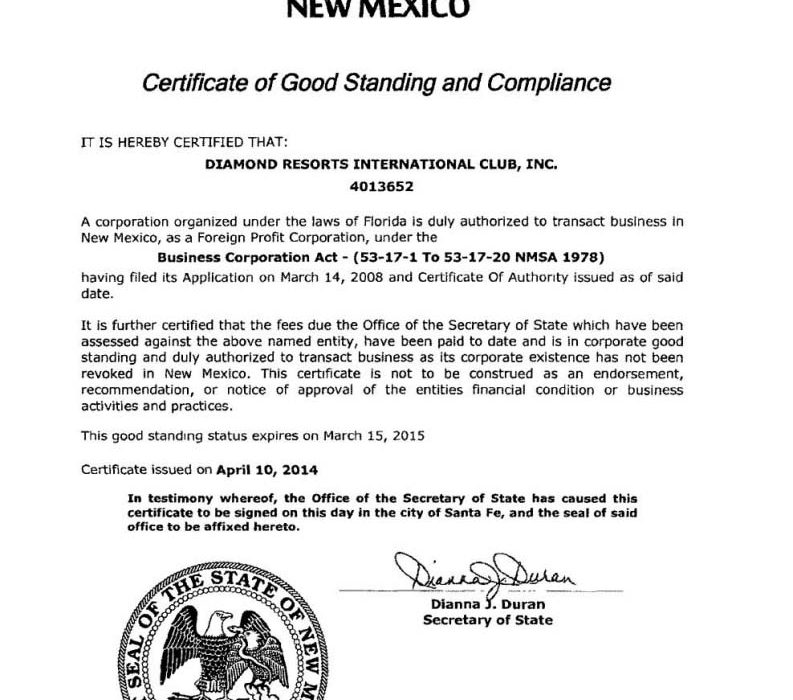

A certificate purportedly issued by the Secretary of State (SOS) confirms that the company is properly registered in the state and that certain fees and taxes due on the form have been duly paid. A certificate of good standing and status from New Mexico confirms almost all of the above for an LLC.

Do I have to register my business in New Mexico?

Upon registration, you will receive a New Mexico tax identification number. You typically collect individual tax IDs for the following accounts, if applicable to your business:

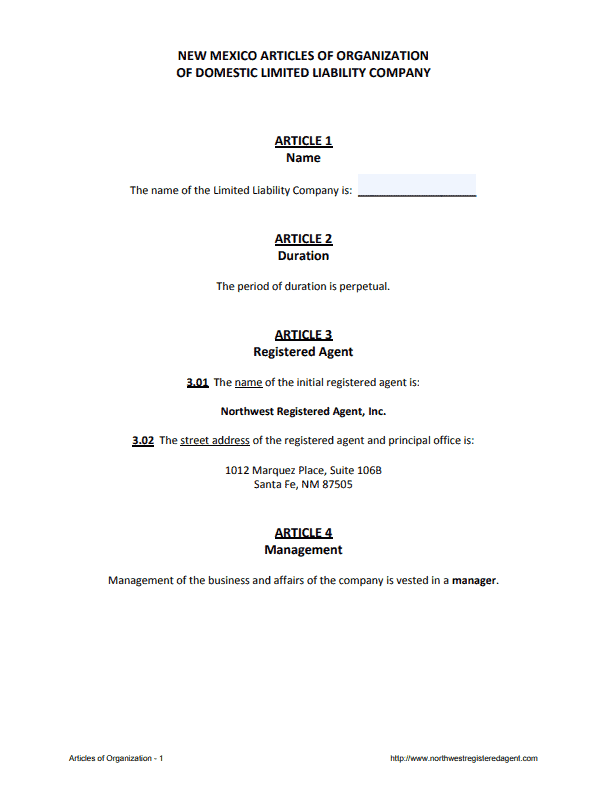

How To Order A Certified Copy Of All Articles Of Incorporation Or A Certified Copy Of New Mexico Articles Of Incorporation

A certified copy of your amazing Articles of Incorporation or Articles of Incorporation can be ordered by fax, mail, or in person, but we encourage you to send it by fax. Normal processingNo up to 10 days, plus extra time for delivery and cash of $10 plus $1 per side or more, mostly depending on the type of business facility. Expedited Service is not available, but there is no additional charge to serve people while they wait.

Creating An LLC In New Mexico Is Very Easy

To form an LLC in New Mexico, you must register an organization associated with an article with the secretary of all states of New Mexico, which costs $50. You can apply online. The Articles of Association is the complete legal document that officially incorporates your New Mexico company.

Open A Commercial Bank Account

Using Commercial Banks and Reports Special solvency is required to protect your commercial Sail company . If your personal and accounting activities are mixed, your personal assets (your room, car, and other valuables) are at risk if your LLC is actually sued.

How To File A Memorandum Of Association For A New A Mexico LLC

In this tutorial, we will no doubt walk you through the submission of ?By becoming your organization to the Secretary of State of New Mexico. This is the document that legally establishes your limited liability company in New Mexico.

Premium Package Includes

With today’s service training, you are more than just the right number. You are all types of valued customers. We offer direct prices, and no upsells, because it’s easier for everyone to come up with this idea. we Take your online business seriously. No reason to fit and education must be exceptional. Our services include:

For Domestic Companies:

Please observe the following specific requirements when preparing to form a company. in New Mexico.

What Is A Certificate Of Good Practice In New Mexico?

A Certificate of Good Practice in Mexico is proof that your business is in full operation and that you have the legal right to conduct business. . This is in accordance with the law. A certificate issued by the Secretary of State (SOS) certifies thatthat the company may be duly registered as the State, and that all dues and taxes due to the State have been duly paid. /p>

Annual Requirements For You In New Mexico

Once you qualify as a New Mexico state foreigner, state law requires corporations to file an annual return. They still have to be filed by public companies every two years, usually by April 15th. Businesses can see the date of their next report online at BizFilings, we clearly explain our fees and how government fees apply for businesses in New Mexico. Check out our preferred C or S Corporation Incorporation Fees to understand clearly:

Incorporation In New Mexico Is Easy

Incorporation of a registered corporation in New Mexico is an easy process . This is achieved by filing a Memorandum of Association with the Secretary of State. In the following guide, we’ll show you step by step how to set up a corporation in the state of New Mexico.

Do you have to register a sole proprietorship in New Mexico?

If you are currently self-employed in the state of New Mexico or want to enter the world of self-ownership, you may have tried to become your own owner.