by individuals providing licensed professional services in Nevada. LLCs are typically companies incorporated in each state and made up of one or more people, called LLC members, who own the company.

Foreign LLCs

Business owners who register a malicious LLC in the state must submit a specific application for registration of a foreign LLC to the Secretary of State in person or by email: email, mail, or fax. . The application should preferably include a copy of the organization’s original articles and other content, as well as a certificate of excellence from the state in which the internet business was established. Visit the Nevada Secretary of State website for information on forms for this process.

A â?? Nevada LLC Acclimatization Law

The current Nevada LLC law is known as the 2013 Nevada Revised Articles of Association Chapter 86. Limited Liability Companies. Some of the most important laws concerningexistence and operation of a limited liability company were first defined in these Nevada statutes between 1991 and 2001. Chapter 86 In 2005, the Nevada state charter was incorporated into an LLC.

What are the advantages of forming an LLC in Nevada?

One of the most important decisions you will need to make for your current LLC is which state will also be included in it.In some cases, one of the reasons for registering outside of your home is to offer you access to out-of-state tax benefits and legal infrastructure. However, out of 50 states, choosing the right one can be tricky.Delaware has traditionally been a favorite subject of incorporation due to its efficient institutions and business-supportive laws. However, Nevada has not become a serious competitor for related companies seeking to form an LLC.Each state has its own set of benefits. But there are key differences that may make the state more suitable for its activities.Nevada or Delaware?There are many good reasons why LLCs have traditionally considered Delaware as a registration haven. From a product standpoint, all of the factors listed below have helped make Delaware the founding country of over a million companies,including half of all public companies and 64% of Fortune 500 companies.The Delaware Corporations division has developed structural upgrades to support new start-ups in these states.Its General Corporations and Business Enterprises Act allows corporations to avoid certain non-state income taxes.Delaware offers low royalties and upfront fees, as well as strong privacy protections for business owners.Delaware created its Court of Chancery to deal with business disputes to a much greater extent than other states.The state’s comprehensive case law serves as the de facto national standard in the courts of the respective country.Although Nevada is relatively new, lawmakers have been working to turn the state into a business-friendly area since the early 1990s. Nevada’s benefits have made it a tool to reduce business owners’ tax problems, and its unique benefit package makes it particularly suitable for small businesses. Benefits of Forming an LLC in NevadaNevada offers a wide rangeadvantages as a state of incorporation, including ease of incorporation, relatively low corporate taxes, and no state taxes. Nevada also offers entrepreneurs strong data protection and a business-friendly environment. If you are starting an LLC, Nevada may be a better home for your business than Delaware.Some of the Nevada benefits for an LLC include:No income, corporate or franchise taxNo taxation of shares or company profitsPrivacy of owners who choose to remain anonymousNo requirements for hours of operation or annual meetingsLow business registration fees and fast processing timesCreation of authorized agencies from one personAuthorized rules for creating actionsJudicial system that relies on case law to resolve disputesA strong corporate veil protecting people in times of responsibilityNo formal information sharing agreement with the IRSThe top-secret difference between Nevada and Delaware corporations may be missingSeeing the Delaware Loophole. This allows corporations to transfer profits to certain subsidiaries in Delaware and reduce their tax liability in other states in which they operate.However, Nevada does not require the lender to have a separate filing director. This favors smaller, more compact family businesses, as opposed to the large associations that Delaware typically attracts.In addition, Delaware has state taxes on franchises, corporations, and payroll, making Nevada a top choice if reducing your tax burden is one of your top priorities.Bottom Line for an LLC in NevadaChoosing a different state of incorporation in your home state can teach you a lot of skills, especially if you plan on doing a big business in that state.However, the company in question may be classified as a foreign legal entity in your country if this task is included elsewhere, which may prevent you from opening an additional account or even legally operating using the software.software if your company is not owned by you. the register of the country leaves the state.Before moving on to State Internet, make sure it’s the smart choice for your business needs. When you’re ready to register your Nevada LLC company, let Incfile help you get started.

Choose The Best Name For Your LLC

Under Nevada law, a good LLC name must state “Limited Liability” includes: Corporation, “Limited Liability Company”, “Limited Liability Company”, “Limited”, or one of the following abbreviations: “Ltd.”, “L.L.C.”, “LLC” or “LC”, abbreviated as “Co”.< /p>

More Information

By using this website, you consent to security monitoring and testing. to detect unauthorized attempts to download or modify the help and manual, or cause damage, including injury, by denial of service to users.

IMPLEMENTATION WORK EFFICIENTLY SERIES LLC

A Series LLC is ideal income holding scheme that generates suitable real estate, such as real estate rentals. The organizer generates only onen a set of organizational articles in the LLC series to create a main or “umbrella” company with limited liability. If the Articles of Association and Operating Agreement provide for the creation of a series of umbrella LLCs under the laws of the State of Nevada, the LLC Organizer may form Cells or form a Principal LLC as a “series” for holding the assets. p>

casetext.com requires that your connection’s security be verified beforehand.

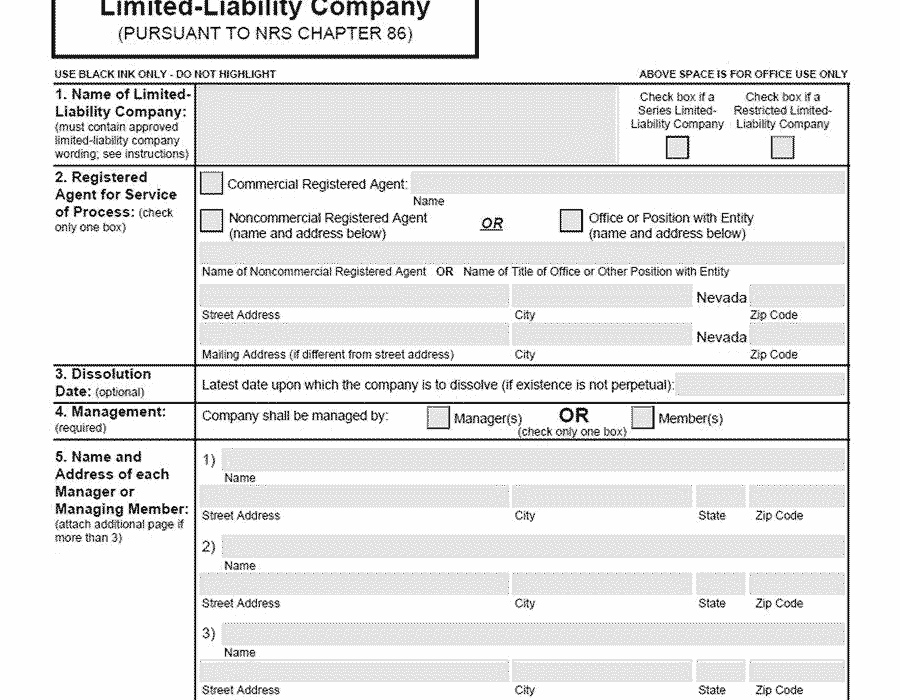

How do I form a limited liability company in Nevada?

By registering an LLC in Nevada, you become a corporation. After that, all you have to do is keep your LLC up to date and active on each state’s website. You must also submit your total budget report to the Nevada Secretary of State for? the last day of your corporation incorporation to avoid fines.

What is the difference between a Nevada LLC and a Nevada Professional LLC?

Professionals often ask our Reno Business Services lawyers how best to organize their business in Nevada. We usually suggest that certain people form a limited liability company, also known as an LLC. As an individual owner of a professional services business, you are protected from various types of liability in several ways. You may also find that you receive certain tax benefits.