To contact the IRS, call 1-800-829-4933 or click on FEIN online. There is probably no fee to register or obtain a tax identification number. You can certainly file ACD 31015 corporate tax to help you with any better-appointed county tax office.

How do I find my NM tax ID number?

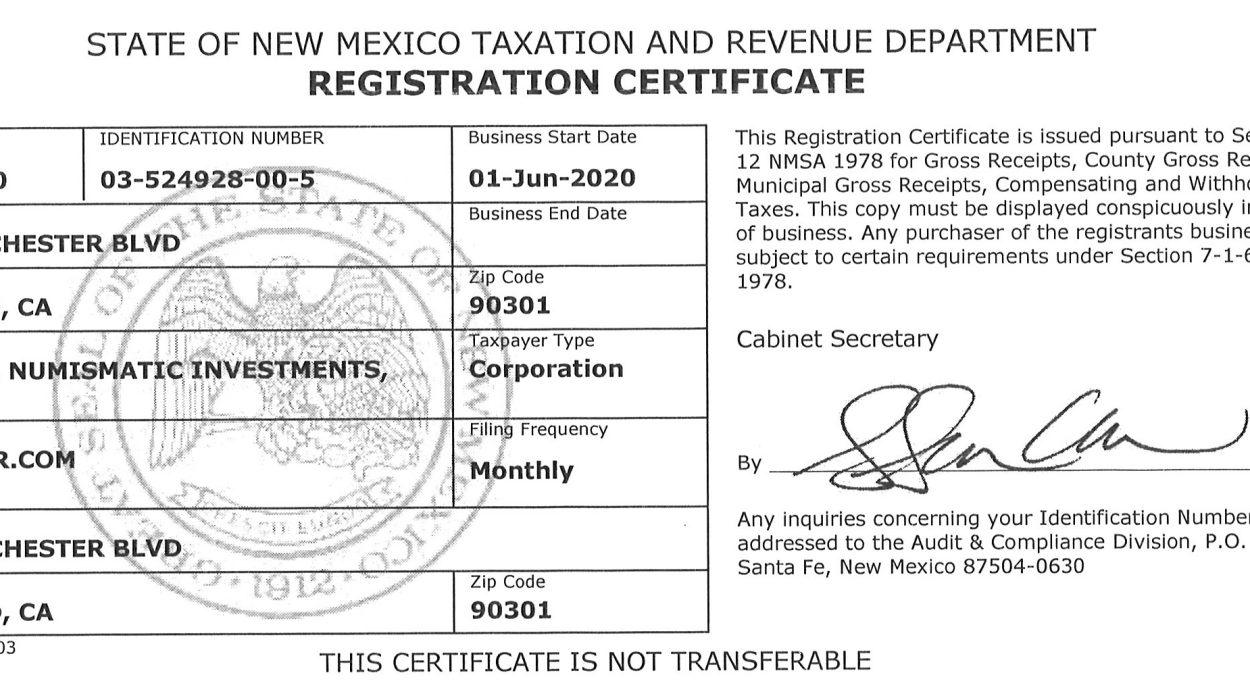

If you are a typical new business, register online with our own New Mexico tax and tax office to get your CRS ID number and medical history frequency. Your filing frequency refers to how often you should receive advance payments from the agency.

The Steps To Get A New Mexico Tax Number (ein):

Your first step should be to successfully prepare all the information you need to complete your application. This? often makes the process much more efficient, meaning you can get your tax identification number faster and with less hassle. At a minimum, you must do the following:

Wait For Your New New Mexico LLC To Be Approved.

Wait for your New Mexico LLC to be approved by the Secretary of State. to implement your EIN. Otherwise, if you are denied an LLC, you must attach an EIN to a non-existent LLC.

Who Must Have A New Mexico TIN?

New Mexico has a gross receipts tax but a sales tax, but most necessities like GRT pass the GRT directly to the actual consumer, like a sales tax. All businesses that sell retail businesses, build condominiums, or provide services in New Mexico must register for a New Mexico CRS identification number and pay the state (and localities, if applicable) a heinous admission fee.

Using The New Mexican Tax Identification Numbers (EIN)

GettingNew Mexican Tax Identification Number (EIN) is a process that most businesses, trusts, estates, charities and church organizations need to go through. completed. Even for businesses that are therefore not required to obtain their New Mexico Taxpayer Identification Number (EIN), obtaining one is recommended as it can help protect individuals’ personal information by requiring them to use their Taxpayer Identification Number (EIN) instead of an EIN) has the right to use their Social Security number in a variety of activities necessary for the operation of their business or organization, including obtaining local licenses and permits in New Mexico. Any business that answers yes to any of the following conditions must receive a New Mexico Tax Identification Number (EIN):

Annual Report

Unlike many other states, located in New Mexico LLCs are not required to file annual returns. However, the state of New Mexico requires LLCs to provide Income and Returns Information (PTE). You canYou can download a copy of the required form from the New Mexico Department of Taxation and Revenue (TRD) website. you must file the Articles of Incorporation with the Secretary of State of New Mexico, which costs $50. You can apply online. The Articles of Association is the legal document that technologically establishes your New Mexico Limited Liability Company.

New Mexico Tax Identification Number

In addition to acquiring your federal tax number (EIN) in Albuquerque , New Mexico, you will also likely need a New Mexico-specific state tax identification number. This ID is required to pay corporate taxes, such as income tax and/or sales tax, on the products you sell. Typically, the tax status ID is used for:

How do I find a company’s EIN number?

Most people know their social security number for a long time, but not all entrepreneurs know their tax number. Your EIN is not something you use every day, so remembering this number is not as easy as remembering the phone number or address of this company.