If the SMLLC shares a taxpayer identification number with a large corporation, a departmental identification number (DIN) assigned by the New Hampshire State Revenue Office, as described in the “Who Must Request One” section above the DIN, is required to process all tax documentation for taxpayers. included.

Wait For Your New Hampshire Limited Liability Company To Be Approved

Wait for your New Hampshire Limited Liability Company to be approved by the Secretary of State before applying for your EIN. Alternatively, if you are denied registration of an LLC, you may have an EIN attached to a non-existent LLC.

Steps To Obtain A Tax Identification Number (ein) And Register A Corporation In New Hampshire< /p>

H2> Your First Step In Deciding How To Structure A Business In New Hampshire Is To Determine What Type Of Business/business Structure Best Suits Your Business Goals. There Are Several Options To Choose From, Including Sole Proprietorships, Limited Liability Partnerships, General Partnerships (LLCs) And Affiliates, And There Are Many Motives To Follow To Make The Right Decision.

Using A New Hampshire Taxpayer Identification Number (EIN)

Obtaining a New Hampshire Taxpayer Identification NumberNew Hampshire Taxpayer (EIN) is a new process used by most corporations, trusts, estates and non-government profits must go and religious organizations must cease. Even for businesses and corporations that are not required to obtain a New Hampshire taxpayer identification number (EIN), it is recommended that obtaining an ID helps protect individuals’ identities by allowing them to use their taxpayer identification number (EIN) instead. related to their social status. security number in the various physical activities required to run their business, possibly within the organization, including obtaining the necessary licenses and permits locally in New Hampshire. Any company that answers yes to any of the following questions is one of the criteria required to obtain a New Hampshire Taxpayer Identification Number (EIN):

What Is An Employer Identification Number (EIN)?< /p>

What Is An Employer Identification Number (EIN))?

H2> EIN Is A Humble Employer Identification Number, Sometimes Aptly Referred To As Federal Employer Identification Number, FEIN, Federal Tax Identifier, Or Federal Tax Service Identification Number. This Is A Type Of Unique Nine-digit Number, Similar To A Social Security Number For An Individual, But Instead Identifies Your Company.

NH $39 Tax Identification Number

Also called Merchant Authorization A, Wholesale Identifier sales, resale ID, reseller ID.

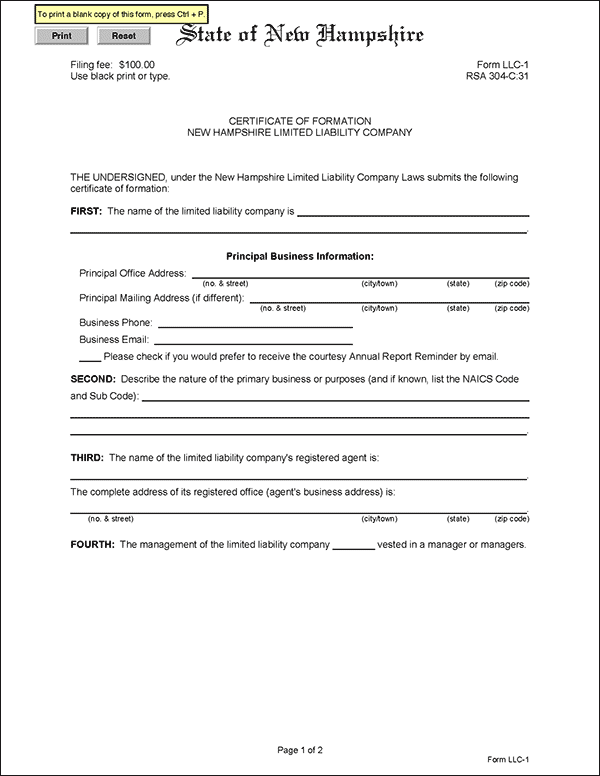

Name This Registered Agent

Any requirement New Hampshire LLC must have an agent in order to function in the state. This is a consumer or business entity that agrees to authorize legal documents on behalf of the LLC in the event of a lawsuit. The registered agent is likely to be a New Hampshire resident or a real corporation, LLC or limited liability company registered for businesssa in New Hampshire. A registered agent must have a physical address in New Hampshire. A list of registered agents is available on the New Hampshire Secretary of State website.

New To Protect Hampshire’s 100% Clean Environment For Animals And People.

Name Your New Hampshire Nonprofit

Choosing a name for your professional is the first and most important step in starting your nonprofit. Of course, choose a name that meets the New Hampshire naming requirements and is easily searchable by potential members and donors. Describe our government contributions and expenses to the New Hampshire corporation. Check out our C or S Corporation Fees to find out what Hampshire is:

How do I get an EIN number in NH?

Use federal Form SS-4 from the IRS website at www.irs.gov to request a FEIN by mail or phone. You can find your FEIN in minutes by calling this Tele-TIN number for your country (see below), or you can mail your completed SS-4 form to your local IRS software center to collect your FEIN on the ship. You will need a completed Form SS-4 to request a FEIN with any of these?? ways.

New State Taxpayer Identification Number

In addition to getting your Federal Taxpayer Identification Number (EIN) in Portsmouth, New Hampshire, a corporation will likely also need an identification numberer taxpayer of the state of New Hampshire. This ID means that you must pay business taxes, incoming government taxes, and/or sales tax on the items you sell. Usually the tax status ID is stored for:

How do I find a company’s EIN number?

Most people know their social security number by heart, but not all entrepreneurs know their taxpayer identification number. Your EIN is not something you use every day, so remembering this number is not as easy as remembering your phone number or business address.