Out-of-state companies typically seek functional certification from the New Jersey government. For this reason, the company is registered as a foreign company, and there is no need to create an ideal new legal entity. Operating without the authority associated with the certificate may result in sanctions and fines.

How do I find out if a business is active in NJ?

1. How do I select an appointment for my New Jersey business?

Permanent Business Certificates, Legal Personality, Trade Name And Trademark/service Mark

Welcome to the Business Records Section of the Revenue and Business Services Division. Thanks to this service You can search for information about all types of companies that operate in New Jersey, including entities such as corporations and LLCs, and Trade names and trademarks/service marks used by New Jersey businesses. You will be able receive permanent references and reports on the status of all transactions fully registered in the citystate and receive copies attached to corporate documents and LLC documents. You can also download prospect lists or Summary of companies using the report.

Copies Of Company Documents, Including Copies Of Annual Reports

You can get photocopies of company and company documents. This includes the incorporation of the original and amended articles of association and changes to the registered agent/office. You may also receive copies of the annual reports submitted by the business unit.

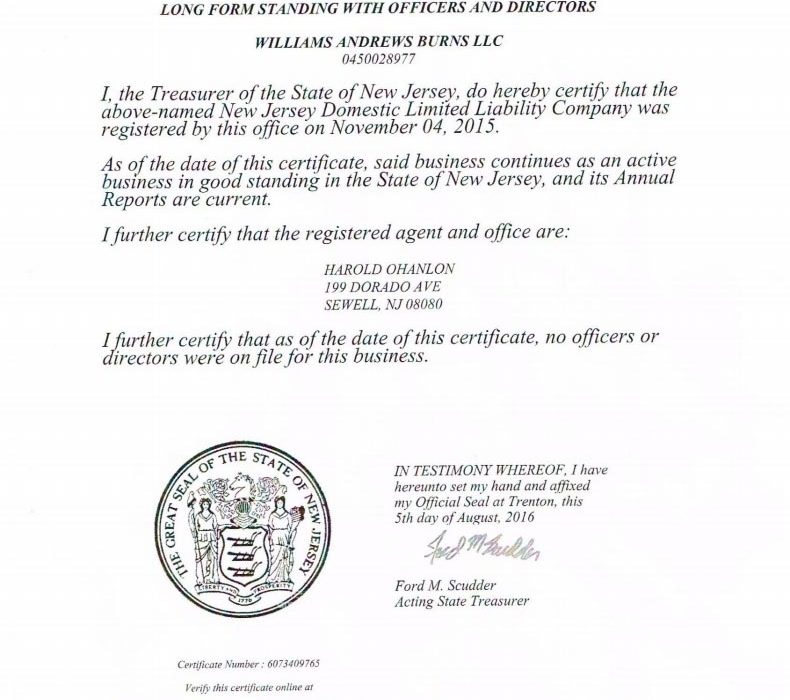

What Is A New Jersey Certificate Authority?

Corporations must register with the New Jersey Department of Revenue before doing business in the State of New Jersey. Corporations that are actually incorporated in another state apply for an affiliate certificate in the state of New Jersey. If you do this, your company will be registered as a foreign company and you will not need to create a new company.

Who Needs A New Jersey Agency Certificate?

New Jersey law requires your company to be able toObtain a Certificate of Sales Tax Eligibility if your New Jersey business generates income from the following activities: retail, rental, use of tangible personal property, or digital property; retail services related to the manufacture, manufacture, production, installation, maintenance, repair and maintenance of personal tangible or digital goods; maintenance, maintenance or possibly even renovation of the property; some direct mail services; services of needles, solarium and massage; investigation and prevention services; information Services; limousine service; Sale of dishes and ready meals in restaurants; rent for hotel and motel rooms; certain entry fees; certain membership fees; Parking Fee; barn services; sale of magazines and magazines by mail; Expenses; as telecommunications services, unless otherwise provided by the Sales and Use Tax Act.

What You Need

If you are not already registered in another state, what do you need for a certificate ?? recognition by the State of New Jersey? Fortunately, this is very simple; You need usage info:

How do I find my NJ entity id?

In order for us to process your PIN request, you must indeed attempt to provide us with your New Jersey Company Identification Number. If you do not know your New Jersey Business Identification Number, you can obtain one from the Business Records Department of the Revenue and Business Services Department using the Legal Entity Name Lookup feature.

What is a NJ 10 digit ID number?

If your business sells taxable goods or suppliers, you must state on your NJ-REG list that you collect sales tax only. You must withhold tax on sales of taxable care provided in this state and/or delivered to a location in New Jersey. The Sales Tax Guide lists items that are often taxed or exempt. Consult the guide to determine if the programs you sell are taxedthose and/or services that you create.

What is a New Jersey Certificate of authority?

This certificate provides the business with a unique New Jersey tax number, also known as the New Jersey Tax Identifier. It is important to understand that obtaining a New Jersey Authority Certificate is actually one of the first steps a business owner must take when starting a large business.

What do I get with my New Jersey business registration certificate?

Upon registration, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Authorization Certificate (for sales tax purposes).

How do I get a sales tax license in NJ?

How to Get a Certificate of Authority in the State of New Jersey. You can obtain the latest Certificate of Authority to Collect Sales Tax Bills by completing Form NJ-REG or by creating an online New Jersey Taxpayer/Employer Registration cp. Before you can get started, you will need a registered businessYour organization and federal phone number EIN.

What is the New Jersey business records service?

Welcome to the Business Records Section of the Revenue and Business Services Division. With this plan, you can search for information on all types of businesses operating in New Jersey, including business entities, especially corporations and LLCs, as well as trade names and trademarks/service marks used by New Jersey businesses .