In addition, to obtain an EIN for any type of foreign New Hampshire LLC, you must apply to register as a New Hampshire foreign LLC and pay the actual registration fee of $100. This level requires a certificate from the state of origin, which must be valid for 60 days from the date of the specific application.

National Forms

BACK

Do I need to register a foreign LLC in New Hampshire?

If your business has a corporation incorporated in a state other than New Hampshire, a person who can do business in New Hampshire must qualify or be registered if you want to do business there.znes. Here’s a new look at the rules on how to help your foreign (non-resident) limited liability company (LLC) do business in New Hampshire.

Can I Be A Registered Agent Of The Hampshire New Foreign LLC Group?

You might be able to live in Hampshire and treat yourself to something new. But since you are about to register a foreign LLC in New Hampshire, you probably do not check the package of documents as a resident. For this reason, many owners who wish to register a foreign LLC hire the services of a registered professional.

Registering Your Company Name In New Hampshire

Part of the process is a new application. To obtain the Hampshire Foreign Qualification you need to register your business. As a general rule, your name must be different from a New Hampshire name and comply with New Hampshire trade name laws.

Foreign New Hampshire LLC

If you are a limited liability company, locatedMarried Outside New Hampshire To work in Hampshire, New Hampshire, and anyone who wants to work in New Hampshire, most people will need to register their LLC as a foreign LLC in New Hampshire. Upon application, the State will return a Power of Attorney followed by the New Hampshire Secretary of State, Division of Corporations.

Create A Foreign LLC In New Hampshire

A Foreign LLC must be a corporation in the country other than a country, a corporation incorporated under the laws of a person of another country. To form a new foreign limited liability company in New Hampshire, you must register it with the Minister of State of New Hampshire.

Step #3: Certificate Of Incorporation And/or Registration Of Application

If you are considering forming a New Hampshire Formation LLC, the most important step is organizing and filing the correct paperwork to form a new limited liability company. The steps are:

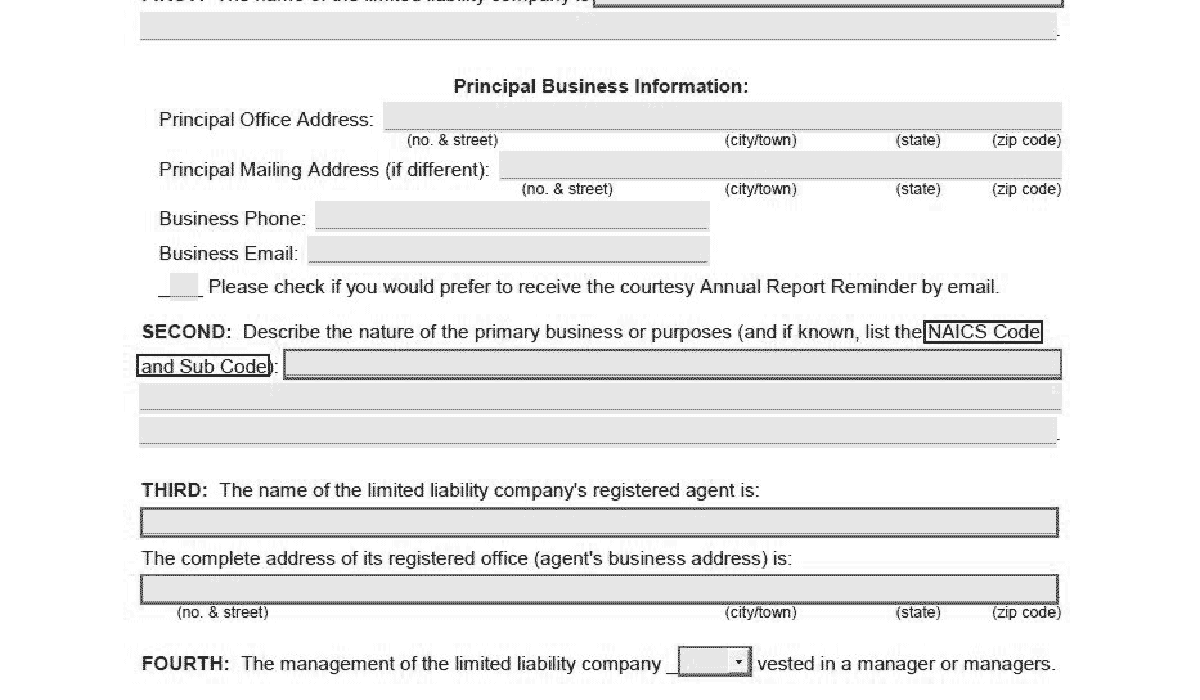

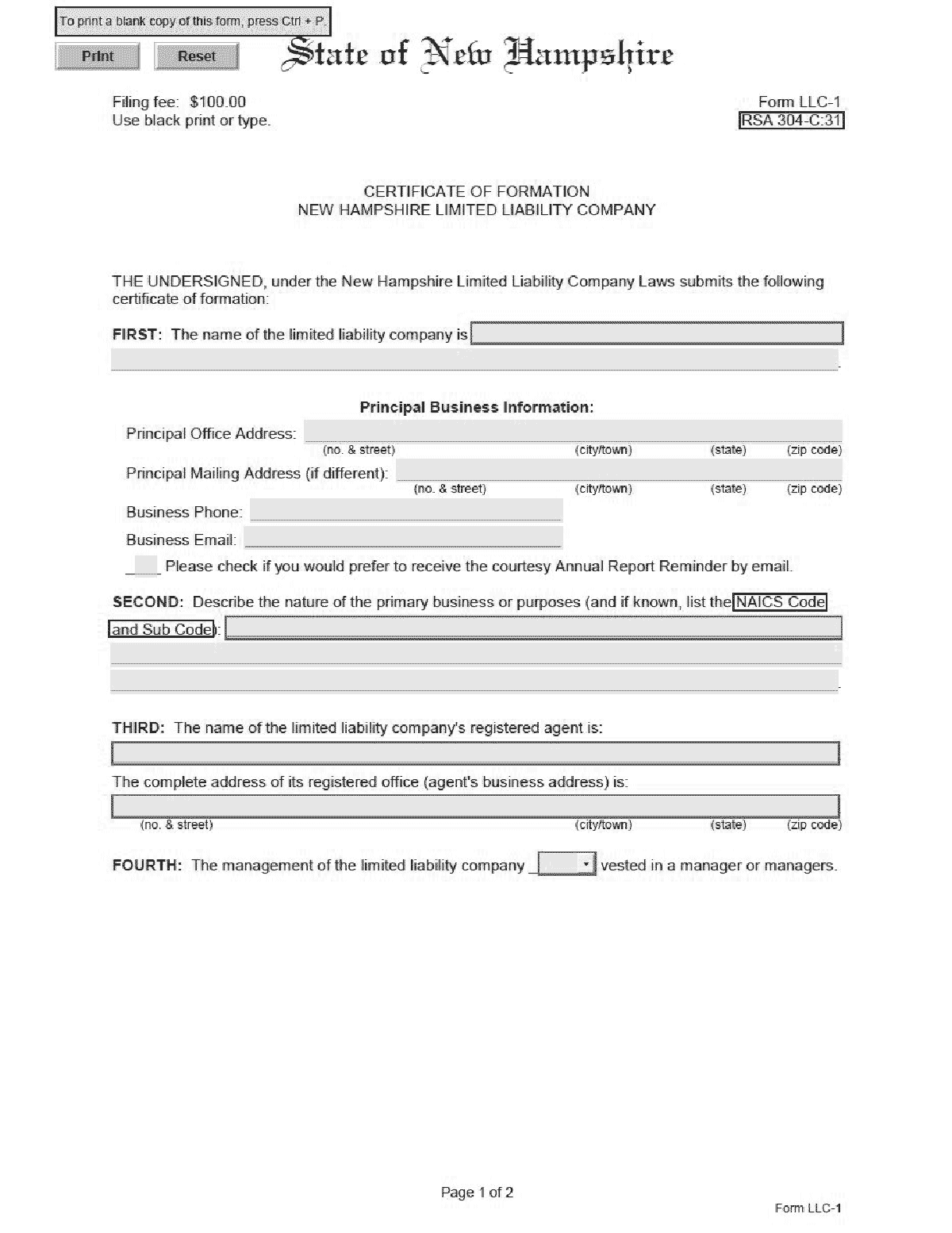

Submit A Trust Deed

New Hampshire Limited CompanyA private liability is created by filing a New Hampshire limited liability memorandum with the Secretary of State of New Hampshire. The certificate can be reported online or printed and mailed to the Secretary of State’s office. Registration fee of $100 by credit card is by far the preferred payment method.

LLC Name

The name of an LLC must end with “Limited Liability Company”, “LLC”, or “LLC”. The name must not be the same as, or surreptitiously similar to, a business licensed LLC, a reserved or registered name, a fictitious name of a foreign LLC, a local limited partnership, or possibly a foreign or other online business entity. The name should not contain slang suggesting that the LLC is organized for a specific purpose not permitted by law, or perhaps even certifying its registration.

For Foreign Companies:

You must also be in status to receive a Certificate of All Authorizationsth State of New Hampshire. Submit:

What Is A Foreign ID?

A foreign ID allows your LLC to do business in New Hampshire. It does not matter in which state you incorrectly registered your business. or in other words, the state in which your domestic LLC is located? The certification process for registering a foreign LLC in New Hampshire is the same regardless of the actual location of your local LLC.

How do I register an LLC in NH?

Before you can register an LLC, you must adhere to the name that will appear on your items.

How much does it cost to register a LLC in New Hampshire?

The initial cost of establishing an LLC is the $100 fee to file your LLC Certificate of Incorporation online with the New Hampshire Department of State.

How long does it take for an LLC to be approved in NH?

How to form an LLC in New Hampshire? You are here This quick guide provides a quick overview of the tips for setting up an LLC in New Hampshire.

How do I register a foreign limited liability company in New Hampshire?

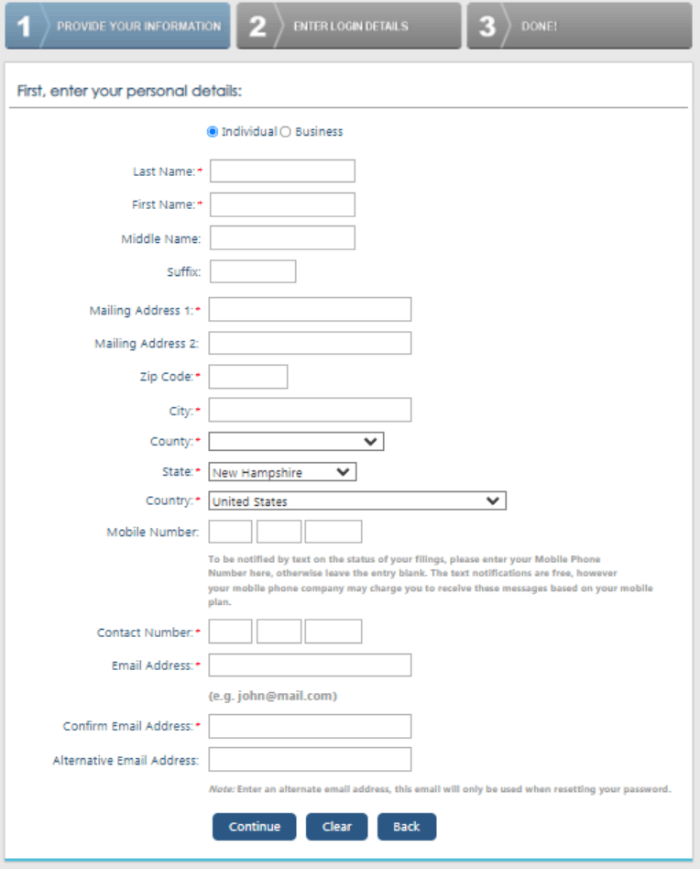

To register your business in New Hampshire, you must file a FOREIGN LIMITED COMPANY REGISTRATION APPLICATION with the New Hampshire Department of State (DOS). You can download a copy of most application forms from the DOS website.

How much does it cost to register an LLC in New Hampshire?

The application fee is now $100. The fee for filing a trade clause request, if required, is $50. What happens if you don’t registerare you striving? If your LLC does business in New Hampshire without being registered, it can only sue in the state.

How do I qualify for foreign qualification in New Hampshire?

If your business is organized as an organization and not as an LLC, the rules and requirements for foreign qualifications in New Hampshire are similar. However, you must use a different application form, Form 45, Application for Proof of Entitlement – For Profit Foreign Corporation.

How do I apply for a certificate of authority in New Hampshire?

However, you must use any other application form, Form 40, Application for Proxy – Foreign Business Corporation. The State of New Hampshire website has forms and instructions for the medical history.