How much does it cost to register a business in New Mexico?

There are no state business licensing requirements in New Mexico. However, you must apply for all professional licenses and municipal permits required to operate your business.

Any Person Who Does Business In New Mexico May Register With The IRS To Pay Taxes.

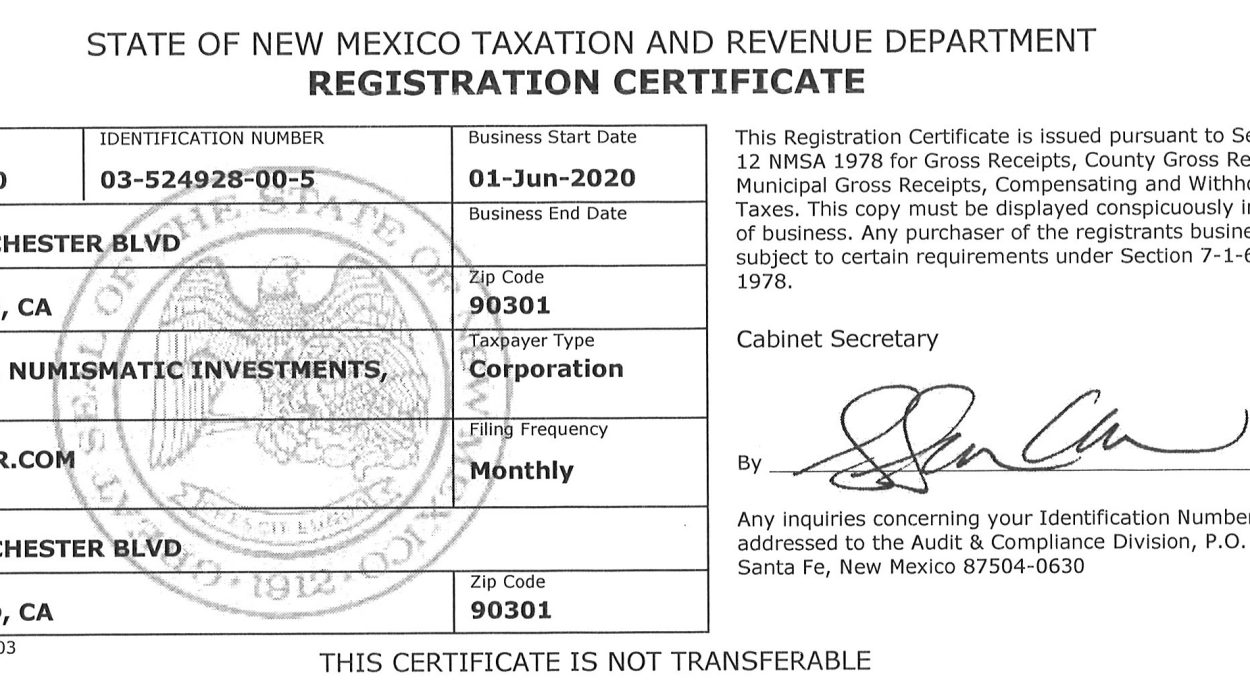

“Doing business” means doing or harming business in connection with a direct or indirect benefit. For a person who does not physically exist in this state, “business” means having aIn a calendar year, the total taxable gross receipts from the sale, lease, and license of conspicuous personal property, and the sale of licenses and profits from services and licenses for the use of real estate acquired pursuant to section 7-1-14 of NMSA 1978, of at least one hundred thousand dollars ($100,000). all corporations doing business in New Mexico are required to register with the New Mexico Tax Administration with the Department of Revenue and receive a state tax identification number, which is included on the Combined Reporting System (CRS) certificate. Their informative name is: New Mexico Department of Taxation and Revenue Local Office 2540 S El PaseoBuilding 2Las Cruces, NM 88004-0607 Phone: 575-524-6225

New Mexico Company Name Search, Mexico

Search It then looks for a specific tool for the New Mexico Secretary of State. This is an important step in the process because if you try to enter a name that has already been used, your application will be rejected. Business

In Angel Fire

In fact, all Angel Fire businesses are taxed.There is a registration fee. The fee is currently $35 per year. If your own business starts at Angel Fire in the last quarter of the year, my first year amount will definitely be $25.

How do I get a New Mexico state tax ID number?

Upon registration, a person receives a New Mexico tax identification number. You will receive individual tax IDs for the following items, if they apply to your business:

Does New Mexico require a CRS number?

2) All New Mexico House corporations registered as a partnership, limited liability company, or CORPORATION must obtain a New Mexico CRS tax identification number. Select the GET STATE CRS NUMBER link to obtain a New Mexico Joint Reporting System (CRS) number.