How much does it cost to file for an LLC in Nevada?

Here are the steps to form an LLC in Nevada. For more information on forming an LLC useful in any state, see the Nolo Resources on Forming an LLC.

How To Register A Company In Nevada

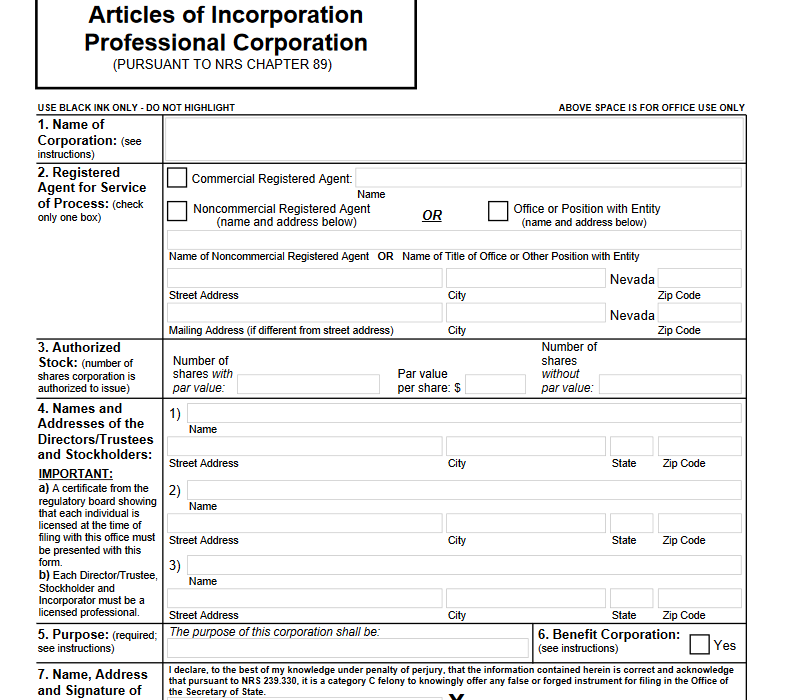

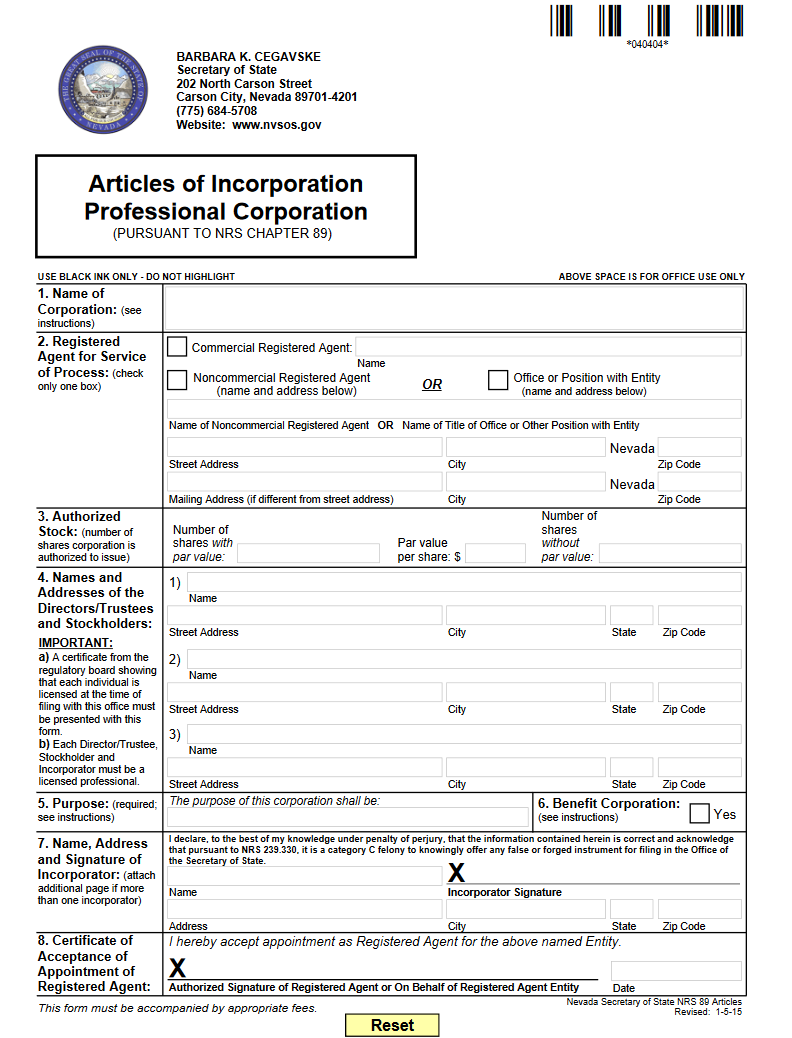

As mentioned earlier, you must file the Articles of Organization with the Secretary of State. The form contains files such as the name of the company and even the address.?; the name and address of the authorized representative; if applicable, date of dissolution; personal identification number or social security number; necessary government licenses and business permits; the full name of the manager or member; and with it the names and addresses of the wedding planners of the company. You can only send them by mail or online.

Submit Certificate Of Registration

Your group will be legally registered upon filing a Certificate of Registration with the Minister of State of Nevada. Items should include company name and address; name, address and unique identifier of the agent for processing the service; the number of Shares at par or par value that the Company has the right to successfully issue; whether the corporation is a sound corporation that will operate without directors (see Nevada Revised Articles of Association 78A.090); the names and addresses of the directors of Barrier; and the name and surname of the founder.

Nevada Annual Report Information

Businesses and non-profit organizations are generally ?Required to file annual returns to stay in good standing. Deputy State Annual returns are generally required in most states. Payment terms and exchange fees by state and entity selection.

Nevada Annual Report, Payment Terms And Fees

Nevada corporation registration fees (local and foreign) are based on the total number of authorized shares listed in your articles of association. The table below presents company filing fees in an important and easy to understand guide.

Nevada Annual Return Fees And Instructions

By law, each corporation in State of Nevada must submit an annual report with that Nevada Secretary of State daily during his anniversary month.

Nevada LLC Online Application Fee: $425

Basic Startup Costs A good LLC is the $425 fee for an online database of incorporation documents, initial listing, and license fees for your LLC with, I would say, secret.Nevada State Champion.

Nevada LLC Expenses

The total annual expenses associated with Nevada LLC are undoubtedly the annual list of managers or directors and the state business license. The list manager’s annual fee is $150 and provides the Secretary of State of Nevada with an up-to-date list of LLC directors. The annual business license fee is actually $200 and is required for an LLC to maintain a good reputation with my secretary of state in Nevada. The total purchase price is $350. Nevada

Our Corporate Services

* SOS accounts have a $75 minimum fee based on the number of shares you have.**Annual Compliance includes government fees ($150 minimum for annual appeal and $500 for disaster recovery) plus our $100 fee.

How much does it cost to file an annual report in Nevada?

1. Annual reports of companies2. Nevada Annual Return Deadline3. Overdue fines 4. Annual reports of limited liability companies5. Deadline for annual reports of LLC6. Presentation of the annual report for non-profit organizations7. Late Filing Sanctions for Non-Profit Organizations

How much does it cost to file a corporation in Nevada?

To register a corporation in Nevada, you must follow the steps below. You can also use Nolo’s online service, which will set up a company for you with everything you and your family need.

How much does it cost to register a trademark in Nevada?

The Nevada Advantage Businesses Terms of Use» Trademark Forms and Fees PrintFeedback Font Size:+- Trademark Fee Trademark Registration $100.00 Trademark Renewalaka $50.00 Trademark Change $60.00 Trademark Assignment $100.00 Trademark Cancellation $50.00 Advertising Rights $25.00 Copies $2.00 .US per page

Where do I file and pay for the state business license?

At Octo, the secretary of state handles the processing and payment of the state business license.

What do you need to know about Nevada securities law?

General Information Overview of Nevada Securities Laws Securities Registration Types of Registration Deregistration Forms of Securities Regulation and Enforcement Laws, Ordinances and Ordinances Latest Legislative Updates Administrative Orders Filing a Complaint Investor Education Information for Your Information Investment Fraud Detection

How much does it cost to create a form?

PrintFeedback Forms & Fees Font Size:+- Trademark Fee Trademark Registration $100.00 Trademark Renewal $50.00 Trademark Change $60.00 Trademark Transfer $100.00 Trademark Removal 50, $00 Publication Rights $25.00 Copies $2.00 per page All Materials Expedite Submission $500.00