Registration with New Hampshire LLC. The New Hampshire Limited Liability Insurance Company is a business entity characterized by a flexible management structure, pass-through taxation, and strong personal liability protection.

Dealer Registration

??NOTE FOR GOVERNMENT REGISTERED INVESTMENT ADVISERS â? The New Hampshire Securities Regulatory Bureau cannot require state-registered investment advisers to provide the new federal disclosure form, the CRS format. Investment advisors should continue to add and update Form ADV Part 2 and provide copies to clients.

Local Investment Trust (NH) Forms And Laws

BACK

Uniform Commercial Code (UCC)

The New Hampshire office of the Uniform Commercial Code (UCC) serves the commercial and bank loan community by acting as custodian of court filings that represent committed security interests in certain owner-occupied assets that are used as collateral for loans. These deposits help the senior secured creditor increase and maintain its claims on the assets in the event of bankruptcy, insolvency or default of the debtor. The Ministry of the Interior is responsible forleaving users and recipients of the UCC process with a universal, free, secure transaction report, including up-to-date information on deposits and investments from commercial creditors and other potential customers with a personal debtor registration history.

Complete An Online Certificate About Forming An LLC In New Hampshire

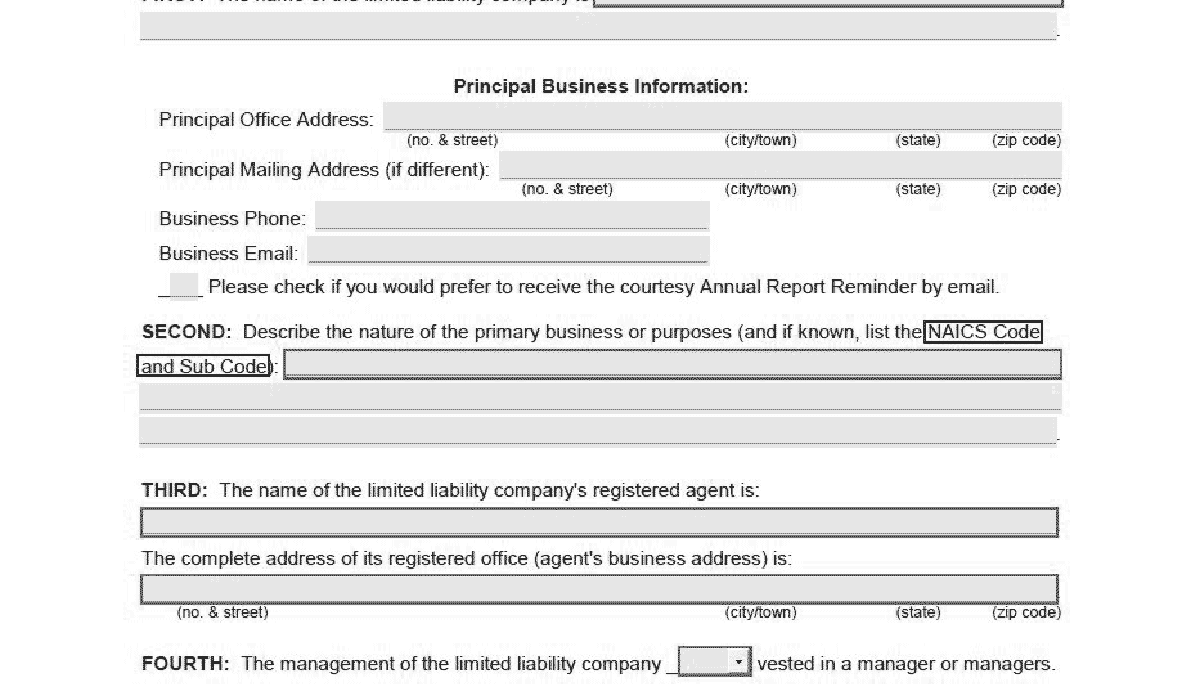

First Article: Company Name: Enter the name of the LLC exactly as you wish, preferably including your capital, and the words “LLC” as well as “LLC”. (The abbreviation “LLC” is quite common.)

Submit Annual Return

All LLCs in New Hampshire and even qualifying foreign limited companies must operate in the state and file an annual return. The report must be submitted without fail to the Minister of Foreign Affairs before April. The filing fee is $100. The application must be submitted online through the New Hampshire Annual Return website.

STEP 3: File New Hampshire LLC Articles Of Association

To re-register your Hampshire LLC, you must file a foundingDocuments to the New Hampshire State Department. Can I apply online through the NH QuickStart website or by mail.

Can I Change My Registered Office And/or Correct My Mailing Address When I Change My LLC?

No. If you have already submitted the company’s annual return, the only way to change the address information is to send the changes by mail or email to DOS. The change must be made on the supplier’s letterhead. You can email changes to [email protected].

Submit New Hampshire Certificate Of Incorporation

To register your limited company in New Hampshire -Hampshire, send your Certificate of Incorporation along with your new Hampshire Secretary of State, Corporations Division. We’ll walk you through this step and complete the submission for you if a person in our organization uses Formation Services. And to help you get started faster, we offer a fast track service to put you at the head of your current queue.

Contact Information

We have the following documentation ?? New Hampshire Secretary of State – Division of Enforcement Societies services for our people. We share this background information to the general public as a courtesy. As As an authorized client agent, you have access to the status The templates are pre-filled with some information about our company to save you time when searching. Information.

Get A Real State Certificate

You can submit a valid registration certificate online or by mail. The state will issue you a certificate confirming that the LLC officially exists shortly after the approval and filing of the LLC’s constituent documents.

The State of New Hampshire requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Secretary of State website. You’ll need your LLC’s state-issued Business ID number to access the online form. The annual

The State of New Hampshire requires you to file a significant annual return for your LLC. You can also mail the report or complete it online at the Secretary of State’s global website. To access the online form, you will need the state company identification number of the LLC.

4. How long does it take to form an LLC in New Hampshire? After filing your certificate of formation in New Hampshire, it could take 3-7 business days to process your online filing. If you file by mail, it could take up to three weeks.Aug 1, 2022Forming a

Limited liability companies (LLC) are a popular business structure among small businesses. To start one, the forms must be submitted through the appropriate state government agency. As an example, you can register a limited liability company in New Hampshire by filing a certificate of supply with the Division of Corporations of the New Hampshire Department of State. After submitting, there are still a few more steps to go and fulfill obligations.