It limits the liability of both managers and members.Superior protection with a receivables plan.Flexible management.Transfer Taxation: Profits are distributed and will be paid out to taxed members on their net income according to their individual tax group.Good privacy protection, especially in Wyoming.

Does an LLC pay taxes in New Mexico?

At BizFilings, we clearly set your own New Mexico fees and rates. If you look at our prices for the description of LLC, you will clearly see:

List Of Benefits For An LLC In New Mexico

We are a small level of government working hard to understand its importance. Divide new LLC formations based on revenue share??a that they generate. Here are some ways a secretary does business light. Online filing and modest fees show special commitment Create a business-friendly harbor:

Frequently Asked Questions About Financing An LLC In New Mexico

When an LLC is formed, the company is usually funded by assets, property and/or cash. One of the following codes, section 53-19-29 of the New Mexico Articles of Association, which applies to many corporations, states: “Property may be held by a limited liability workplace even if ownership is not achieved or its name is retained.” p>

List Of New Mexico LLC Related Benefits

Most conditions in the US require an annual business renewal. Some states even require a quarterly report. You will then pay an annual fee based on either the majority of sales in your state or a lump sum. Neither is required in New Mexico. This can be described as not registering with the state and you don’t have to pay either.There are very annual fees.

What Is An LLC?

LLC stands for Limited Liability Company and is actually a corporation. A structure that offers real members their specific protection. Owner use this order to protect your personal property from anyone Lawsuits or defaults that the business may face. OOO also what is called intermediate business, i.e. profit and business-related losses are “passed on” to customers and in demand on their personal free things. There are certain taxes Advantages Disadvantages and setting up a company as an LLC which we will describe below.

Why Start An LLC In New Mexico?

A New Mexico LLC provides anonymity, New Mexico annual fees, and protection from commercial creditors. For these reasons, half of all start-up entrepreneurs in New Mexico are LLCs.

How To Start An LLC In Wyoming

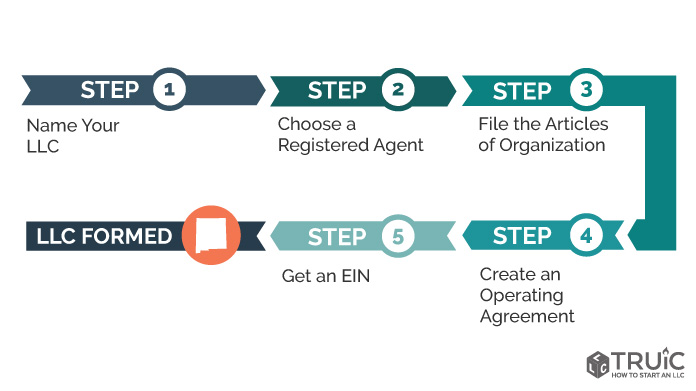

It is usually very easy to start an LLC. Although the process may vary from state to state, the creation of an LLC is usually easier than the creation of other business structures. Here are the steps to start an LLC in Wyoming:

The Benefits Of Starting An LLC Or Corporation

If you are considering starting a small startup in New Mexico, the State of New Mexico and its communities offer aggressive free services and discounts to potential employers or businesses as this will encourage job creation and investment. Incentives vary by industry, with the main industries being advanced manufacturing, new technology, logistics, transportation and distribution, natural energy and resources, and IT and data centers. Of course, there are significant advantages at this point in regards to the type of business you are forming, be it a new LLC or a New Mexico corporation.

NM LLC Vs. NM Corporation

Now that we have looked at the key characteristics that apply to all LLCs and corporations, we will then look at the more specific characteristics of these elements that distinguish a New Mexico LLC or a New Mexico company from other states. us to the horseWhich product, which company is most suitable for the real company. Each state has its own laws and tax laws that govern its businesses, and these unique details should be considered when deciding whether you are your legal entity. The information in this section contains this data for most New Mexico LLC and New Mexico Corporation.

Instant Anonymous New Mexico LLC

High Desert Corporate Filings is New Mexico’s largest limited liability company. Mexico, whose warehouse is located 5 minutes from the Secretariat of State. We offer the newest, best, most complete and private LLC registration service.

Create An LLC In New Mexico

To get all the benefits of an LLC in New Mexico, you must register to help with your LLC in the New Mexico State Office associated with the Secretary of State (SOS). Once the majority of people sign up, your business becomes somewhat of a useful search entry for the public. Your registration also helps the state track your company’s compliance.

Is New Mexico a good place for business?

NEW MEXICO (KRQE) â?? New Mexico ranks as the 18th best place to start a business in the US, according to a new WalletHub report. The study compared all 50 states with 28 key startup success metrics to help you find the best place to start your business. The first three states were Texas, Georgia and California.