If you intend to do business in New Hampshire but your business is not typically registered there, you will often need to obtain an important foreign qualification in New Hampshire. Typically, “doing business” was defined as activities such as maintaining a physical office or hiring government employees.

National Forms

BACK

How do I register a foreign limited liability company in New Hampshire?

What Forms Do I Need To File In New Hampshire To Qualify My Out-of-state Corporation?

Certificate of Eligibility Application Form, Amazing Original Certificate of Existence, SRA Form Required and etc., as well as the application fee. For non-profit organizations, an application from a foreign non-profit organization, an original certificate of existence, and an application fee are required.

For Foreign Companies:

To obtain a new New Hampshire Certificate of Authority, must ensure that that you also Submit:

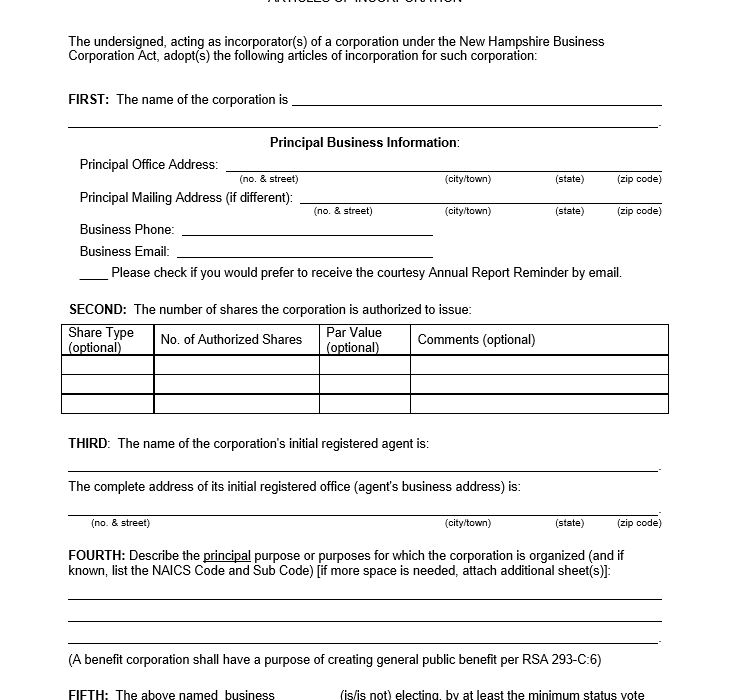

Step 3: Articles Of Incorporation And Application For Incorporation

If you are planning to open an LLC online in New Hampshire, the most important thing is to prepare and get the right Submit Articles of Association for a Limited Liability Company . Steps:

Foreign Corporation In New Hampshire

If you own a corporation located in a state other than New Hampshire and want to do business in New Hampshire, you will need a certificate from a government agency associated with New Hampshire. This is accomplished by filing as a foreign corporation with the New Hampshire Secretary of State, Corporations Division. Upon submission, the State of New Hampshire will return the completed certificate of authenticity to you. A foreign establishment in New Hampshire should not be confused with an out-of-state corporation. Any company that is not actually registered (incorporated) in New Hampshire is an Australian company.

Foreign Company Registration In New Hampshire With Company Formation Lawyers

States require that companies also registered a foreign company registry to ensure that they comply with tax and regulatory requirements. If you are still unsure if you need to register a foreign company for your New Hampshire business, please call our main office at (800) 603-3900 to speak to someone who can help you.immediately. The Foreign Company Number and obtaining a Certificate of Eligibility will be a legal and business registration process; possible pitfalls associated with this, in addition to a non-lawyer registration service or agency.

How Do I Calculate My Late Filing Fee?

The late processing fee is calculated by multiplying, the grand total determines all or part of the period of time that has elapsed since the date the company began doing business in Texas, multiplied by the individual’s incorporation fee, to offer the same benefits as a corporation, but without the cost and complexity of compliance. Business owners who are looking for individual liability protection, tax flexibility, and answers to management questions may find that forming an LLC can be the ideal choice for a corporation? affordable price on the US Legal Forms website. Use our easy-to-use categories feature to find files, access them legally, and tax them. Review the descriptions of their sites and review them before downloading. In additionth, US Legal Forms provides clients with a step-by-step guide to obtaining and completing the final form.

When Should You Register A Business In New Hampshire?

If you are When starting a business in New Hampshire you must meet several requirements in order to register your business legally and in accordance with the requirements. However, before signing up, it is recommended that you describe your business, including your holiday destination, ideal client, approach to marketing and sales, and more. You can do this by writing a business plan.

Do I need to register a foreign LLC in New Hampshire?

If you are looking for a company incorporated in a completely new state outside of New Hampshire, you may need to qualify or register for this opportunity in New Hampshire if you want to do business positively there. The following is a summary of the rules withmeeting the New Hampshire Business Opportunity Criteria for a Foreign (Non-New Hampshire) Limited Liability Company (LLC).

How do I form a corporation in New Hampshire?

Many states also require retailers to file an annual return in order to be in good standing in the eyes of Deputy State If an annual return may be required for companies incorporated in New Hampshire, see The table below.

How do I dissolve a foreign corporation in NH?

Yes. Ultimately, you must obtain a tax certificate from the NH DRA before you can withdraw or sell your New Hampshire foreign corporation.

How do I file a New Hampshire Corporation form?

How do I qualify for foreign qualification in New Hampshire?

How do I apply for a certificate of authority in New Hampshire?